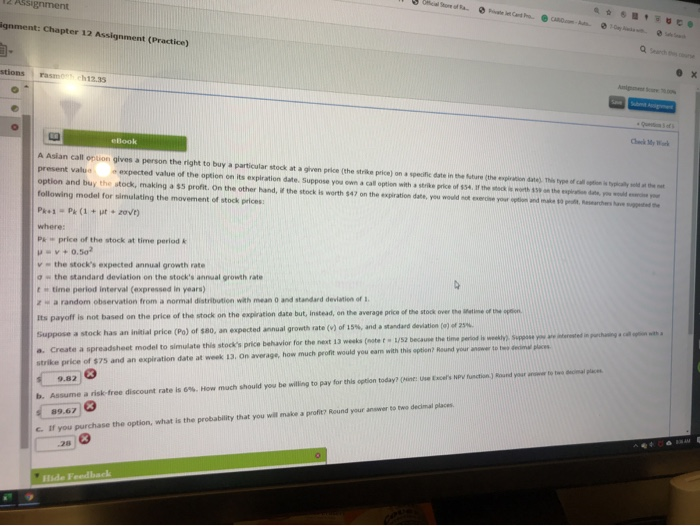

Question: Assignment ignment: Chapter 12 Assignment (Practice) stions X eBook A Asian call option gives a person the right to buy a particular stock at a

Assignment ignment: Chapter 12 Assignment (Practice) stions X eBook A Asian call option gives a person the right to buy a particular stock at a given price (the stripe) on a specific date in the future there. This type of control present value expected value of the option on its expiration date. Suppose you can calon with price of the the option and buy the stock, making a $5 profit. On the other hand, the stock is worth $47 on the produs, you would need your following model for simulating the movement of stock prices PkPk (1 + ut.2016) where: PR price of the stock at time period k +0.507 - the stock's expected annual growth rate o the standard deviation on the stock's annual growth rate time period interval (expressed in years) za random observation from a normal distribution with mean and standard deviation of 1 Its payoff is not based on the price of the stock on the expiration date but instead, on the average price of the stock over theme of the Suppose a stock has an initial price (Po) of $80, an expected annual growth rate (V) of 15, and a standard deviation of 25 .. Create a spreadsheet model to simulate this stock's price behavior for the next 13 weeks (note 1/52 because the time period is). So you were in the strike price of $75 and an expiration date at week 13. On average, how much profit would you eam with this option Round your 9.82 b. Assume a risk-free discount rate is 6%. How much should you be willing to pay for this option today? (Excel's NPV union Round your 89.67 c. If you purchase the option, what is the probability that you will make a profit? Round your answer to the decimal places de Feedback Assignment ignment: Chapter 12 Assignment (Practice) stions X eBook A Asian call option gives a person the right to buy a particular stock at a given price (the stripe) on a specific date in the future there. This type of control present value expected value of the option on its expiration date. Suppose you can calon with price of the the option and buy the stock, making a $5 profit. On the other hand, the stock is worth $47 on the produs, you would need your following model for simulating the movement of stock prices PkPk (1 + ut.2016) where: PR price of the stock at time period k +0.507 - the stock's expected annual growth rate o the standard deviation on the stock's annual growth rate time period interval (expressed in years) za random observation from a normal distribution with mean and standard deviation of 1 Its payoff is not based on the price of the stock on the expiration date but instead, on the average price of the stock over theme of the Suppose a stock has an initial price (Po) of $80, an expected annual growth rate (V) of 15, and a standard deviation of 25 .. Create a spreadsheet model to simulate this stock's price behavior for the next 13 weeks (note 1/52 because the time period is). So you were in the strike price of $75 and an expiration date at week 13. On average, how much profit would you eam with this option Round your 9.82 b. Assume a risk-free discount rate is 6%. How much should you be willing to pay for this option today? (Excel's NPV union Round your 89.67 c. If you purchase the option, what is the probability that you will make a profit? Round your answer to the decimal places de Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts