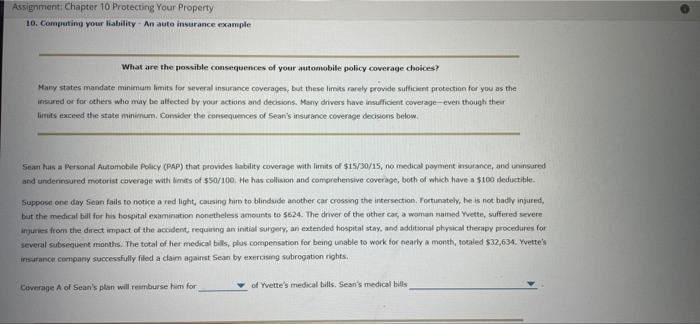

Question: Assignment Chapter 10 Protecting Your Property 10. Computing your liability. An auto insurance example What are the possible consequences of your automobile policy coverage choices?

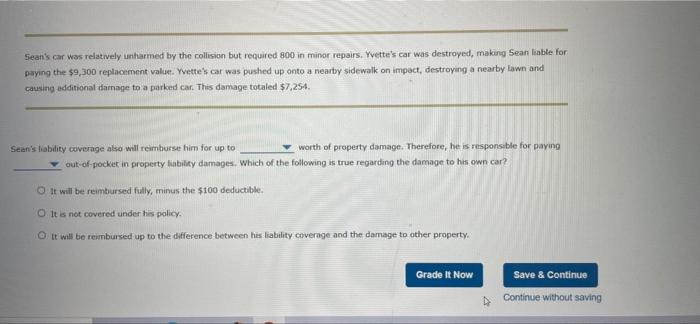

Assignment Chapter 10 Protecting Your Property 10. Computing your liability. An auto insurance example What are the possible consequences of your automobile policy coverage choices? Many states mandate minimum limits for several insurance coverages, but these limits rarely provide sufficient protection for you as the insured or for others who may be alfected by your actions and decisions. Many drivers have insufficient coverage-even though their limits exceed the state minimum. Consider the consequences of Sean's insurance coverage decisions below. Sean husa Personal Automobile Policy (PAP) that provides lability coverage with limits of $15/30/15, no medical payment insurance, and uninsured and undernsured motorist coverage with limits of $50/100. He has collision and comprehensive coverage, both of which have a $100 deductible Support one day Sean fails to notice a red light, causing him to blindude another car crossing the intersection. Fortunately, he is not badly injured, but the medical bil for his hospital examination nonetheless amounts to $624. The driver of the other car, a woman named Yvette, suffered severe injuries from the direct impact of the accident, requiring an initial surgery, an extended hospital stay, and additional physical therapy procedures for several subsequent months. The total of her medical bills, plus compensation for being unable to work for nearly a month, totaled $32,634. Yvette's insurance company successfully filed a claim against Sean by emring subrogation rights Coverage A of Sean's plan will remburse him for of Yvette's medical bills. Sean's medical bills Sean's car was relatively unharmed by the collision but required 800 in minor repairs. Yvette's car was destroyed, making Sean liable for paying the $9,300 replacement value. Yvette's car was pushed up onto a nearty sidewalk on impact, destroying a nearby lawn and causing additional damage to a parked car. This damage totaled 57,254 Sean's liability coverage also will reimburse him for up to worth of property damage. Therefore, he is responsible for paying out-of-pocket in property liability damages. Which of the following is true regarding the damage to his own car? It will be reimbursed fully, minus the $100 deductible. O It is not covered under his policy. It will be reimbursed up to the difference between his liability coverage and the damage to other property. Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts