Question: ( Assignment Instructions ) : Please do problem 3 on page 4 0 9 and problem 5 on page 4 1 0 & 4 1

Assignment Instructions:

Please do problem on page and problem on page & with the following modifications. See Link to Chapter Problems.

Problem

Replace the MACRS depreciation with straight line depreciation.

For part a just do NPV IRR and MIRR.

Skip part b

Problem

Just do part a

I need to submit this via xlxs using Excel workbook so please make sure to show that with formulas you used.

Arroy Snackfoods is considering replacing a fiveyearold machine that originally cost $ It was being depreciated using straightline to an expected salvage value of zero over its original year life, and could now be sold for $ The replacement machine would cost $ and have a fiveyear expected life. It would be depreciated using the MACRS year class life. The expected salvage value of this machine after years is $ The new machine is expected to operate much more efficiently, saving $ per year in energy costs. In addition, it will eliminate one salaried position saving another $ annually. The firm's marginal tax rate is and the WACC is

Set up an operating cash flow statement, and calculate the payback, discounted payback, NPV IRR, and MIRR of the replacement project.

Should the project be accepted?

At what discount rate would you be indifferent between keeping the existing equipment and purchasing the new equipment?

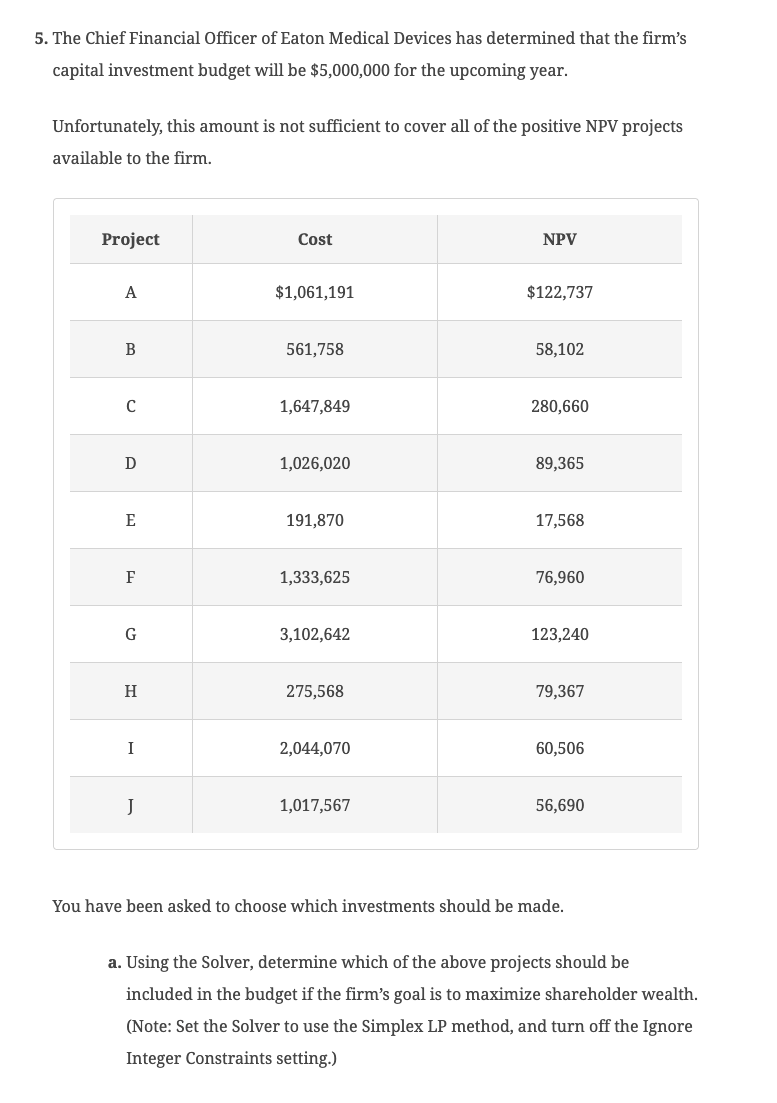

The Chief Financial Officer of Eaton Medical Devices has determined that the firm's capital investment budget will be $ for the upcoming year.

Unfortunately, this amount is not sufficient to cover all of the positive NPV projects available to the firm.

Project Cost NPV

A $ $

B

C

D

E

F

G

H

I

J

You have been asked to choose which investments should be made.

a Using the Solver, determine which of the above projects should be included in the budget if the firm's goal is to maximize shareholder wealth. Note: Set the Solver to use the Simplex LP method, and turn off the Ignore Integer Constraints setting.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock