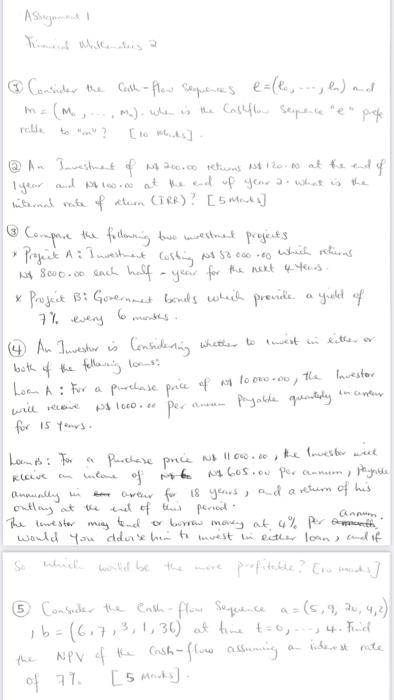

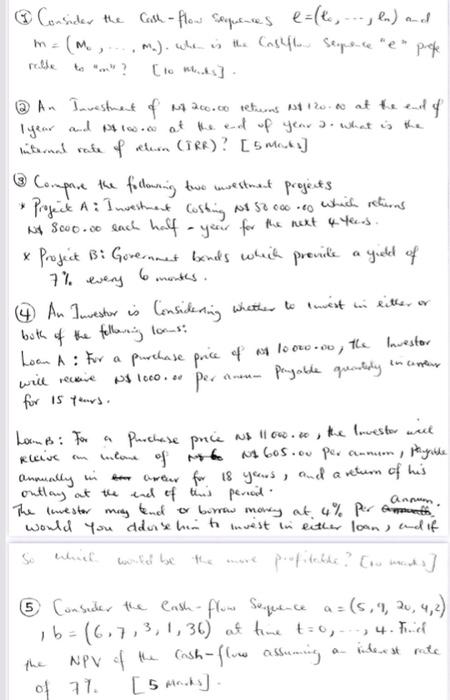

Question: Assignment @ Consider the Call-flow sequences e= (helen) and m.). When is the Cashflow sepence e prefe in = (m. relle @ An Lavestiment of

Assignment @ Consider the Call-flow sequences e= (helen) and m.). When is the Cashflow sepence "e" prefe in = (m. relle @ An Lavestiment of 200.00 returns 200 at the end of 1 year and it 10.0 at the end up year a. what is the internal rate of return (IRR) ? [5 Marts] & Compare the following two investment projects Project A Investment costing for so eco eo which returns N& Scoo. each half year for the next 4 years. x Project B: Government bonds which provide gold of 7% every 6 4 An Investor is considering whether to twist in either or both of the following lows: home A: For a purchase price of as to www.es the Investor will receive poco per for is years. Looms: For a purchase price wallow.o. the investor will KUOLUE o walome of me N16os.ou per annum, Payntle arer for 18 years, and a retum of his outlay at the end of this period The lowester may tend or borrow money at 4% per month would you adors han to invest in either loan and it So would be payable quently in antur Anmelding i Q Consider the Cash-flow Sequence a=(5, 9, 2, 4, 2) i b = (6,713, 1, 36) at time too. 4. Kid NPV of the Cash-flow assuming [5 Marts] of 77 @ Consider the Cash-flow sequences e=(teln) and m (m, m.). When is the Cashflow separe de prefe [tomt] rable PS loco. 2 An Investment of 200.co terms as 12:00 at the end I year and Ms 100... at the end of year a. harun rate of whern GIRR)? [5 mek] Compare the following two investment projects Project A: Investment Costing at 50 000 to which returns No Scoo..o each half -year for the next 4 years. x Project B: Government bonds which provide a yield of 7% 6 every 4 An Investor is Considering whether to twent in litter or both of the following lows: Loan A: For a purchase price of as to ow.oo, the Investor will receive per payable guantly for 15 years homes for a prochase price as low. o, the lowester will kleive an income of it is 60s ou per annum, pynthe annually in arter for 18 years, and a return of his outlay at the end of this period. The livestor may tend or borrow money at 4% por apreth would you adurs him to invest in either loan, and if would be profitable to works] 6 Consider the Cash-flome Sequence a= (s. 9, 2, 4,2) 1b = (6, 7, 3, 1, 36) at time to, 4. hd the NPV of the cash flow assuming of 71. [5 rocks] Onun (5 2 Assignment @ Consider the Call-flow sequences e= (helen) and m.). When is the Cashflow sepence "e" prefe in = (m. relle @ An Lavestiment of 200.00 returns 200 at the end of 1 year and it 10.0 at the end up year a. what is the internal rate of return (IRR) ? [5 Marts] & Compare the following two investment projects Project A Investment costing for so eco eo which returns N& Scoo. each half year for the next 4 years. x Project B: Government bonds which provide gold of 7% every 6 4 An Investor is considering whether to twist in either or both of the following lows: home A: For a purchase price of as to www.es the Investor will receive poco per for is years. Looms: For a purchase price wallow.o. the investor will KUOLUE o walome of me N16os.ou per annum, Payntle arer for 18 years, and a retum of his outlay at the end of this period The lowester may tend or borrow money at 4% per month would you adors han to invest in either loan and it So would be payable quently in antur Anmelding i Q Consider the Cash-flow Sequence a=(5, 9, 2, 4, 2) i b = (6,713, 1, 36) at time too. 4. Kid NPV of the Cash-flow assuming [5 Marts] of 77 @ Consider the Cash-flow sequences e=(teln) and m (m, m.). When is the Cashflow separe de prefe [tomt] rable PS loco. 2 An Investment of 200.co terms as 12:00 at the end I year and Ms 100... at the end of year a. harun rate of whern GIRR)? [5 mek] Compare the following two investment projects Project A: Investment Costing at 50 000 to which returns No Scoo..o each half -year for the next 4 years. x Project B: Government bonds which provide a yield of 7% 6 every 4 An Investor is Considering whether to twent in litter or both of the following lows: Loan A: For a purchase price of as to ow.oo, the Investor will receive per payable guantly for 15 years homes for a prochase price as low. o, the lowester will kleive an income of it is 60s ou per annum, pynthe annually in arter for 18 years, and a return of his outlay at the end of this period. The livestor may tend or borrow money at 4% por apreth would you adurs him to invest in either loan, and if would be profitable to works] 6 Consider the Cash-flome Sequence a= (s. 9, 2, 4,2) 1b = (6, 7, 3, 1, 36) at time to, 4. hd the NPV of the cash flow assuming of 71. [5 rocks] Onun (5 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts