Question: Assignment Objective: To be able to solve problems with the uniform series compound interest factors and annuity functions. Problems: 1. (2.5 points) John is buying

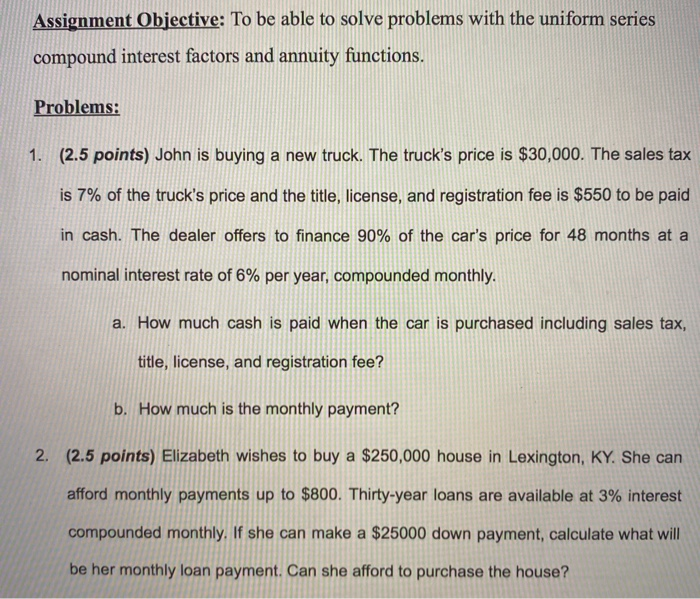

Assignment Objective: To be able to solve problems with the uniform series compound interest factors and annuity functions. Problems: 1. (2.5 points) John is buying a new truck. The truck's price is $30,000. The sales tax is 7% of the truck's price and the title, license, and registration fee is $550 to be paid in cash. The dealer offers to finance 90% of the car's price for 48 months at a nominal interest rate of 6% per year, compounded monthly. a. How much cash is paid when the car is purchased including sales tax, title, license, and registration fee? b. How much is the monthly payment? 2. (2.5 points) Elizabeth wishes to buy a $250,000 house in Lexington, KY. She can afford monthly payments up to $800. Thirty-year loans are available at 3% interest compounded monthly. If she can make a $25000 down payment, calculate what will be her monthly loan payment. Can she afford to purchase the house

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts