Question: Assignment Description 1 This assignment requires you to answer a series of questions. Assignment Requirement 1 Q 4 - 1 MEGG Inc. just paid a

Assignment Description

This assignment requires you to answer a series of questions.

Assignment Requirement

Q

MEGG Inc. just paid a dividend of $ per share on its stock. The dividends are expected to growth at a constant percent per year indefinitely. If investors require a percent return on the stock, what is the current price? What will the price be in years? In years?

Q

BrainSoft has coupon bonds on the market with years to maturity. The bonds make semiannual payments and currently sell for of par. What is the current yield on the bonds? The yield to maturity?

Q

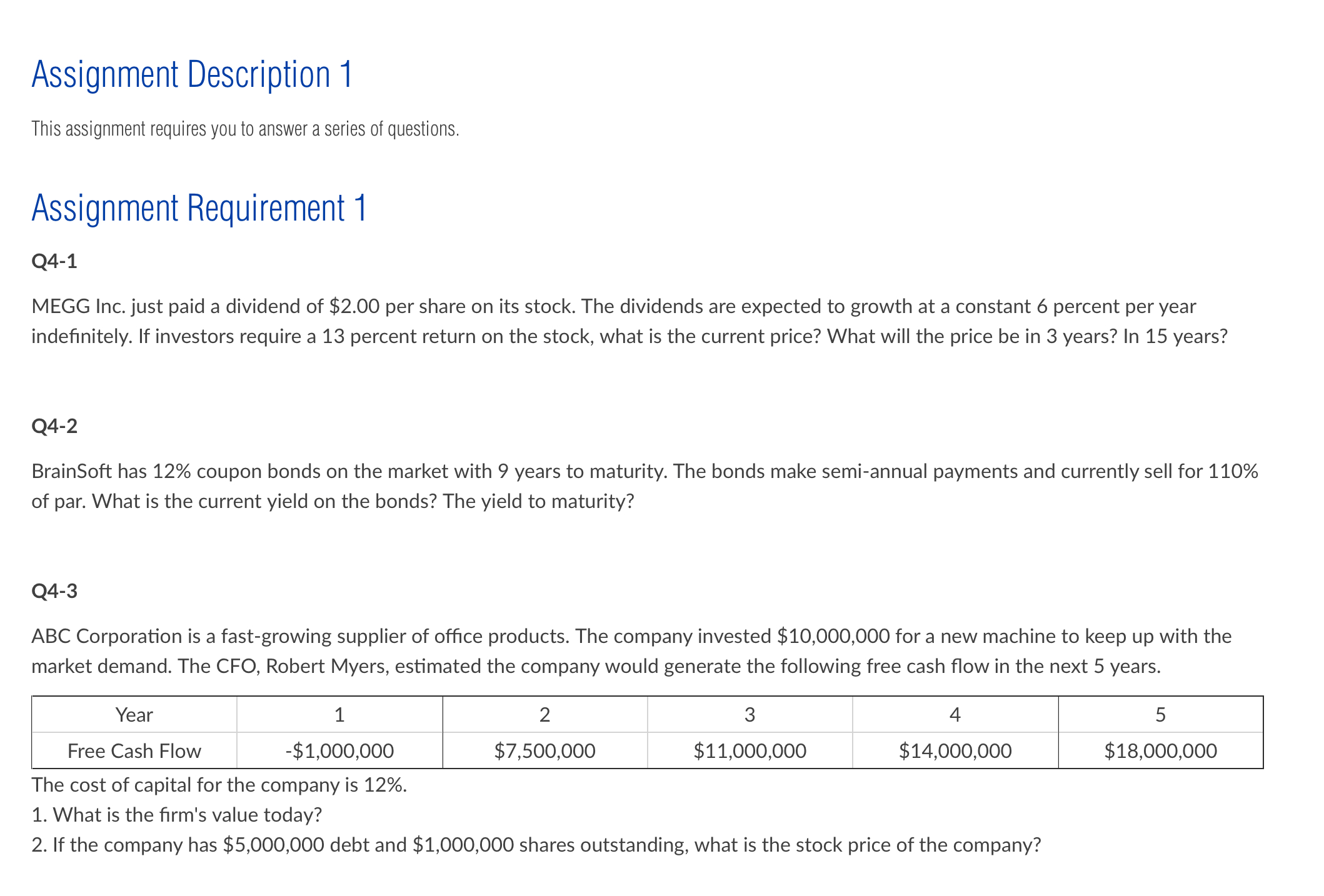

ABC Corporation is a fastgrowing supplier of office products. The company invested $ for a new machine to keep up with the market demand. The CFO, Robert Myers, estimated the company would generate the following free cash flow in the next years.

The cost of capital for the company is

What is the firm's value today?

If the company has $ debt and $ shares outstanding, what is the stock price of the company?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock