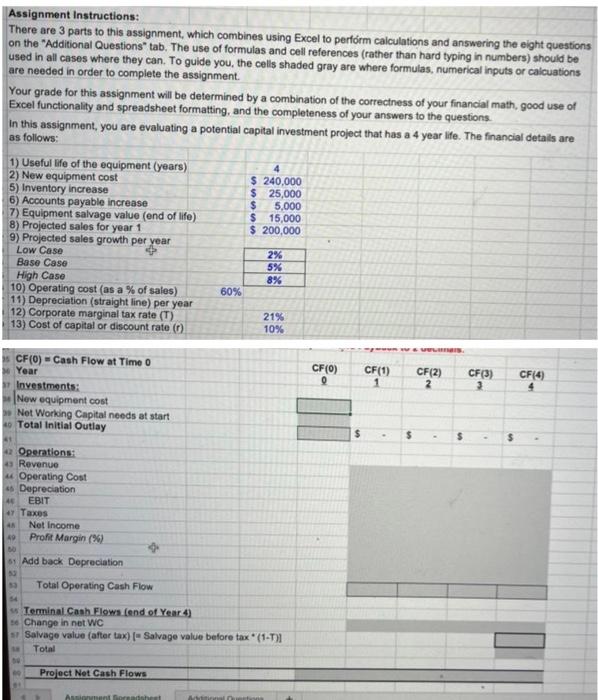

Question: Assignment Instructions: There are 3 parts to this assignment, which combines using Excel to perform calculations and answering the eight questions on the Additional Questions

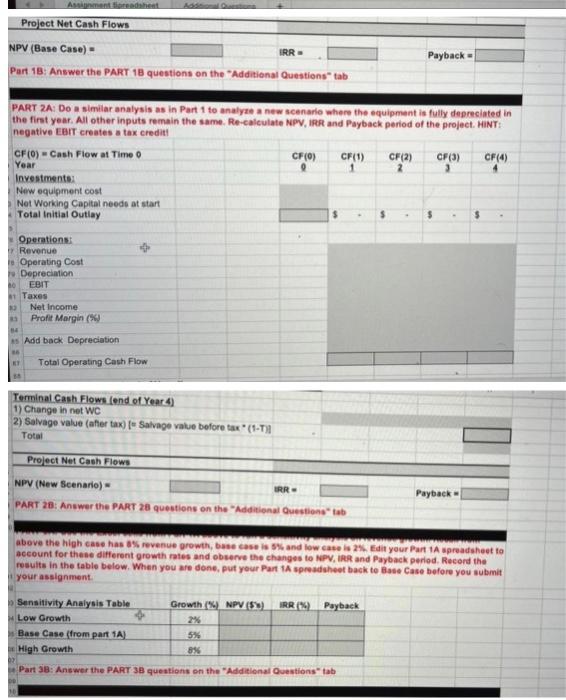

Assignment Instructions: There are 3 parts to this assignment, which combines using Excel to perform calculations and answering the eight questions on the "Additional Questions" tab. The use of formulas and cell references (rather than hard typing in numbers) should be used in all cases where they can. To guide you, the cells shaded gray are where formulas, numerical inputs or calcuations are needed in order to complete the assignment. Your grade for this assignment will be determined by a combination of the correctness of your financial math, good use of Excel functionality and spreadsheet formatting. and the completeness of your answers to the questions. In this assignment, you are evaluating a potential copital investment project that has a 4 year life. The financial details are as follows: PART 2A: Do a similar analysis as in Part 1 to analyze a new scenarle where the equipment is fully depreciated in the first year. All other inputs remain the same. Re-calculate NPV, iRR and Payback period of the project. HiNT: negative EBrT creates a tax credit' Terminal.Cash. Flows (end of Year 4) 1) Change in net WC 2) Salvage value (after tax) [= Salvage value before tax " (1-T)] Total Project Net Cash Flows NPY ( New Scenario )= PART 28: Answer the PART 28 questions on the "Additional Questions* tab above the high case has aS, revenue growth, base cose is 5% and low case is 2%. Fith your Part 1A apreadsheet to account for thene different growth rates and observe the changes to NPV, inf and Payback peried. Recerd the results in the table below. When you are done, put your Part 1A spreadsheet back to Base Case before you aubmit your assignment. Part 38: Answer the PART 38 questions on the "Additienal Questions" tab

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts