Question: Assignment: Backup log in for the assignment: Example for the policy and procedures assignment: Unit 3 Backup and Recovery Policy and Procedures Accounting data is

Assignment:

Backup log in for the assignment:

Example for the policy and procedures assignment:

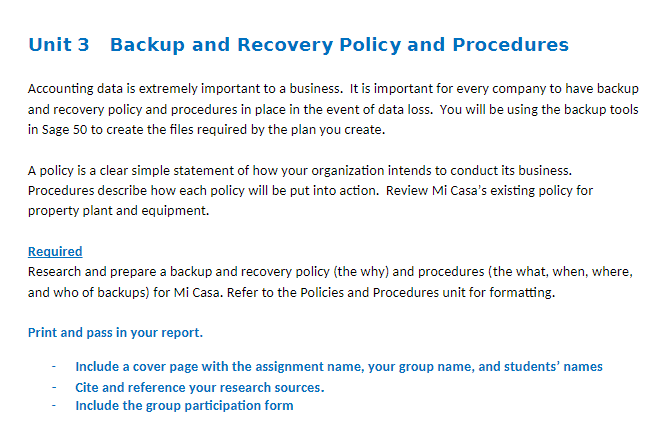

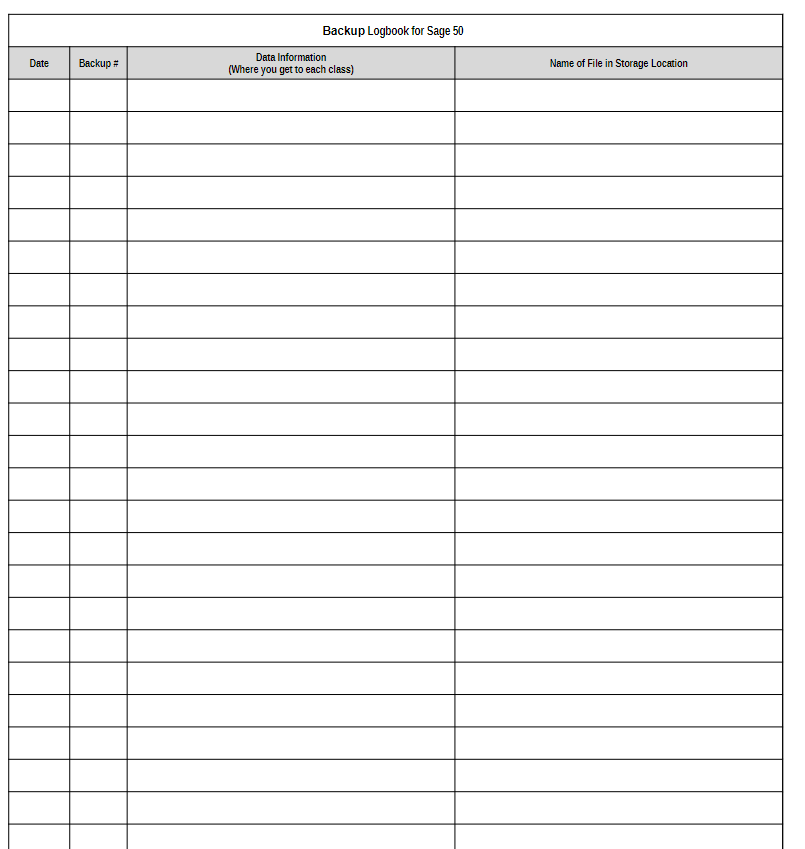

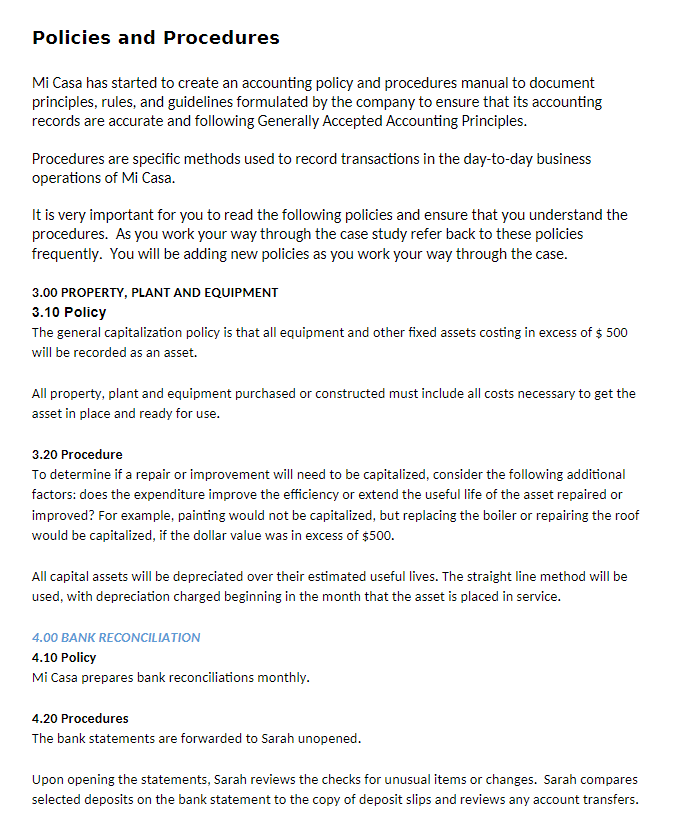

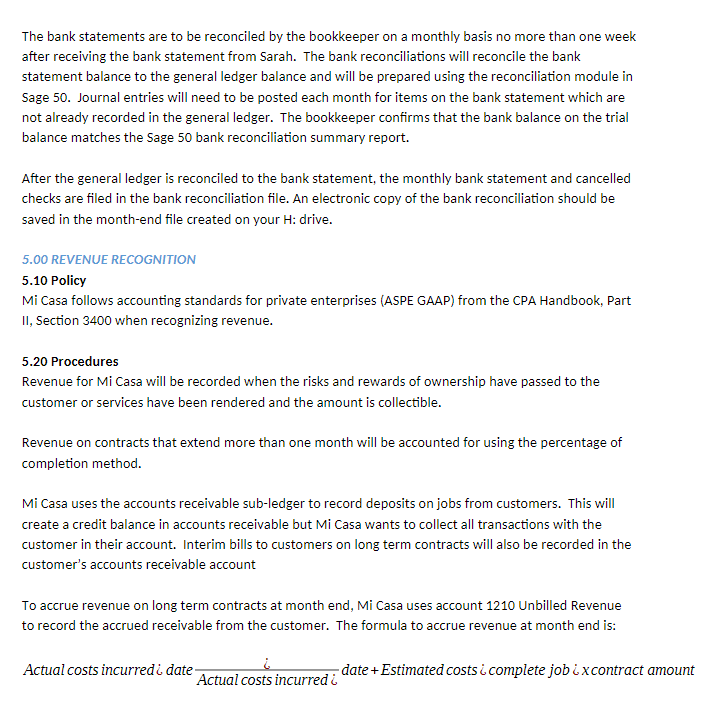

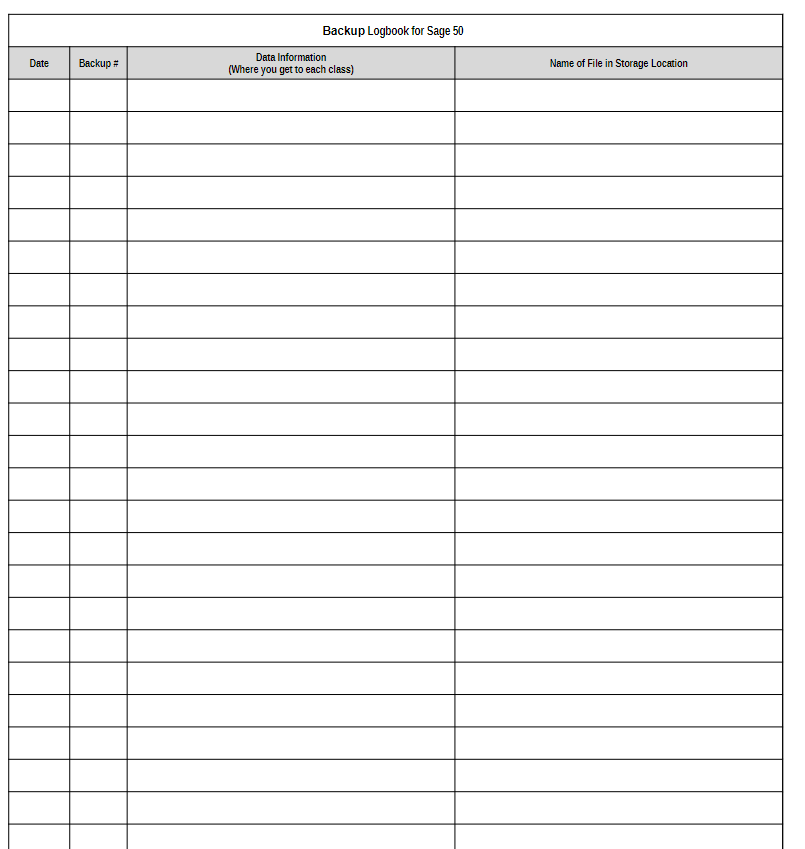

Unit 3 Backup and Recovery Policy and Procedures Accounting data is extremely important to a business. It is important for every company to have backup and recovery policy and procedures in place in the event of data loss. You will be using the backup tools in Sage 50 to create the files required by the plan you create. A policy is a clear simple statement of how your organization intends to conduct its business. Procedures describe how each policy will be put into action. Review Mi Casa's existing policy for property plant and equipment. Required Research and prepare a backup and recovery policy (the why) and procedures (the what, when, where, and who of backups) for Mi Casa. Refer to the Policies and Procedures unit for formatting. Print and pass in your report. Include a cover page with the assignment name, your group name, and students' names Cite and reference your research sources. Include the group participation form Backup Logbook for Sage 50 Data Information (Where you get to each class) Date Backup # Name of File in Storage Location Policies and Procedures Mi Casa has started to create an accounting policy and procedures manual to document principles, rules, and guidelines formulated by the company to ensure that its accounting records are accurate and following Generally Accepted Accounting Principles. Procedures are specific methods used to record transactions in the day-to-day business operations of Mi Casa. It is very important for you to read the following policies and ensure that you understand the procedures. As you work your way through the case study refer back to these policies frequently. You will be adding new policies as you work your way through the case. 3.00 PROPERTY, PLANT AND EQUIPMENT 3.10 Policy The general capitalization policy is that all equipment and other fixed assets costing in excess of $ 500 will be recorded as an asset. All property, plant and equipment purchased or constructed must include all costs necessary to get the asset in place and ready for use. 3.20 Procedure To determine if a repair or improvement will need to be capitalized, consider the following additional factors: does the expenditure improve the efficiency or extend the useful life of the asset repaired or improved? For example, painting would not be capitalized, but replacing the boiler or repairing the roof would be capitalized, if the dollar value was in excess of $500. All capital assets will be depreciated over their estimated useful lives. The straight line method will be used, with depreciation charged beginning in the month that the asset is placed in service. 4.00 BANK RECONCILIATION 4.10 Policy Mi Casa prepares bank reconciliations monthly. 4.20 Procedures The bank statements are forwarded to Sarah unopened. Upon opening the statements, Sarah reviews the checks for unusual items or changes. Sarah compares selected deposits on the bank statement to the copy of deposit slips and reviews any account transfers. The bank statements are to be reconciled by the bookkeeper on a monthly basis no more than one week after receiving the bank statement from Sarah. The bank reconciliations will reconcile the bank statement balance to the general ledger balance and will be prepared using the reconciliation module in Sage 50. Journal entries will need to be posted each month for items on the bank statement which are not already recorded in the general ledger. The bookkeeper confirms that the bank balance on the trial balance matches the Sage 50 bank reconciliation summary report. After the general ledger is reconciled to the bank statement, the monthly bank statement and cancelled checks are filed in the bank reconciliation file. An electronic copy of the bank reconciliation should be saved in the month-end file created on your H: drive. 5.00 REVENUE RECOGNITION 5.10 Policy Mi Casa follows accounting standards for private enterprises (ASPE GAAP) from the CPA Handbook, Part II, Section 3400 when recognizing revenue. 5.20 Procedures Revenue for Mi Casa will be recorded when the risks and rewards of ownership have passed to the customer or services have been rendered and the amount is collectible. Revenue on contracts that extend more than one month will be accounted for using the percentage of completion method. Mi Casa uses the accounts receivable sub-ledger to record deposits on jobs from customers. This will create a credit balance in accounts receivable but Mi Casa wants to collect all transactions with the customer in their account. Interim bills to customers on long term contracts will also be recorded in the customer's accounts receivable account To accrue revenue on long term contracts at month end, Mi Casa uses account 1210 Unbilled Revenue to record the accrued receivable from the customer. The formula to accrue revenue at month end is: Actual costs incurredi date Actual costs incurred i date +Estimated costs i complete job i x contract amount Unit 3 Backup and Recovery Policy and Procedures Accounting data is extremely important to a business. It is important for every company to have backup and recovery policy and procedures in place in the event of data loss. You will be using the backup tools in Sage 50 to create the files required by the plan you create. A policy is a clear simple statement of how your organization intends to conduct its business. Procedures describe how each policy will be put into action. Review Mi Casa's existing policy for property plant and equipment. Required Research and prepare a backup and recovery policy (the why) and procedures (the what, when, where, and who of backups) for Mi Casa. Refer to the Policies and Procedures unit for formatting. Print and pass in your report. Include a cover page with the assignment name, your group name, and students' names Cite and reference your research sources. Include the group participation form Backup Logbook for Sage 50 Data Information (Where you get to each class) Date Backup # Name of File in Storage Location Policies and Procedures Mi Casa has started to create an accounting policy and procedures manual to document principles, rules, and guidelines formulated by the company to ensure that its accounting records are accurate and following Generally Accepted Accounting Principles. Procedures are specific methods used to record transactions in the day-to-day business operations of Mi Casa. It is very important for you to read the following policies and ensure that you understand the procedures. As you work your way through the case study refer back to these policies frequently. You will be adding new policies as you work your way through the case. 3.00 PROPERTY, PLANT AND EQUIPMENT 3.10 Policy The general capitalization policy is that all equipment and other fixed assets costing in excess of $ 500 will be recorded as an asset. All property, plant and equipment purchased or constructed must include all costs necessary to get the asset in place and ready for use. 3.20 Procedure To determine if a repair or improvement will need to be capitalized, consider the following additional factors: does the expenditure improve the efficiency or extend the useful life of the asset repaired or improved? For example, painting would not be capitalized, but replacing the boiler or repairing the roof would be capitalized, if the dollar value was in excess of $500. All capital assets will be depreciated over their estimated useful lives. The straight line method will be used, with depreciation charged beginning in the month that the asset is placed in service. 4.00 BANK RECONCILIATION 4.10 Policy Mi Casa prepares bank reconciliations monthly. 4.20 Procedures The bank statements are forwarded to Sarah unopened. Upon opening the statements, Sarah reviews the checks for unusual items or changes. Sarah compares selected deposits on the bank statement to the copy of deposit slips and reviews any account transfers. The bank statements are to be reconciled by the bookkeeper on a monthly basis no more than one week after receiving the bank statement from Sarah. The bank reconciliations will reconcile the bank statement balance to the general ledger balance and will be prepared using the reconciliation module in Sage 50. Journal entries will need to be posted each month for items on the bank statement which are not already recorded in the general ledger. The bookkeeper confirms that the bank balance on the trial balance matches the Sage 50 bank reconciliation summary report. After the general ledger is reconciled to the bank statement, the monthly bank statement and cancelled checks are filed in the bank reconciliation file. An electronic copy of the bank reconciliation should be saved in the month-end file created on your H: drive. 5.00 REVENUE RECOGNITION 5.10 Policy Mi Casa follows accounting standards for private enterprises (ASPE GAAP) from the CPA Handbook, Part II, Section 3400 when recognizing revenue. 5.20 Procedures Revenue for Mi Casa will be recorded when the risks and rewards of ownership have passed to the customer or services have been rendered and the amount is collectible. Revenue on contracts that extend more than one month will be accounted for using the percentage of completion method. Mi Casa uses the accounts receivable sub-ledger to record deposits on jobs from customers. This will create a credit balance in accounts receivable but Mi Casa wants to collect all transactions with the customer in their account. Interim bills to customers on long term contracts will also be recorded in the customer's accounts receivable account To accrue revenue on long term contracts at month end, Mi Casa uses account 1210 Unbilled Revenue to record the accrued receivable from the customer. The formula to accrue revenue at month end is: Actual costs incurredi date Actual costs incurred i date +Estimated costs i complete job i x contract amount