Question: Assignment Five The assignment is due by 04/19, 11:59pm US EST. Question 1: You buy an eight-year bond that has a 6% current yield and

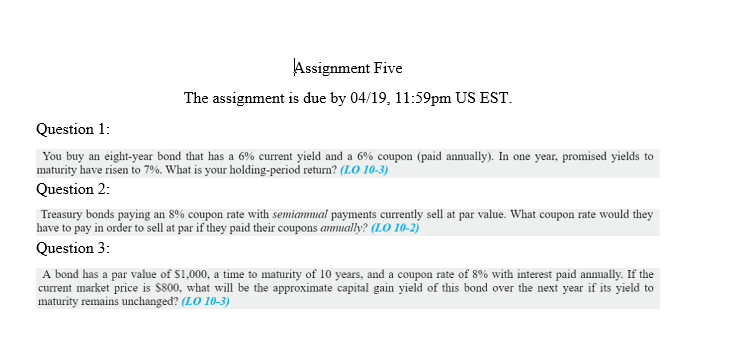

Assignment Five The assignment is due by 04/19, 11:59pm US EST. Question 1: You buy an eight-year bond that has a 6% current yield and a 6% coupon (paid annually). In one year, promised yields to maturity have risen to 7%. What is your holding-period return? (LO 10-3) Question 2: Treasury bonds paying an 8% coupon rate with semiannual payments currently sell at par value. What coupon rate would they have to pay in order to sell at par if they paid their coupons annually? (LO 10-2) Question 3: A bond has a par value of $1.000, a time to maturity of 10 years, and a coupon rate of 8% with interest paid annually. If the current market price is $800, what will be the approximate capital gain yield of this bond over the next year if its yield to maturity remains unchanged? (LO 10-3) Assignment Five The assignment is due by 04/19, 11:59pm US EST. Question 1: You buy an eight-year bond that has a 6% current yield and a 6% coupon (paid annually). In one year, promised yields to maturity have risen to 7%. What is your holding-period return? (LO 10-3) Question 2: Treasury bonds paying an 8% coupon rate with semiannual payments currently sell at par value. What coupon rate would they have to pay in order to sell at par if they paid their coupons annually? (LO 10-2) Question 3: A bond has a par value of $1.000, a time to maturity of 10 years, and a coupon rate of 8% with interest paid annually. If the current market price is $800, what will be the approximate capital gain yield of this bond over the next year if its yield to maturity remains unchanged? (LO 10-3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts