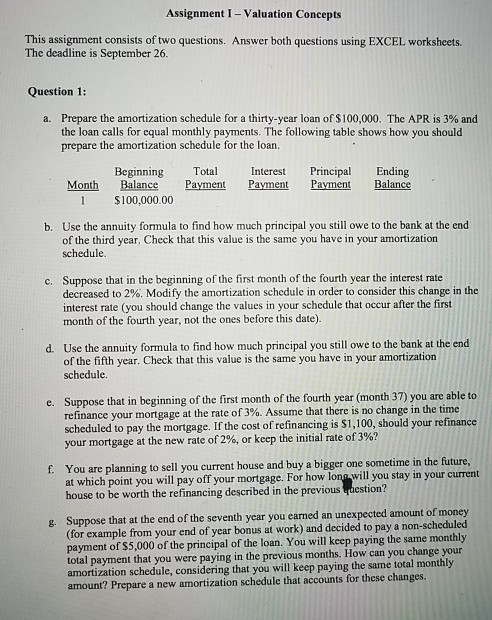

Question: Assignment I- Valuation Concepts This assignment consists of two questions. Answer both questions using EXCEL worksheets The deadline is September 26 Question 1: Prepare the

Assignment I- Valuation Concepts This assignment consists of two questions. Answer both questions using EXCEL worksheets The deadline is September 26 Question 1: Prepare the amortization schedule for a thirty-year loan of $100,000. The APR is 3% and the loan calls for equal monthly payments. The following table shows how you should prepare the amortization schedule for the loan a. Beginning Total Interest Principal Ending Month Balance Payment Payment Payment Balance $100,000.00 Use the annuity formula to find how much principal you still owe to the bank at the end of the third year, Check that this value is the same you have in your amortization schedule b. Suppose that in the beginning of the first month of the fourth year the interest rate decreased to 2%. Modify the amortization schedule in order to consider this change in the interest rate (you should change the values in your schedule that occur after the first month of the fourth year, not the ones before this date) c. Use the annuity formula to find how much principal you still owe to the bank at the end of the fifth year. Check that this value is the same you have in your amortization schedule d. Suppose that in beginning of the first month of the fourth year (month 37) you are able to e. r mortgage at the rate of 3%. Assume that there is no change in the time If the cost of refinancing is $1,100, should your refinance scheduled to pay the mortgage. your mortgage at the new rate of 296, or keep the initial rate of 370 You are planning to sell you current house and buy a bigger one sometime in the future at which point you will pay off your mortgage. For how lone will you stay in your current house to be worth the refinancing described in the previous destion? f. Suppose that at the end of the seventh year you earned an unexpected amount of money (for example from your end of year bonus at work) and decided to pay a non-scheduled payment of $5,000 of the principal of the loan. You will keep paying the same monthly total payment that you were paying in the previous months. How can you change your amortization schedule, considering that you will keep paying the same total monthly amount? Prepare a new amortization schedule that accounts for these changes g

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts