Question: Assignment Exercise 2: a) Find Expected Return on Dhofar Stock given that the Expected Return on Market Portfolio is 18% and Risk-Free Rate is 6%

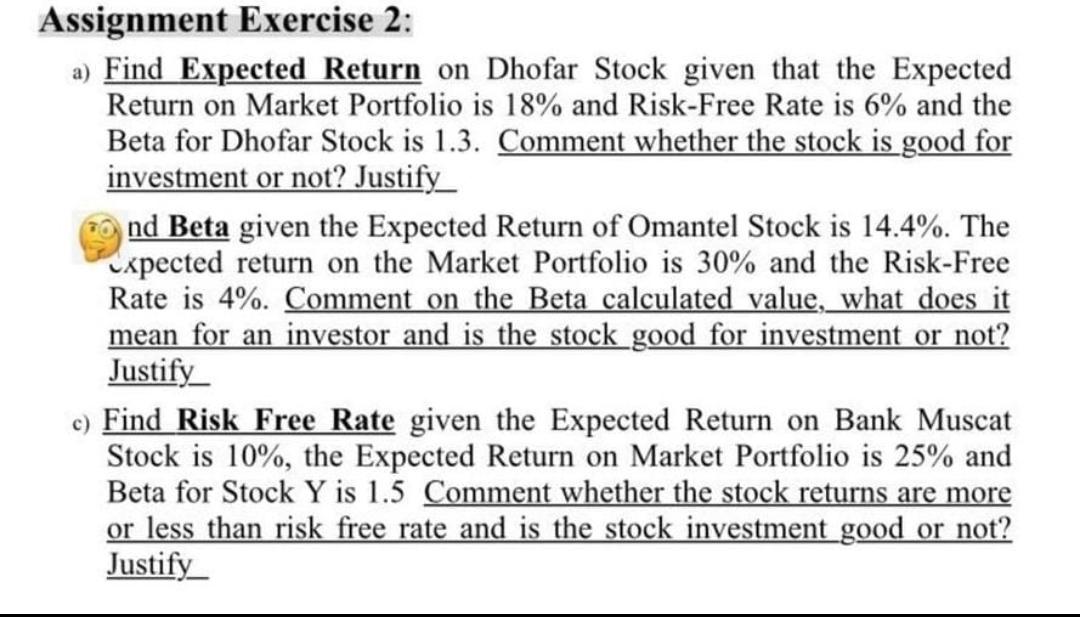

Assignment Exercise 2: a) Find Expected Return on Dhofar Stock given that the Expected Return on Market Portfolio is 18% and Risk-Free Rate is 6% and the Beta for Dhofar Stock is 1.3. Comment whether the stock is good for investment or not? Justify__ nd Beta given the Expected Return of Omantel Stock is 14.4%. The expected return on the Market Portfolio is 30% and the Risk-Free Rate is 4%. Comment on the Beta calculated value, what does it mean for an investor and is the stock good for investment or not? Justify c) Find Risk Free Rate given the Expected Return on Bank Muscat Stock is 10%, the Expected Return on Market Portfolio is 25% and Beta for Stock Y is 1.5 Comment whether the stock returns are more or less than risk free rate and is the stock investment good or not? Justify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts