Question: Assignment folder on the course website. 1. A European call option is a right to buy a stock as a specified strike price on a

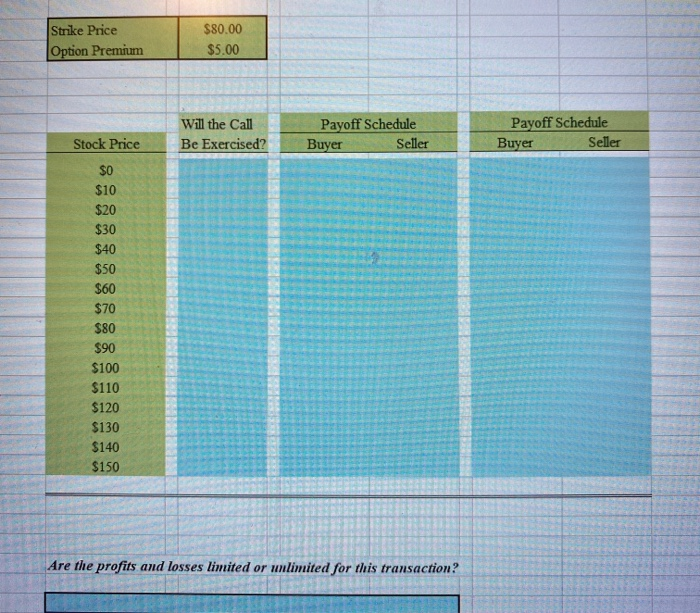

Assignment folder on the course website. 1. A European call option is a right to buy a stock as a specified strike price on a specified date. Suppose that you have purchased a call option to buy a share of XYZ Inc. in three months at a strike price of $80. The call option costs $5. The table below presents several possible prices for the share in three months (just before the call expires). For each possible price (column B), indicate whether you will exercise the call in column D (YES or NO) and calculate the payoff to you in column F. (Do not include the costs of the call in your payoff calculations.) Next, calculate the payoff schedule for your counterparty (the seller of the call option) in column G. Finally, calculate the profits for you (column 1) and your counterparty (column)). Are the profits and losses limited or unlimited for this transaction? Why or why not? (Put your answer in cell B38)? Stock Price SO $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 S150 Strike Price Option Premium $80.00 $5.00 Will the Call Be Exercised? Payoff Schedule Buyer Seller Payoff Schedule Buyer Seller Stock Price $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 $150 Are the profits and losses limited or unlimited for this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts