Question: Assignment Learning Objective (linked to CLO4): Collect and analyze reliable information on a company's business operations, stock market activities and financial ratios in order to

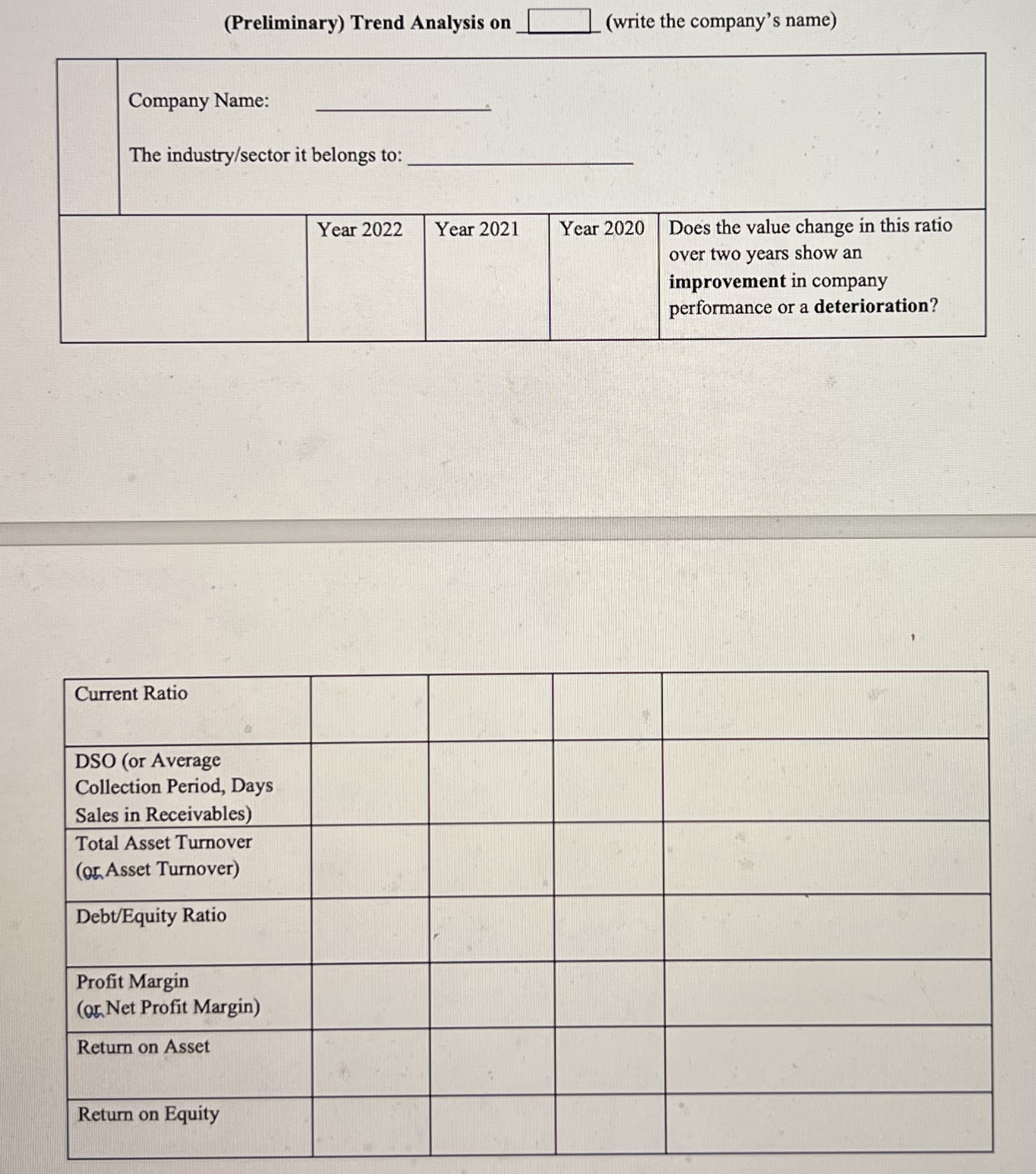

Assignment Learning Objective (linked to CLO4): Collect and analyze reliable information on a company's business operations, stock market activities and financial ratios in order to evaluate the company's performance and market competitiveness. Instruction Analyze a company's business performance using web provided financial ratios. 1. Pick a publicly traded company and use free online financial outlets such as: https://www.macrotrends.net/ ; https://finance.yahoo.com/to find the company's financial ratio information page. 2. Use the value of each financial ratio on the webpage to fill in the blanks in the second and third columns of the table below. (Note: there is NO calculation needed. If a ratio value is not provided, you can put "N/A" in the blank) 3. For each ratio type, conduct trend analysis by comparing its two years' value and write your comments in the last column of the table. Indicate clearly if the two years' ratio value change is a sign of improvement or deterioration of the business in that specific area 4. After filling in the blanks, use one paragraph to summarize the comments you made in the table. To be more specific: Does the company have more improving operational areas, or deteriorating ones? Out of the four major ratio categories: liquidity, asset management, debt management and profitability, which area(s) is(are) the company's strengthening? Which area(s) needs to be changed? 5. Use one paragraph to make 2-3 recommendations to further improve the business's performance. 6. Submit your answer to part 4 and part 5 along with the completed trend analysis table to the designated DropBox folder. (Preliminary) Trend Analysis on . _(write the company's name) Assignment Learning Objective (linked to CLO4): Collect and analyze reliable information on a company's business operations, stock market activities and financial ratios in order to evaluate the company's performance and market competitiveness. Instruction Analyze a company's business performance using web provided financial ratios. 1. Pick a publicly traded company and use free online financial outlets such as: https://www.macrotrends.net/ ; https://finance.yahoo.com/to find the company's financial ratio information page. 2. Use the value of each financial ratio on the webpage to fill in the blanks in the second and third columns of the table below. (Note: there is NO calculation needed. If a ratio value is not provided, you can put "N/A" in the blank) 3. For each ratio type, conduct trend analysis by comparing its two years' value and write your comments in the last column of the table. Indicate clearly if the two years' ratio value change is a sign of improvement or deterioration of the business in that specific area 4. After filling in the blanks, use one paragraph to summarize the comments you made in the table. To be more specific: Does the company have more improving operational areas, or deteriorating ones? Out of the four major ratio categories: liquidity, asset management, debt management and profitability, which area(s) is(are) the company's strengthening? Which area(s) needs to be changed? 5. Use one paragraph to make 2-3 recommendations to further improve the business's performance. 6. Submit your answer to part 4 and part 5 along with the completed trend analysis table to the designated DropBox folder. (Preliminary) Trend Analysis on . _(write the company's name)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts