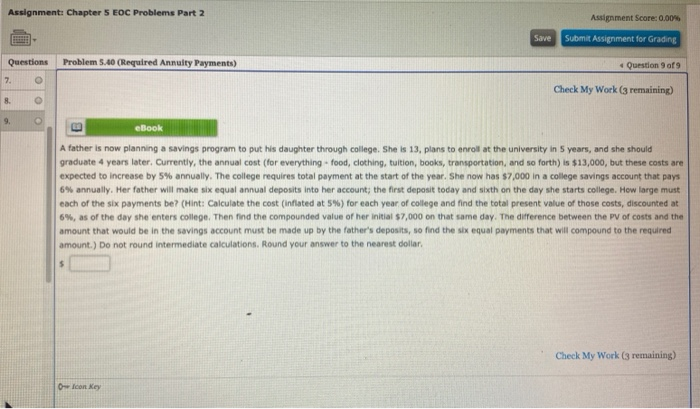

Question: Assignment: Chapter 5 EOC Problems Part 2 Assignment Score: 0.00% Save Submit Assignment for Grading Problem 5.40 (Required Annuity Payments) Question 9 of 9 Questions

Assignment: Chapter 5 EOC Problems Part 2 Assignment Score: 0.00% Save Submit Assignment for Grading Problem 5.40 (Required Annuity Payments) Question 9 of 9 Questions 7. Check My Work (3 remaining) 8. 9. eBook A father is now planning a savings program to put his daughter through college. She is 13. plans to enroll at the university in 5 years, and she should graduate 4 years later. Currently, the annual cost (for everything - food, clothing, tuition, books, transportation, and so forth) is $13,000, but these costs are expected to increase by 5% annually. The college requires total payment at the start of the year. She now has $7,000 in a college savings account that pays 6% annually. Her father will make six equal annual deposits into her account; the first deposit today and sixth on the day she starts college. How large must each of the six payments be? (Hint: Calculate the cost (Inflated at 5%) for each year of college and find the total present value of those costs, discounted at 6%, as of the day she enters college. Then find the compounded value of her initial $7,000 on that same day. The difference between the PV of costs and the t that would be in the savings account must be made up by the father's deposits, so find the six equal payments that will compound to the required amount.) Do not round intermediate calculations. Round your answer to the nearest dollar $ Check My Work (3 remaining) Owlcon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts