Question: Assignment Assignment Gradebook ORION Downloadable eTextbook ent Exercise 12-4 McGill and Smyth have capital balances on January 1 of $52,000 and $45,000, respectively. The partnership

Assignment

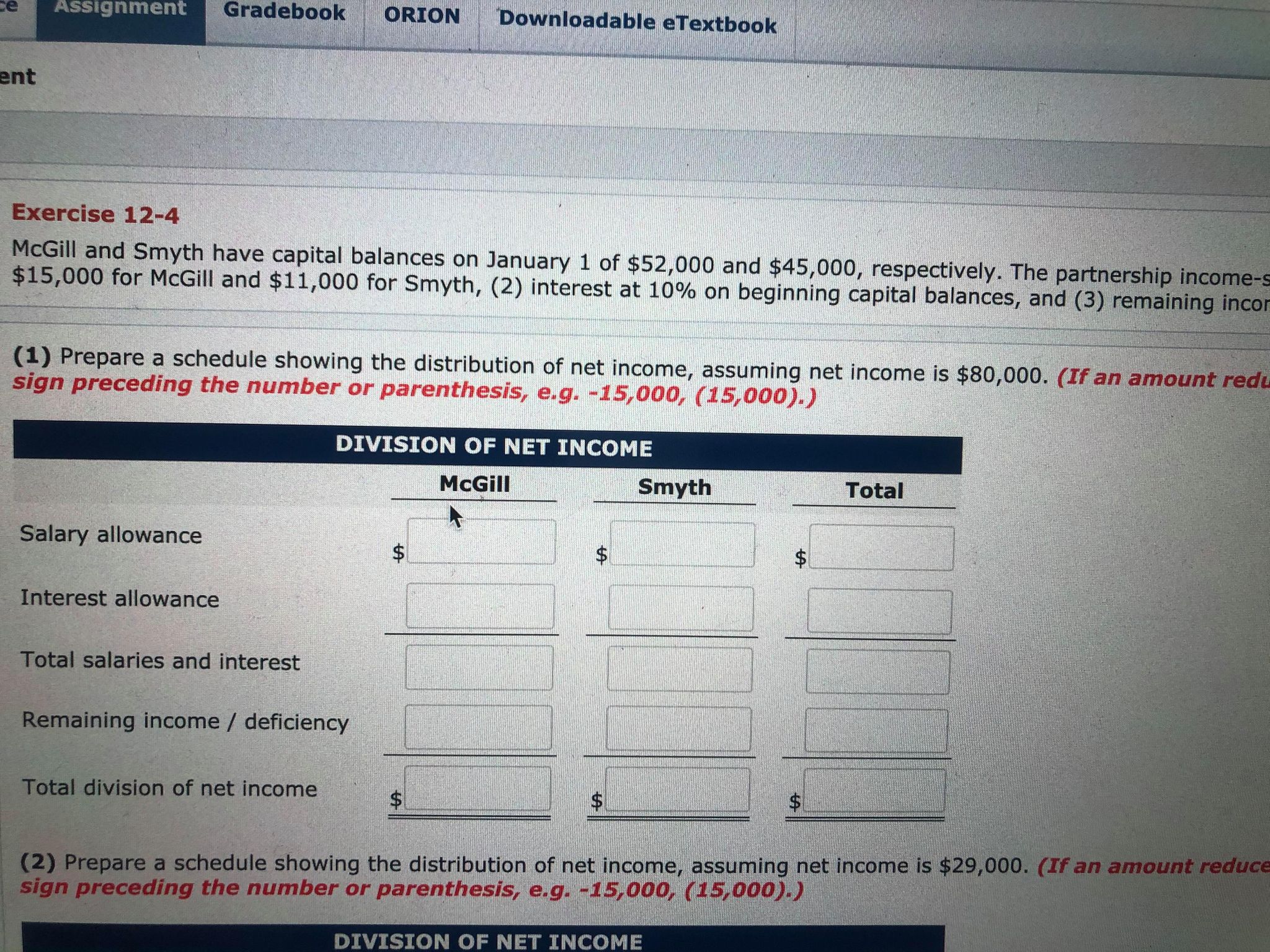

Assignment Gradebook ORION Downloadable eTextbook ent Exercise 12-4 McGill and Smyth have capital balances on January 1 of $52,000 and $45,000, respectively. The partnership income- $15,000 for McGill and $11,000 for Smyth, (2) interest at 10% on beginning capital balances, and (3) remaining incon (1) Prepare a schedule showing the distribution of net income, assuming net income is $80,000. (If an amount red sign preceding the number or parenthesis, e.g. -15,000, (15,000).) DIVISION OF NET INCOME McGill Smyth Total Salary allowance Interest allowance Total salaries and interest Remaining income / deficiency Total division of net income (2) Prepare a schedule showing the distribution of net income, assuming net income is $29,000. (If an amount reduce sign preceding the number or parenthesis, e.g. -15,000, (15,000).) DIVISION OF NET INCOME

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts