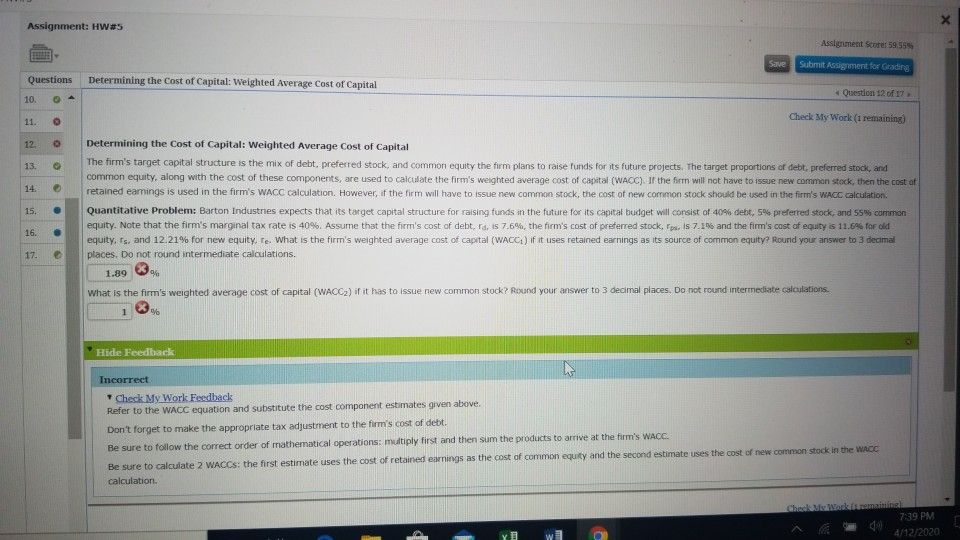

Question: Assignment: HW#5 Assignment Score: 58.55 Save Submit Assignment for Grading Questions Determining the Cost of Capital: Weighted Average Cost of Capital Question 12 of 17

Assignment: HW#5 Assignment Score: 58.55 Save Submit Assignment for Grading Questions Determining the Cost of Capital: Weighted Average Cost of Capital Question 12 of 17 10. Check My Work (1 remaining) 11 12. Determining the cost of capital: Weighted Average cost of Capital The firm's target capital structure is the mix of debt, preferred stock, and common equity the firm plans to raise funds for its future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common stock, then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will have to issue new common stock, the cost of new common stock should be used in the firm's WACC calculation Quantitative Problem: Barton Industries expects that its target capital structure for raising funds in the future for its capital budget will consist of 40% debt, 5% preferred stock, and 55% common equity. Note that the firm's marginal tax rate is 40%. Assume that the firm's cost of debt, rd, is 7.6%, the firm's cost of preferred stock, pis 7.1% and the firm's cost of equity is 11.6% for old equity, and 12.21% for new equity, Te What is the firm's weighted average cost of capital (WACC) if it uses retained earnings as its source of common equity Round your answer to 3 decimal places. Do not round intermediate calculations. 1.89 What is the firm's weighted average cost of capital (WACC) if it has to issue new common stock? Round your answer to 3 decimal places. Do not round intermediate calculations 1 % Hide Feedback Incorrect Check My Work Feedback Refer to the WACC equation and substitute the cost component estimates given above. Dont forget to make the appropriate tax adjustment to the firm's cost of debt. Be sure to follow the correct order of mathematical operations: multiply first and then sum the products to arrive at the firm's WACC. Be sure to calculate 2 WACCS: the first estimate uses the cost of retained earnings as the cost of common equity and the second estimate uses the cost of new common stock in the WACC calculation 7:39 PM 4/12/2020 A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts