Question: Assignment Objectives: This assignment combines knowledge from your accounting courses as well as financial performance discussions in class. Upon completion of the assignment, you will

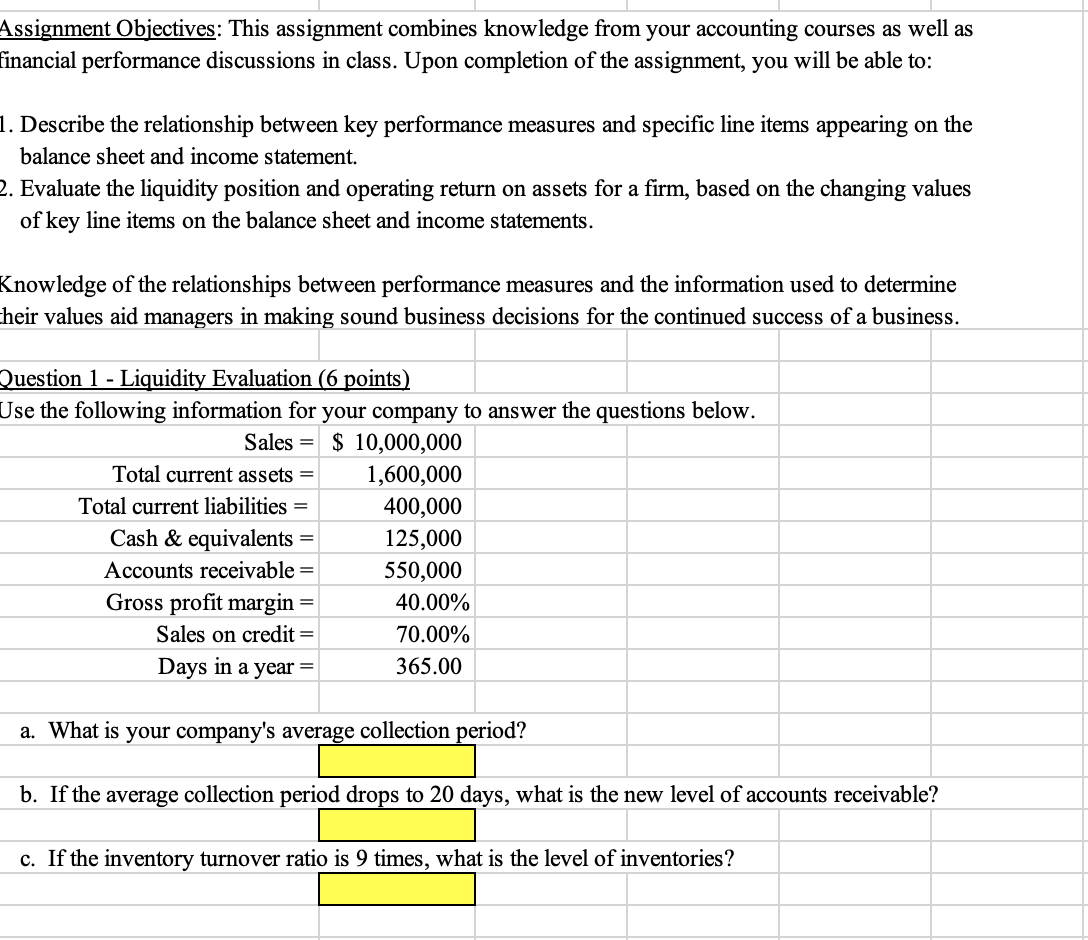

Assignment Objectives: This assignment combines knowledge from your accounting courses as well as financial performance discussions in class. Upon completion of the assignment, you will be able to: 1. Describe the relationship between key performance measures and specific line items appearing on the balance sheet and income statement. 2. Evaluate the liquidity position and operating return on assets for a firm, based on the changing values of key line items on the balance sheet and income statements. Knowledge of the relationships between performance measures and the information used to determine heir values aid managers in making sound business decisions for the continued success of a business. Question 1 - Liquidity Evaluation (6 points) Use the following information for your company to answer the questions below. Sales = $ 10,000,000 Total current assets = 1,600,000 Total current liabilities = 400,000 Cash & equivalents 125,000 Accounts receivable 550,000 Gross profit margin 40.00% Sales on credit 70.00% Days in a year 365.00 a. What is your company's average collection period? b. If the average collection period drops to 20 days, what is the new level of accounts receivable? c. If the inventory turnover ratio is 9 times, what is the level of inventories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts