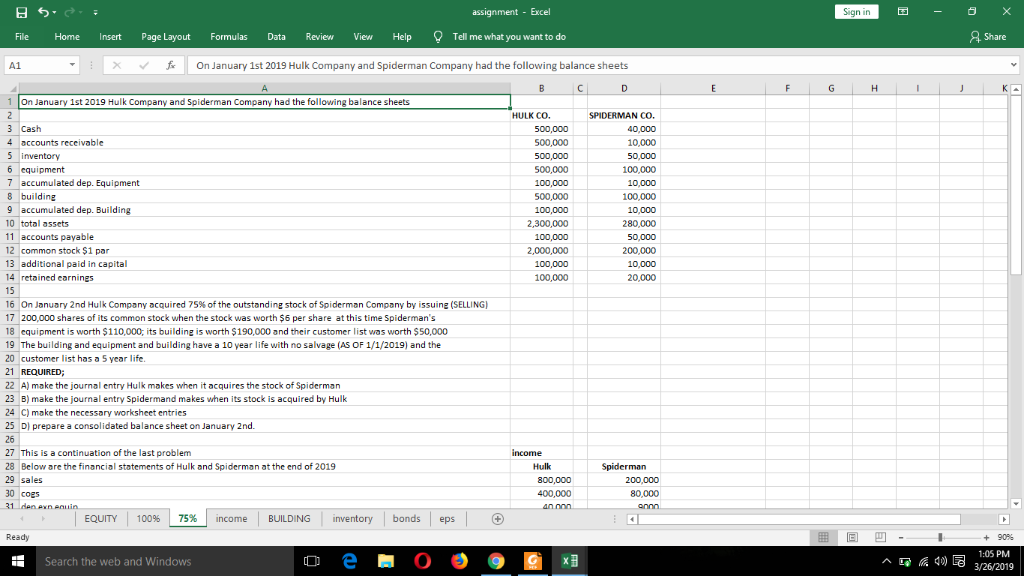

Question: . assignment - Excel Sign in File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fOn January

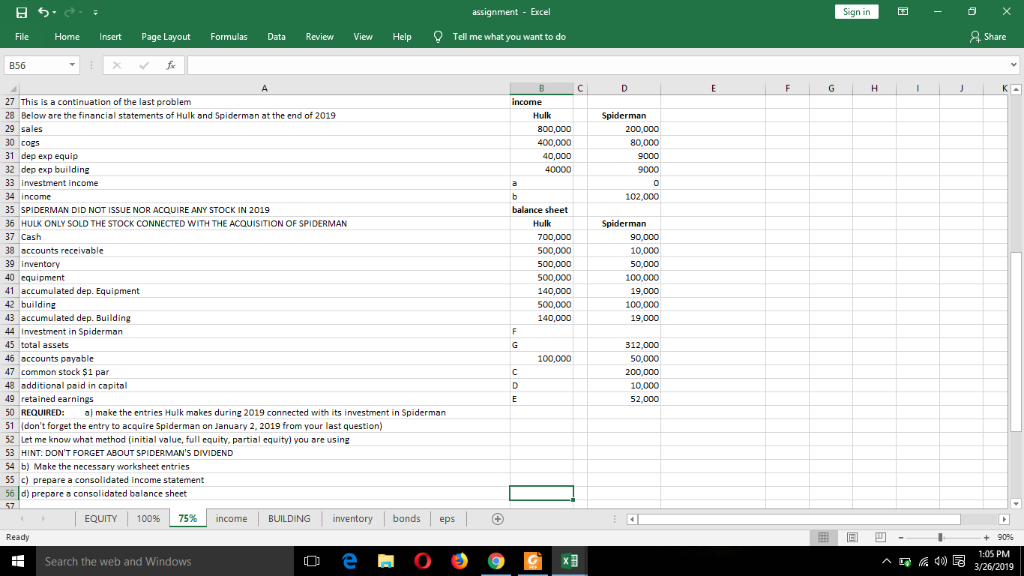

. assignment - Excel Sign in File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fOn January 1st 2019 Hulk Company and Spiderman Company had the following balance sheets 1 On January 1st 2019 Hulk Company and Spiderman Company had the following balance sheets HULK CO SPIDERMAN CO. 3 Cash 4 accounts receivable 5 inventory 6 equipment 7 accumulated dep. Equipment 8 building 9 accumulated dep. Building 10 total assets 11 accounts payable 12 common stock $1 par 13 additional paid in capital 14 retained carningS 500,000 500,000 500,000 00,000 100,000 00,000 100,000 10,000 2,300,00 280,000 100,000 2,000,000 100,000 100,000 16 On January 2nd Hulk Company acquired 75% of the outstanding stock of Spiderman Com pony by issuing (SELLING) 17 200,000 shares of its common stock when the stock was worth $6 per share at this time Spiderman's 18 equipment is worth $110,000, its building is worth $190,000 and their customer list was worth $50,000 19 The building and equipment and building have a 10 year life with no salvage (AS OF 1/1/2019) and the 20 customer list has a 5 year life 21 REQUIRED 22 A) make the journal entry Hulk makes when it acquires the stock of Spiderman 23 B) make the journal entry Spidermand makes when its stock is acquired by Hulk 24 C) make the necessary worksheet entries 25 DI prepare a consolidated balance sheet on January 2nd. 27 This is a continuation of the last problem 28 Below are the financial statements of Hulk and Spiderman at the end of 2019 29 sales 30 COEs 31 denexn Hulk 800,000 400,000 80,000 | EQUITY | 100% | 75% | income BUILDING inventory bonds | eps Ready +90% 1:05 PM 43/26/2019 De.OO. Search the web and Windows assignment - Excel Sign in File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share 27 This is a continuation of the last problem 28 Below are the financial statements of Hulk and Spiderman at the end of 2019 29 sales 30 COES 31 dep exp equip 32 dep exp building 33 investment income 34 income 35 SPIDERMAN DID NOT ISSUE NOR ACQUIRE ANY STOCK IN 2019 36 HULK ONLY SOLD THE STOCK CONNECTED WITH THE ACQUISITION OF SPIDERMAN 37 Cash 38 accounts receivable 39 inventory 40 equipment 41 accumulated dep. Equipment 42 building 43 accumulated dep. Building 800,000 400,000 40,000 80,000 102,000 balance sheet 700,000 500,000 10,000 00,000 00,000 140,000 45 total assets 46 accounts payable 47 common stock $1 par 48 additional paid in capital 49 retained earnings 50 REQUIRED: a) make the entries Hulk makes during 2019 connected with its investment in Spiderman 51 (don't forget the entry to acquire Spiderman on January 2, 2019 from your last question) 52 Let me know what method (initial value, full equity, partial equity) you are using 53 HINT: DON'T FORGET ABOUT SPIDERMAN'S DIVIDEND 54 b) Make the necessary worksheet entries 55 c) prepare a consolidated income statement 100,000 0,000 56 d) prepare a consolidated balance sheet | EQUITY | 100% | 75% | income BUILDING inventory bonds | eps Ready +90% 1:05 PM Search the web and Windows 49 3/26/2019 ^ . assignment - Excel Sign in File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do fOn January 1st 2019 Hulk Company and Spiderman Company had the following balance sheets 1 On January 1st 2019 Hulk Company and Spiderman Company had the following balance sheets HULK CO SPIDERMAN CO. 3 Cash 4 accounts receivable 5 inventory 6 equipment 7 accumulated dep. Equipment 8 building 9 accumulated dep. Building 10 total assets 11 accounts payable 12 common stock $1 par 13 additional paid in capital 14 retained carningS 500,000 500,000 500,000 00,000 100,000 00,000 100,000 10,000 2,300,00 280,000 100,000 2,000,000 100,000 100,000 16 On January 2nd Hulk Company acquired 75% of the outstanding stock of Spiderman Com pony by issuing (SELLING) 17 200,000 shares of its common stock when the stock was worth $6 per share at this time Spiderman's 18 equipment is worth $110,000, its building is worth $190,000 and their customer list was worth $50,000 19 The building and equipment and building have a 10 year life with no salvage (AS OF 1/1/2019) and the 20 customer list has a 5 year life 21 REQUIRED 22 A) make the journal entry Hulk makes when it acquires the stock of Spiderman 23 B) make the journal entry Spidermand makes when its stock is acquired by Hulk 24 C) make the necessary worksheet entries 25 DI prepare a consolidated balance sheet on January 2nd. 27 This is a continuation of the last problem 28 Below are the financial statements of Hulk and Spiderman at the end of 2019 29 sales 30 COEs 31 denexn Hulk 800,000 400,000 80,000 | EQUITY | 100% | 75% | income BUILDING inventory bonds | eps Ready +90% 1:05 PM 43/26/2019 De.OO. Search the web and Windows assignment - Excel Sign in File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do Share 27 This is a continuation of the last problem 28 Below are the financial statements of Hulk and Spiderman at the end of 2019 29 sales 30 COES 31 dep exp equip 32 dep exp building 33 investment income 34 income 35 SPIDERMAN DID NOT ISSUE NOR ACQUIRE ANY STOCK IN 2019 36 HULK ONLY SOLD THE STOCK CONNECTED WITH THE ACQUISITION OF SPIDERMAN 37 Cash 38 accounts receivable 39 inventory 40 equipment 41 accumulated dep. Equipment 42 building 43 accumulated dep. Building 800,000 400,000 40,000 80,000 102,000 balance sheet 700,000 500,000 10,000 00,000 00,000 140,000 45 total assets 46 accounts payable 47 common stock $1 par 48 additional paid in capital 49 retained earnings 50 REQUIRED: a) make the entries Hulk makes during 2019 connected with its investment in Spiderman 51 (don't forget the entry to acquire Spiderman on January 2, 2019 from your last question) 52 Let me know what method (initial value, full equity, partial equity) you are using 53 HINT: DON'T FORGET ABOUT SPIDERMAN'S DIVIDEND 54 b) Make the necessary worksheet entries 55 c) prepare a consolidated income statement 100,000 0,000 56 d) prepare a consolidated balance sheet | EQUITY | 100% | 75% | income BUILDING inventory bonds | eps Ready +90% 1:05 PM Search the web and Windows 49 3/26/2019 ^

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts