Question: Assignment Construct a three-step binomial interest rate model assuming the following: 1. The current one-period spot rate is 7% 2. The upward parameter u =

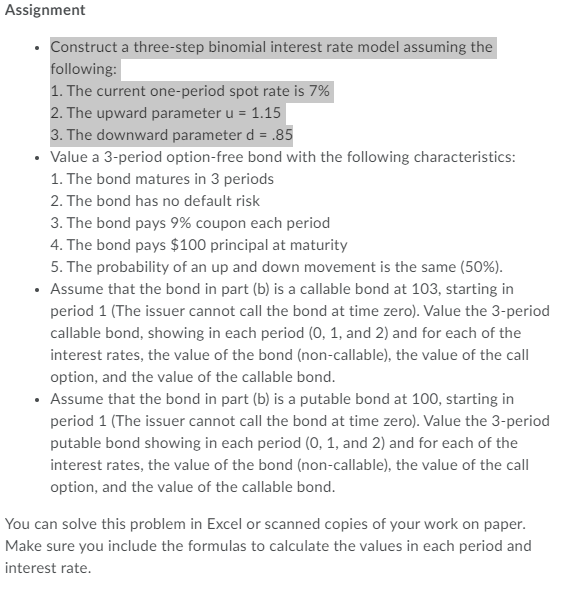

Assignment Construct a three-step binomial interest rate model assuming the following: 1. The current one-period spot rate is 7% 2. The upward parameter u = 1.15 3. The downward parameter d = .85 Value a 3-period option-free bond with the following characteristics: 1. The bond matures in 3 periods 2. The bond has no default risk 3. The bond pays 9% coupon each period 4. The bond pays $100 principal at maturity 5. The probability of an up and down movement is the same (50%). Assume that the bond in part (b) is a callable bond at 103, starting in period 1 (The issuer cannot call the bond at time zero). Value the 3-period callable bond, showing in each period (0, 1, and 2) and for each of the interest rates, the value of the bond (non-callable), the value of the call option, and the value of the callable bond. Assume that the bond in part (b) is a putable bond at 100, starting in period 1 (The issuer cannot call the bond at time zero). Value the 3-period putable bond showing in each period (0, 1, and 2) and for each of the interest rates, the value of the bond (non-callable), the value of the call option, and the value of the callable bond. You can solve this problem in Excel or scanned copies of your work on paper. Make sure you include the formulas to calculate the values in each period and interest rate. Assignment Construct a three-step binomial interest rate model assuming the following: 1. The current one-period spot rate is 7% 2. The upward parameter u = 1.15 3. The downward parameter d = .85 Value a 3-period option-free bond with the following characteristics: 1. The bond matures in 3 periods 2. The bond has no default risk 3. The bond pays 9% coupon each period 4. The bond pays $100 principal at maturity 5. The probability of an up and down movement is the same (50%). Assume that the bond in part (b) is a callable bond at 103, starting in period 1 (The issuer cannot call the bond at time zero). Value the 3-period callable bond, showing in each period (0, 1, and 2) and for each of the interest rates, the value of the bond (non-callable), the value of the call option, and the value of the callable bond. Assume that the bond in part (b) is a putable bond at 100, starting in period 1 (The issuer cannot call the bond at time zero). Value the 3-period putable bond showing in each period (0, 1, and 2) and for each of the interest rates, the value of the bond (non-callable), the value of the call option, and the value of the callable bond. You can solve this problem in Excel or scanned copies of your work on paper. Make sure you include the formulas to calculate the values in each period and interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts