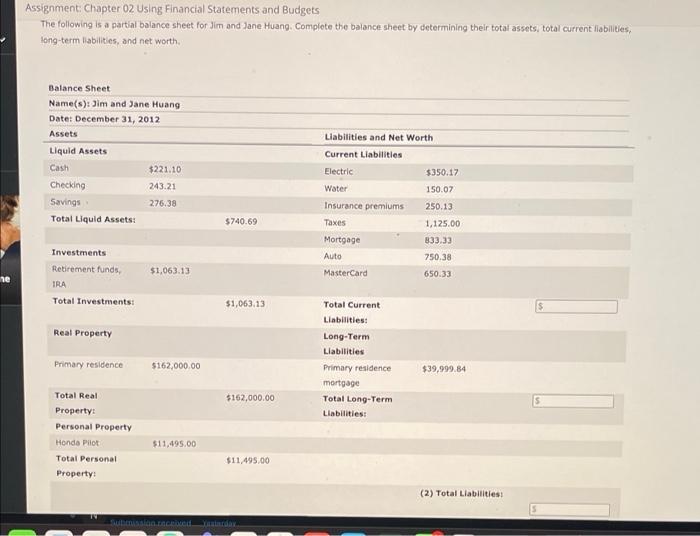

Question: Assignment Chapter 02 Using Financial Statements and Budgets The following is a partial balance sheet for Jim and Jane Huang Complete the balance sheet by

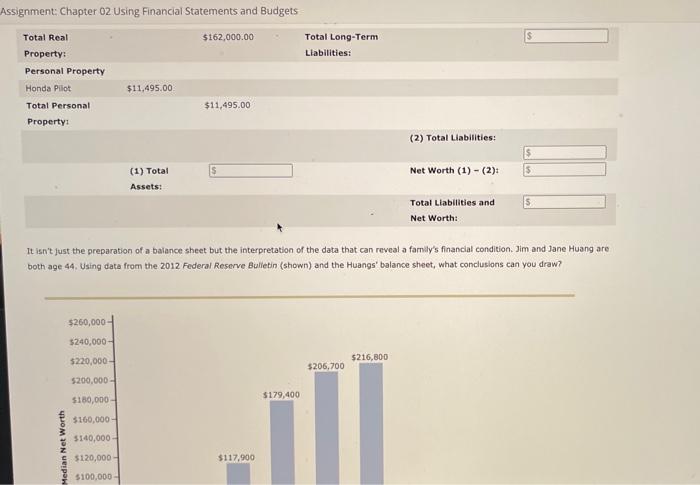

Assignment Chapter 02 Using Financial Statements and Budgets The following is a partial balance sheet for Jim and Jane Huang Complete the balance sheet by determining their total assets, total current liabilities, long-term liabilities, and net worth Balance Sheet Name(s): Jim and Jane Huang Date: December 31, 2012 Assets Liquid Assets Cash $221.10 Checking 243.21 Savings 276.38 Total Liquid Assets: Liabilities and Net Worth Current Liabilities Electric $350.17 Water 150.07 Insurance premiums 250.13 Taxes 1,125.00 Mortgage 833.33 Auto 750.38 $740.69 $1,063.13 Investments Retirement funds, TRA Total Investments MasterCard 650.33 he $1,063.13 Total Current Liabilities: Real Property Primary residence $162,000.00 $39,999.84 Long-Term Liabilities Primary residence mortgage Total Long-Term Liabilities: $162,000.00 S Total Real Property Personal Property Honda Pilot Total Personal Property: $11,495.00 $11.495.00 (2) Total Liabilities: Assignment: Chapter 02 Using Financial Statements and Budgets $162,000.00 s Total Long-Term Liabilities: Total Real Property: Personal Property Honda Pilot Total Personal Property: $11,495.00 $11,495.00 (2) Total Liabilities: is 5 (1) Total Assets: Net Worth (1) - (2): S Total Liabilities and Net Worth: It isn't just the preparation of a balance sheet but the interpretation of the data that can reveal a family's financial condition. Jim and Jane Huang are both age 44. Using data from the 2012 Federal Reserve Bulletin (shown) and the Huangs" balance sheet, what conclusions can you draw? $260,000 $240,000 $220,000 $216,800 $206,700 5200,000 - $160,000 $179,400 $160,000 $140,000 Median Net Worth $120,000 $117.900 $100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts