Question: Assignment Objective: Complete variance analysis to analyze management decisions and what caused them. Assess an organization's success by comparing the budgeted plan to actual results.

Assignment Objective: Complete variance analysis to analyze management decisions and what caused them. Assess an organization's success by comparing the budgeted plan to actual results.

Assignment Details:

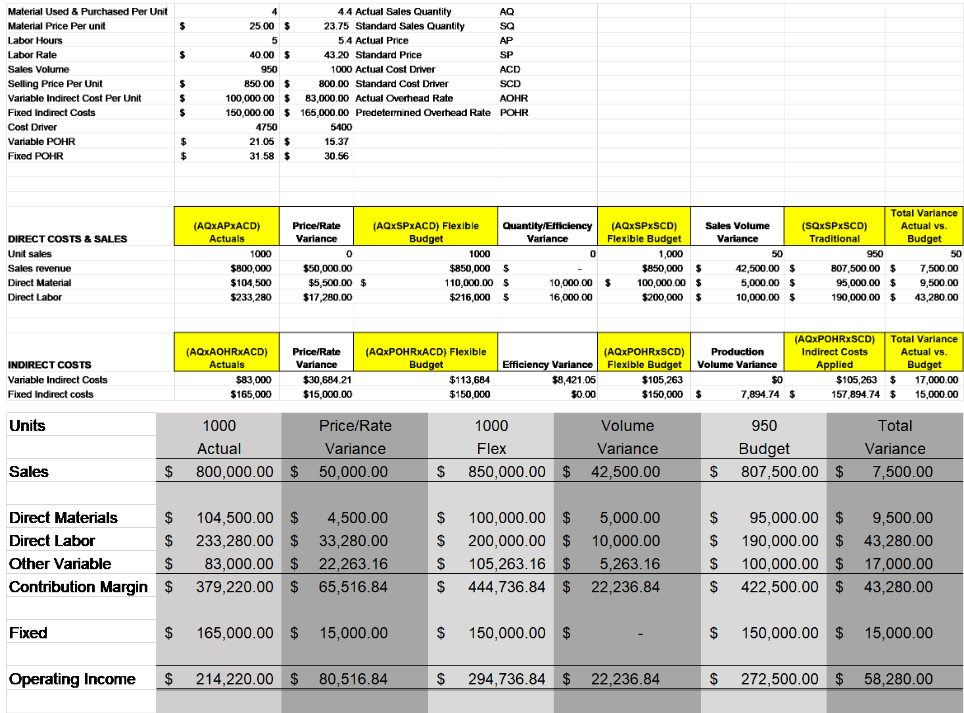

A variance analysis to compare your budget to your actual results was completed at the end of the first quarter. Solve the variance analysis.

- How was the flexible budget prepared? What is the flexible budgets purpose in variance?

- What is the Sales Volume Variance? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

- What is the Selling Price Variance? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

- What is the Direct Material Price & Quantity Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

- What is the Direct Labor Rate & Wage Variances?Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

- What is the Variable Indirect Price & Efficiency Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

- What is the Fixed Indirect Price & Volume Variances? Is it favorable or unfavorable? What could have been potential cause of the variance in relation to the cost object? What would be a proactive step to mitigate effects of unfavorable OR optimize favorable variances?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts