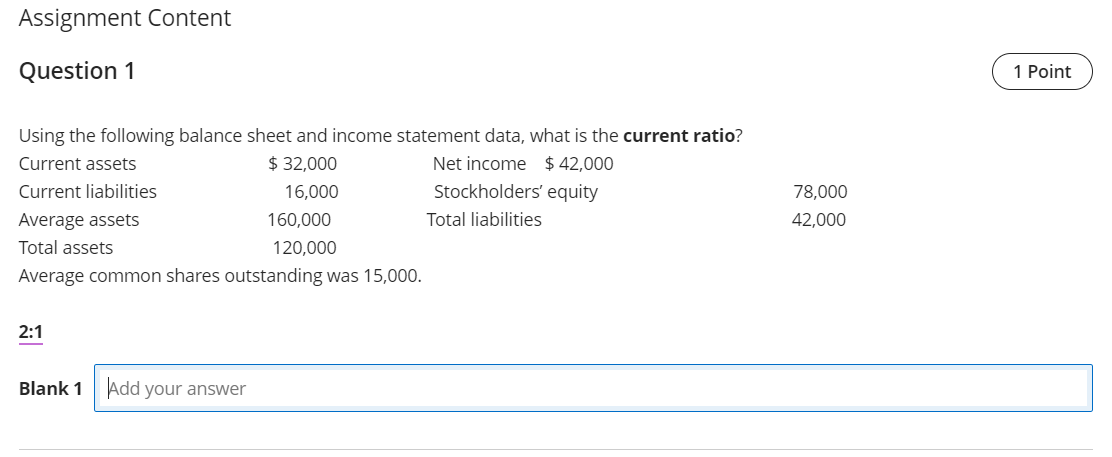

Question: Assignment Content Question 1 Using the following balance sheet and income statement data, what is the current ratio? Average common shares outstanding was 15,000 .

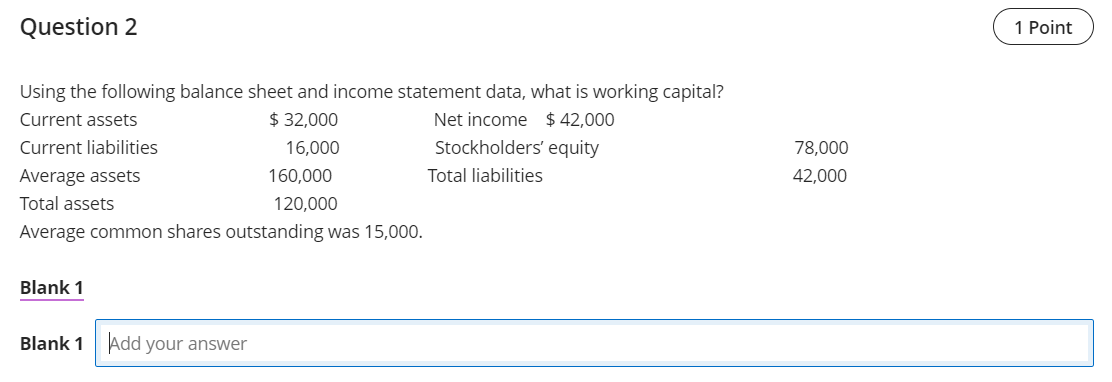

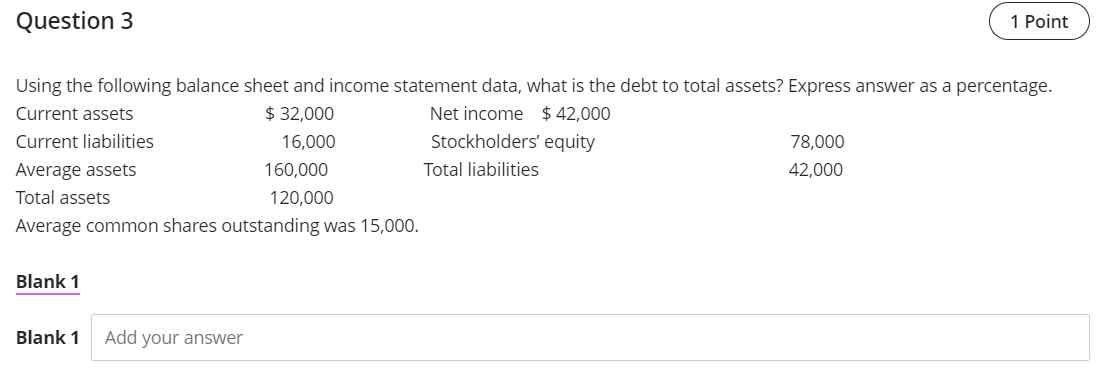

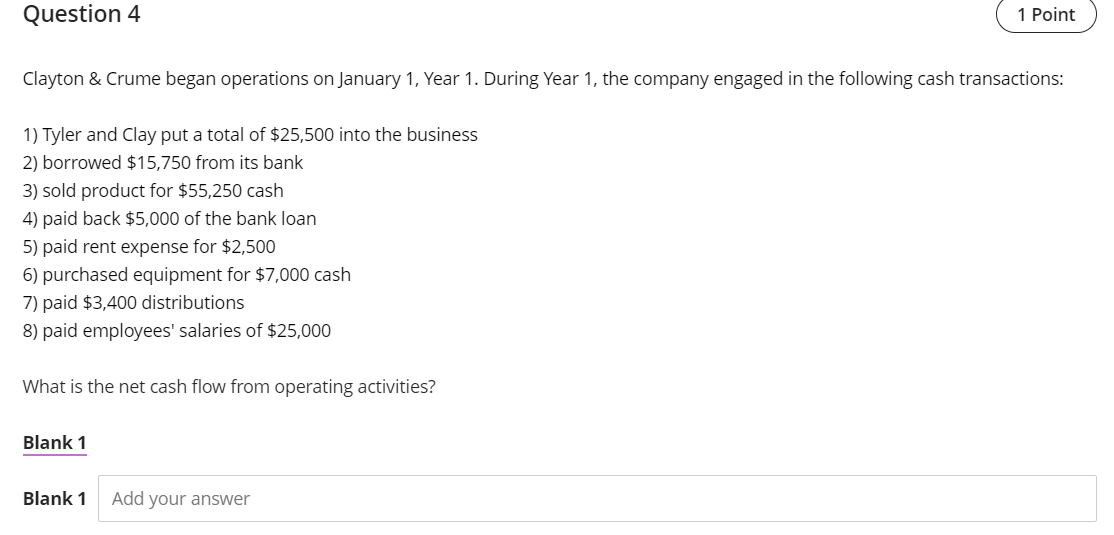

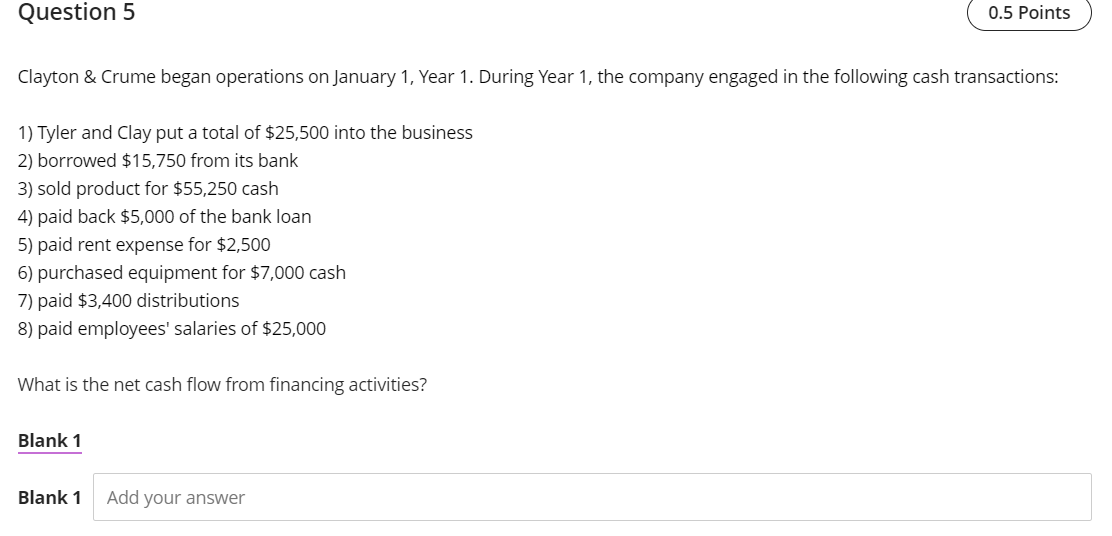

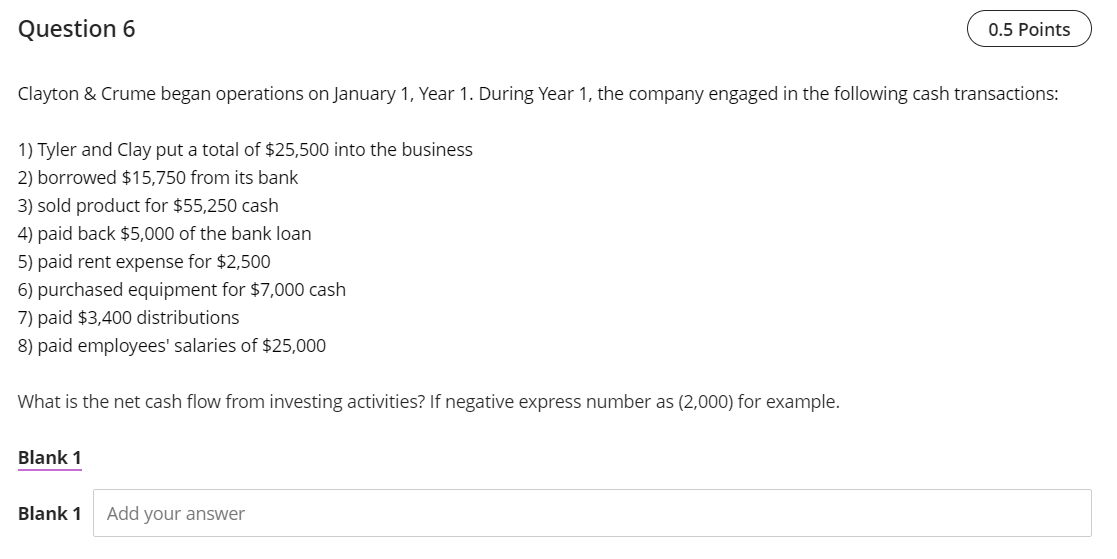

Assignment Content Question 1 Using the following balance sheet and income statement data, what is the current ratio? Average common shares outstanding was 15,000 . Using the following balance sheet and income statement data, what is working capital? Average common shares outstanding was 15,000 . Average common shares outstanding was 15,000 . Clayton \& Crume began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) Tyler and Clay put a total of $25,500 into the business 2) borrowed $15,750 from its bank 3) sold product for $55,250 cash 4) paid back $5,000 of the bank loan 5) paid rent expense for $2,500 6) purchased equipment for $7,000 cash 7) paid $3,400 distributions 8) paid employees' salaries of $25,000 What is the net cash flow from operating activities? Clayton \& Crume began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) Tyler and Clay put a total of $25,500 into the business 2) borrowed $15,750 from its bank 3) sold product for $55,250 cash 4) paid back $5,000 of the bank loan 5) paid rent expense for $2,500 6) purchased equipment for $7,000 cash 7) paid $3,400 distributions 8) paid employees' salaries of $25,000 What is the net cash flow from financing activities? Clayton \& Crume began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) Tyler and Clay put a total of $25,500 into the business 2) borrowed $15,750 from its bank 3) sold product for $55,250 cash 4) paid back $5,000 of the bank loan 5) paid rent expense for $2,500 6) purchased equipment for $7,000 cash 7) paid $3,400 distributions 8) paid employees' salaries of $25,000 What is the net cash flow from investing activities? If negative express number as (2,000) for example

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts