Question: Assignment is to fill out the forecasted years using the assumptions(show work) 63% 63% 3% 6% 10 years 10 years Expansion Key Assumptions: Variable Cost

Assignment is to fill out the forecasted years using the assumptions(show work)

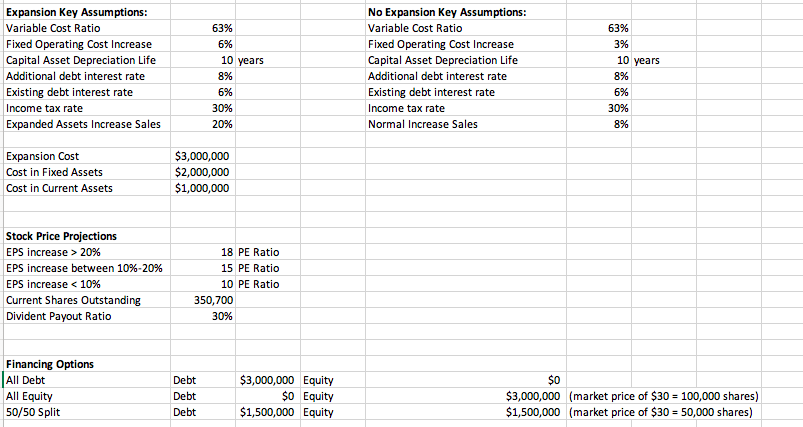

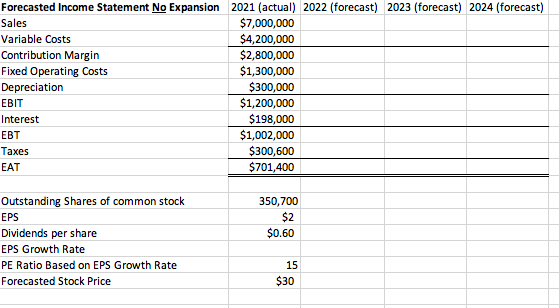

63% 63% 3% 6% 10 years 10 years Expansion Key Assumptions: Variable Cost Ratio Fixed Operating Cost Increase Capital Asset Depreciation Life Additional debt interest rate Existing debt interest rate Income tax rate Expanded Assets Increase Sales No Expansion Key Assumptions: Variable Cost Ratio Fixed Operating Cost Increase Capital Asset Depreciation Life Additional debt interest rate Existing debt interest rate Income tax rate Normal Increase Sales 896 8% 6% 30% 20% 6% 30% 8% Expansion Cost Cost in Fixed Assets Cost in Current Assets $3,000,000 $2,000,000 $1,000,000 Stock Price Projections EPS increase > 20% EPS increase between 10%-20% EPS increase 20% EPS increase between 10%-20% EPS increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts