Question: ASSIGNMENT EQUITY ANALYSIS Due in groups of three or less on31st march 2020 at beginning of class. QUESTION ONE Hansen has a beta of

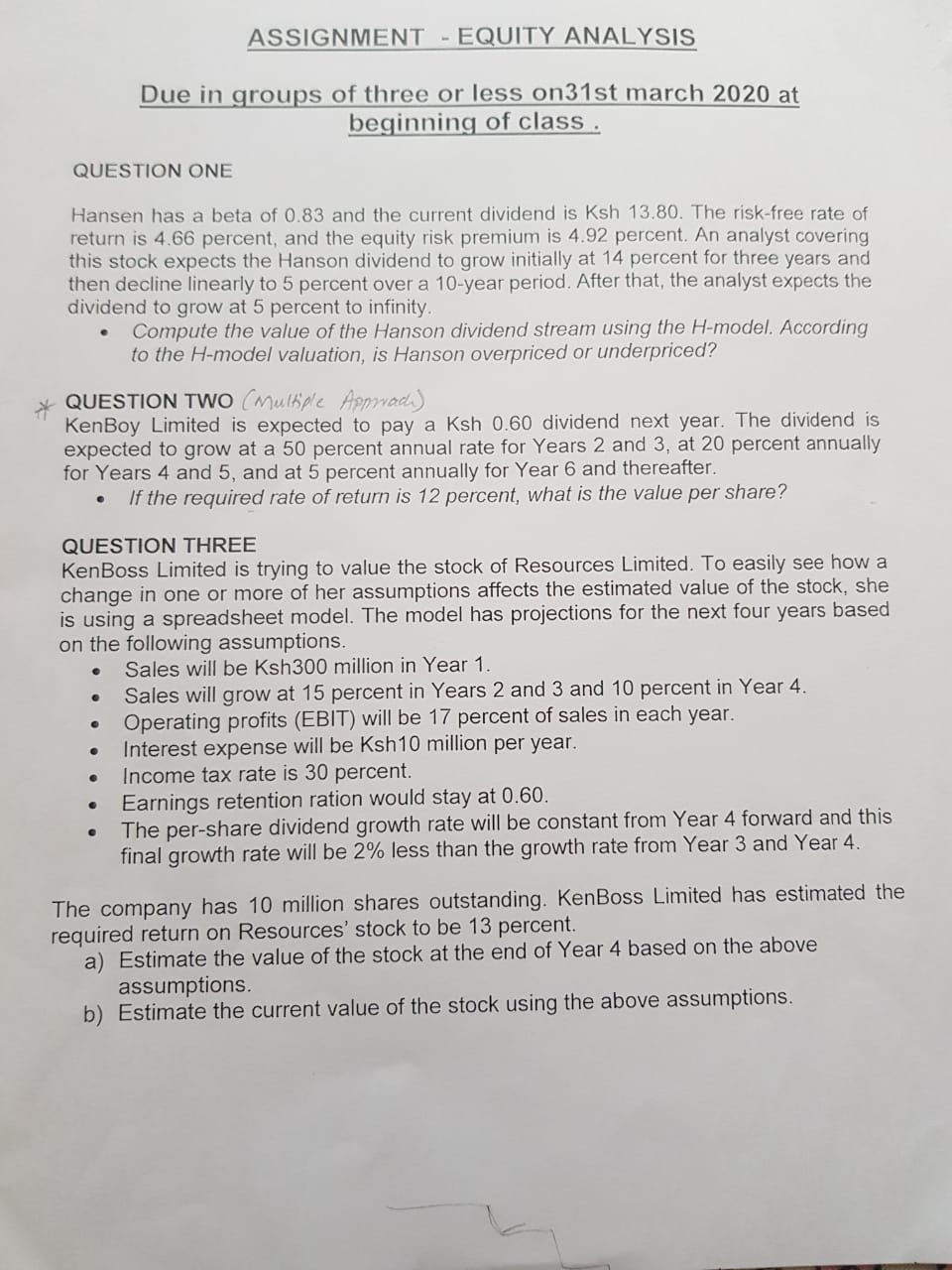

ASSIGNMENT EQUITY ANALYSIS Due in groups of three or less on31st march 2020 at beginning of class. QUESTION ONE Hansen has a beta of 0.83 and the current dividend is Ksh 13.80. The risk-free rate of return is 4.66 percent, and the equity risk premium is 4.92 percent. An analyst covering this stock expects the Hanson dividend to grow initially at 14 percent for three years and then decline linearly to 5 percent over a 10-year period. After that, the analyst expects the dividend to grow at 5 percent to infinity. Compute the value of the Hanson dividend stream using the H-model. According to the H-model valuation, is Hanson overpriced or underpriced? QUESTION TWO (Multiple Apprradh) KenBoy Limited is expected to pay a Ksh 0.60 dividend next year. The dividend is expected to grow at a 50 percent annual rate for Years 2 and 3, at 20 percent annually for Years 4 and 5, and at 5 percent annually for Year 6 and thereafter. If the required rate of return is 12 percent, what is the value per share? QUESTION THREE KenBoss Limited is trying to value the stock of Resources Limited. To easily see how a change in one or more of her assumptions affects the estimated value of the stock, she is using a spreadsheet model. The model has projections for the next four years based on the following assumptions. Sales will be Ksh300 million in Year 1 Sales will grow at 15 percent in Years 2 and 3 and 10 percent in Year 4. Operating profits (EBIT) will be 17 percent of sales in each year. Interest expense will be Ksh10 million per year. Income tax rate is 30 percent. Earnings retention ration would stay at 0.60. The per-share dividend growth rate will be constant from Year 4 forward and this final growth rate will be 2% less than the growth rate from Year 3 and Year 4. The company has 10 million shares outstanding. KenBoss Limited has estimated the required return on Resources' stock to be 13 percent. a) Estimate the value of the stock at the end of Year 4 based on the above assumptions. b) Estimate the current value of the stock using the above assumptions.

Step by Step Solution

There are 3 Steps involved in it

Lets go through each question step by step Question One To compute the value of the Hanson dividend stream using the Hmodel we need to calculate the present value of the expected future dividends The ... View full answer

Get step-by-step solutions from verified subject matter experts