Question: Assignment: Chapter 10 Project Cash Flows and Risk As A Assignment: Chanter in Drnibet Cach Finue and Diet Assienment: Chaoter 10 Prolect Cash Flows and

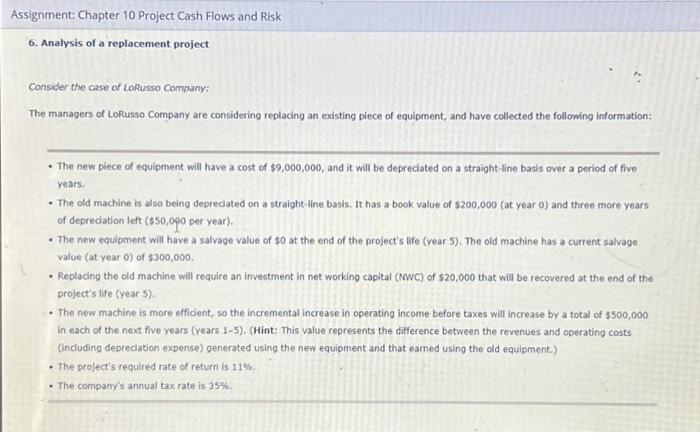

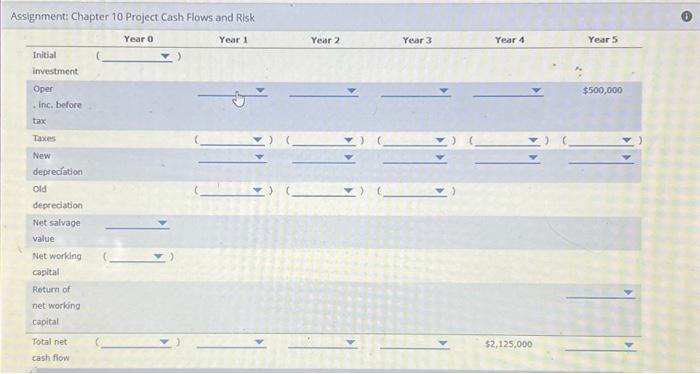

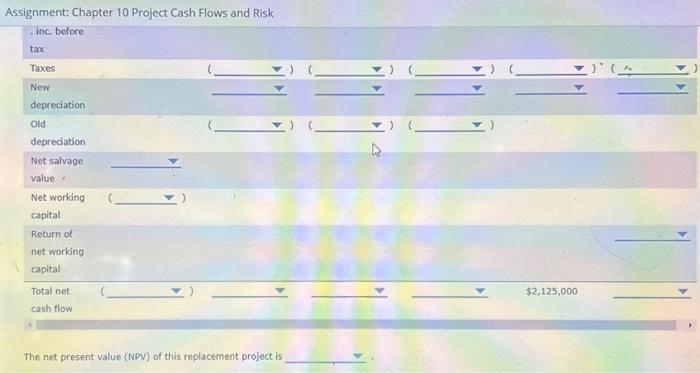

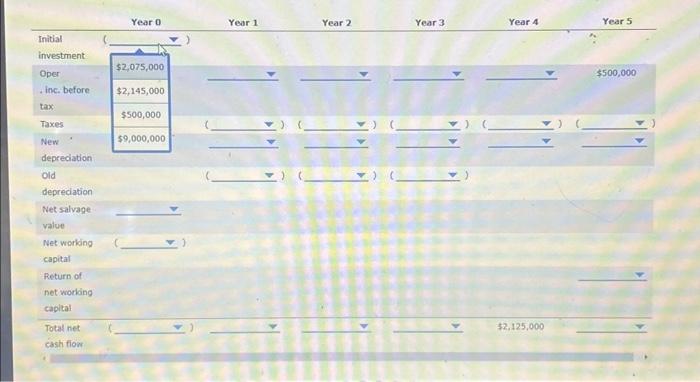

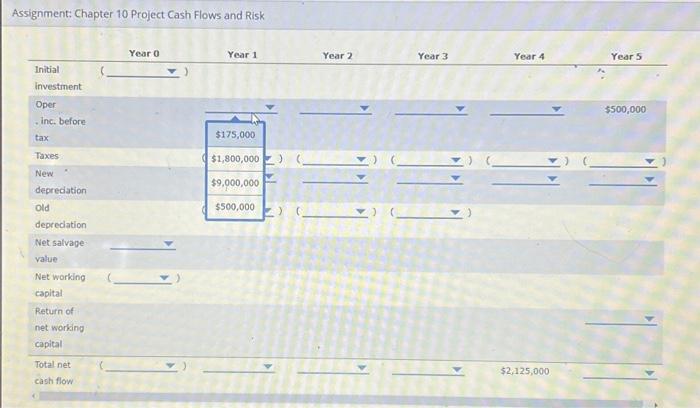

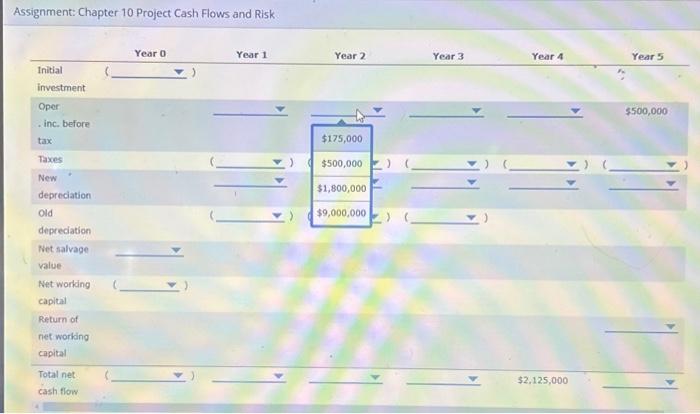

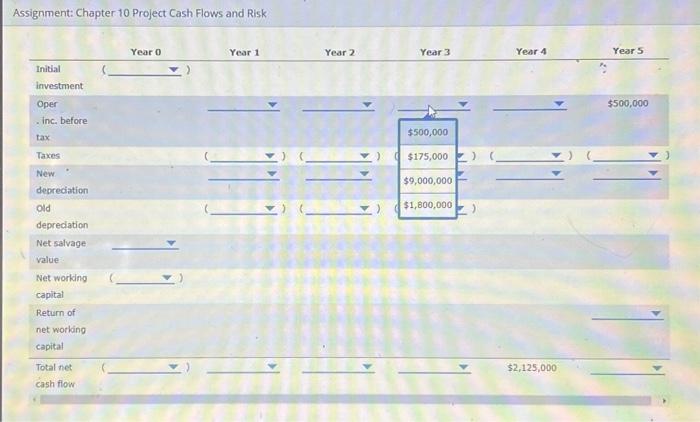

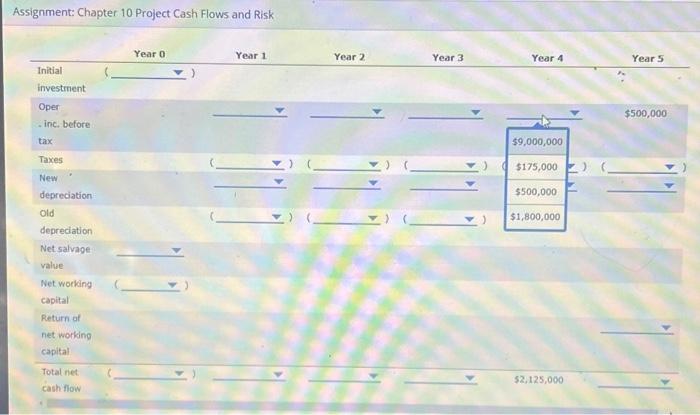

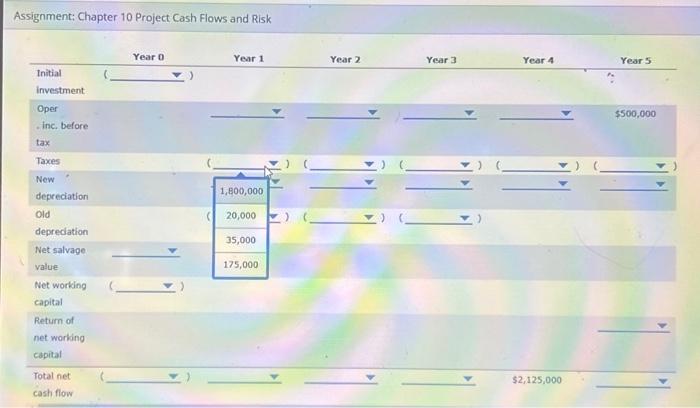

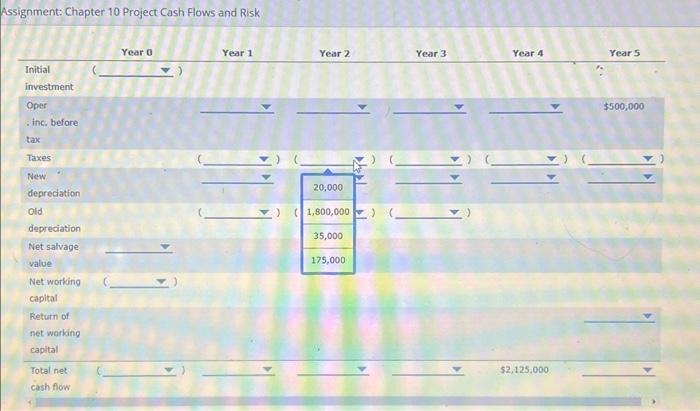

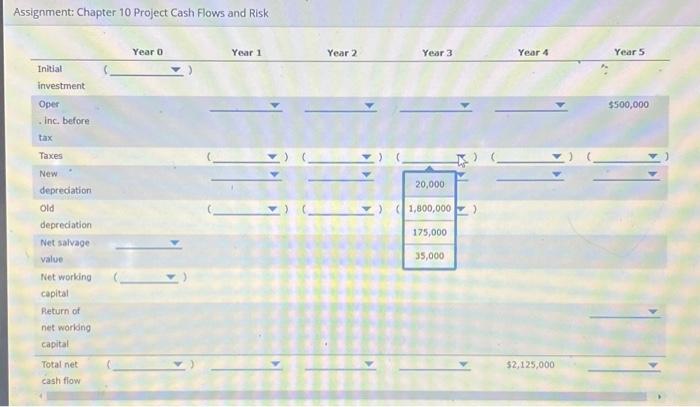

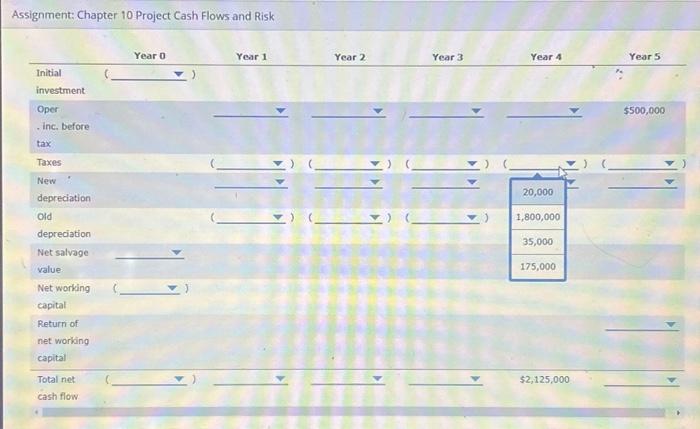

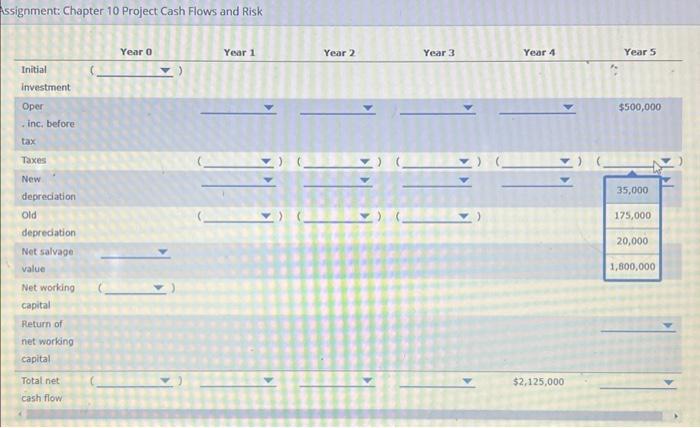

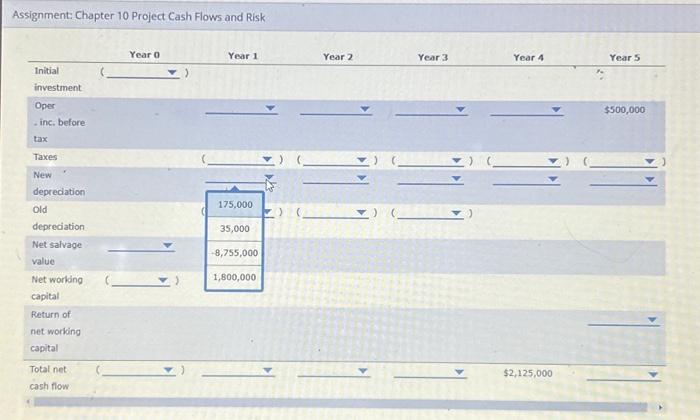

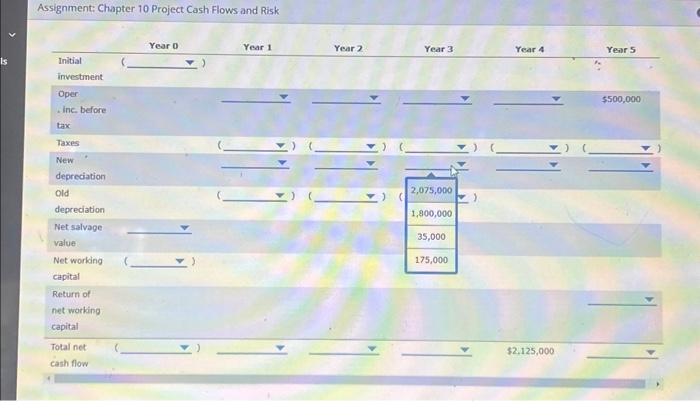

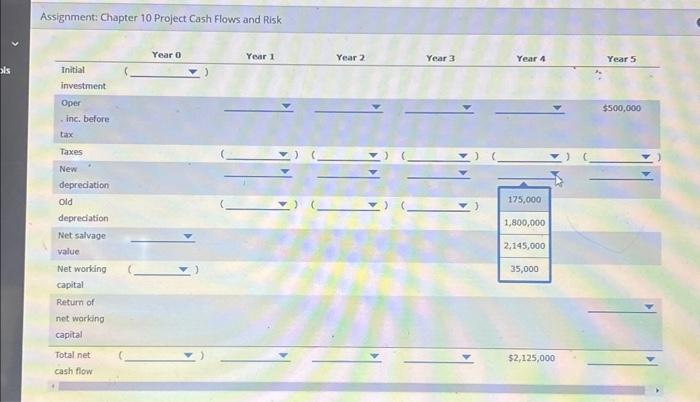

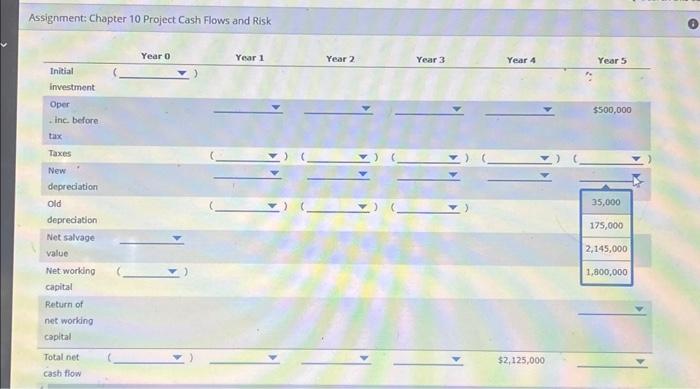

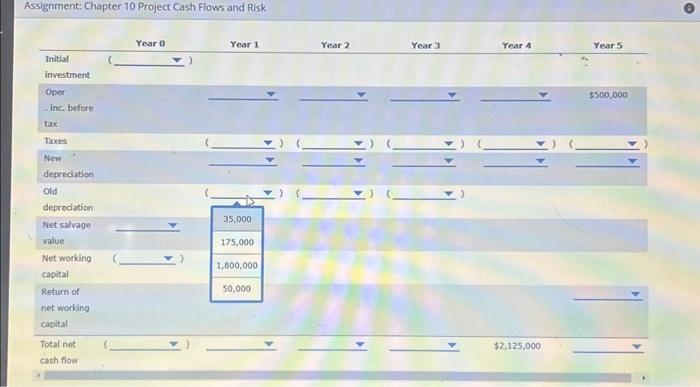

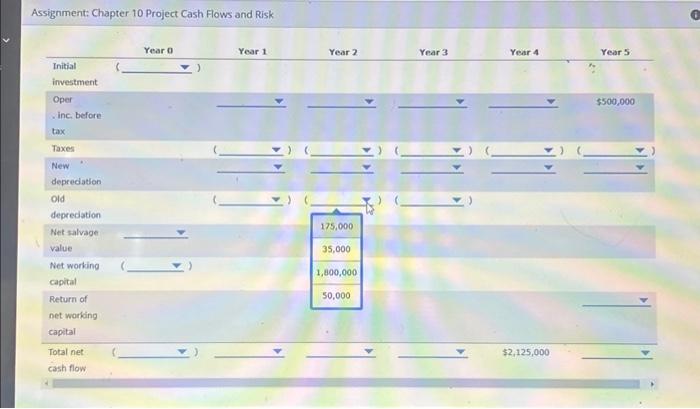

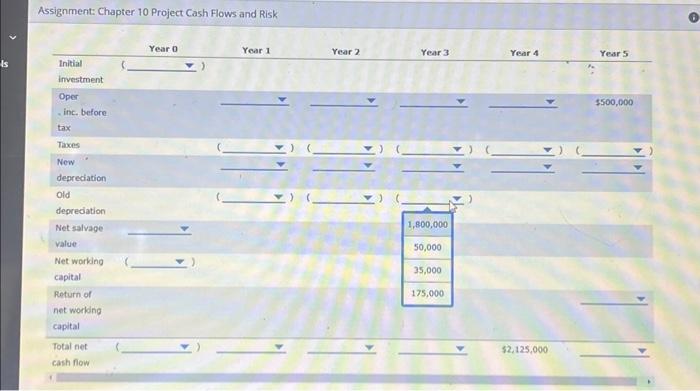

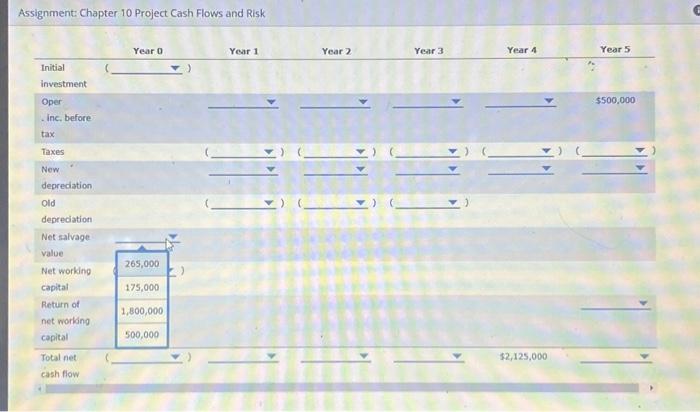

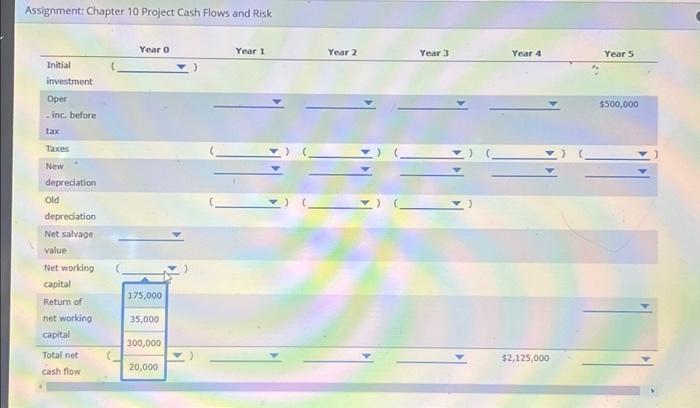

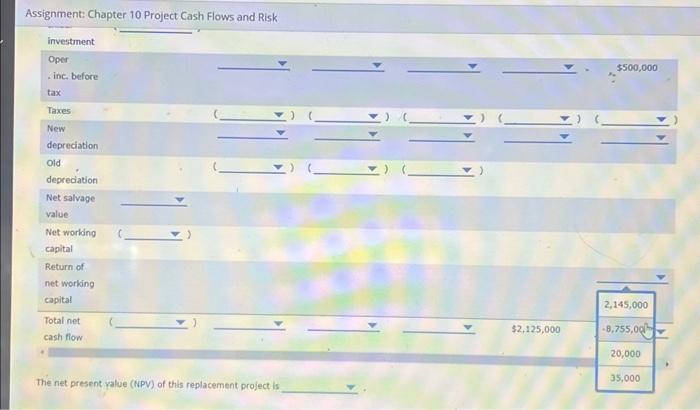

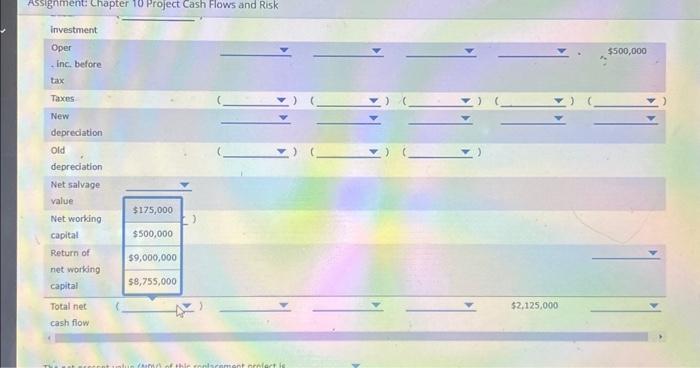

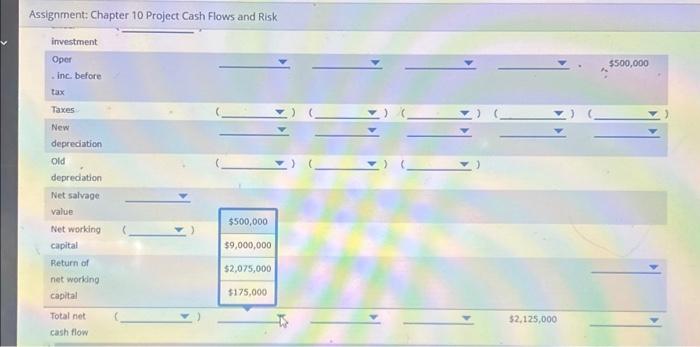

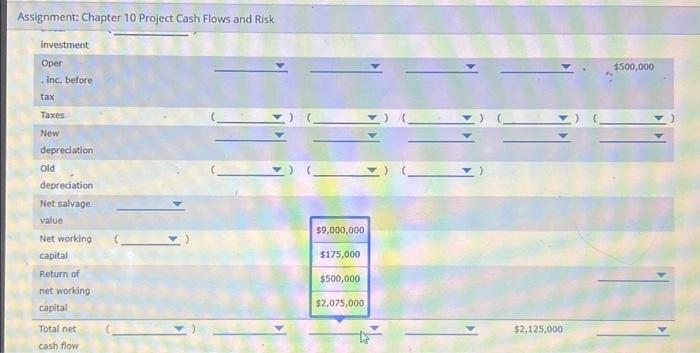

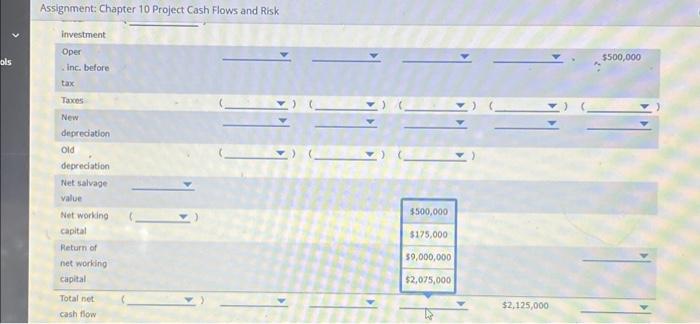

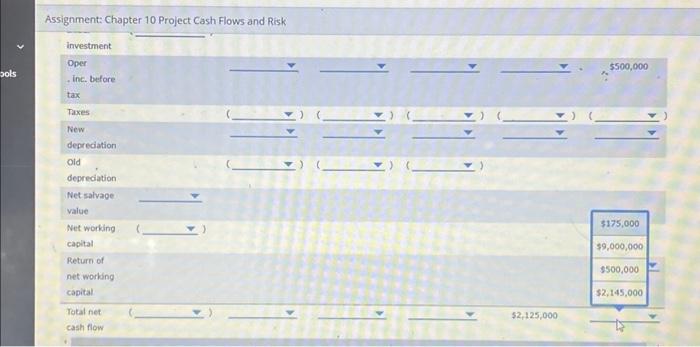

Assignment: Chapter 10 Project Cash Flows and Risk As A Assignment: Chanter in Drnibet Cach Finue and Diet Assienment: Chaoter 10 Prolect Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk As Assignment: Chapter 10 Project Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk Assirnment: Chapter 10 Proiect Cach Flows and Piek. Assignment: Chapter 10 Project Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk Initial investment As A Assi Assignment: Chapter 10 Project Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk As: Assignment: Chapter 10 Project Cash Flows and Risk Assignment: Chapter 10 Project Cash Flows and Risk investment Oper - inc, before tax Taxes New depredation old depreciation Net salvage value Net working capital Return of net working capital ( ) $500,000 Total net cash flow Assignment: Chanter 10 Proiert Cach Flowe and Dhel Assignment: Chaoter 10 Proiect Cach Flowe and Diel Assignment: Chapter 10 Project Cash Flows and Risk 6. Analysis of a replacement project Consider the case of LoRusso Company: The managers of LoRusso Company are considering replacing an existing piece of equipment, and have collected the following information: - The new piece of equipment will have a cost of $9,000,000, and it will be depreciated on a straight-line basis over a period of five years. - The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000(at year 0) and three more years of depredation left ($50,000 per vear ). - The new equipment will have a salvage value of 50 at the end of the project's life (vear 5 ). The old machine has a current salvage value (at year 0) of $300,000. - Replacing the old machine will require an investment in net working capital (NWC) of $20,000 that will be recovered at the end of the project's life (year 5 ). - The new machine is more efficient, so the incremental increase in operating income before taxes will increase by a total of 3500,000 in each of the next five years (years 1-5). (Hint: This value represents the difference between the revenues and operating costs (including depreciation expense) generated using the new equipment and that earmed using the old equipment.) - The profect's required rate of return is 11%. - The company's annual tax rate is 35%. Assignment: Chapter 10 Project Cash Flows and Risk investment Oper - inc, before tax Taxes New depreciation old depreciation Net salvage value Net working capital Return of net working capital ()( ()( v) ) c - $500,000 Total net cash flow $2,125,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts