Question: ASSIGNMENT # ONE ( 1 ) 2 0 2 4 1 4 . The following trial balance relates to Bonilinda Ltd as at 3 1

ASSIGNMENT # ONE

The following trial balance relates to Bonilinda Ltd as at December :

General reserve

Land at valuation

Buildings: at cost

depreciation to January

Plant and machinery: at cost

depreciation to January

Inventory at January

Receivables current assers

Cash in hand

Payables

Bank

Administration expenses

Selling and distribution expenses

Ordinary dividends paid

Loan note interest paid

Returns inwards

Sales

Purchases

Carriage inwards

Carriage outwards

Returns outwards

Discounts received

Retained earnings at January

Preference shares, K each

Suspense

Share premium

Revaluation reserve as at Jan.

Ordinary shares of K each

Loan notes

tabletableDrKtableCrKtableCcarrendkasecfsin

The following additional information is available at December :

One million new ordinary shares were issued for K per share on October The proceeds have been left in a suspense account. The company proposed to pay a final ordinary dividend of K for the year.

At December prepaid administration expenses were K and accrued selling and distribution expenses were K

ASSIGNMENT # ONE

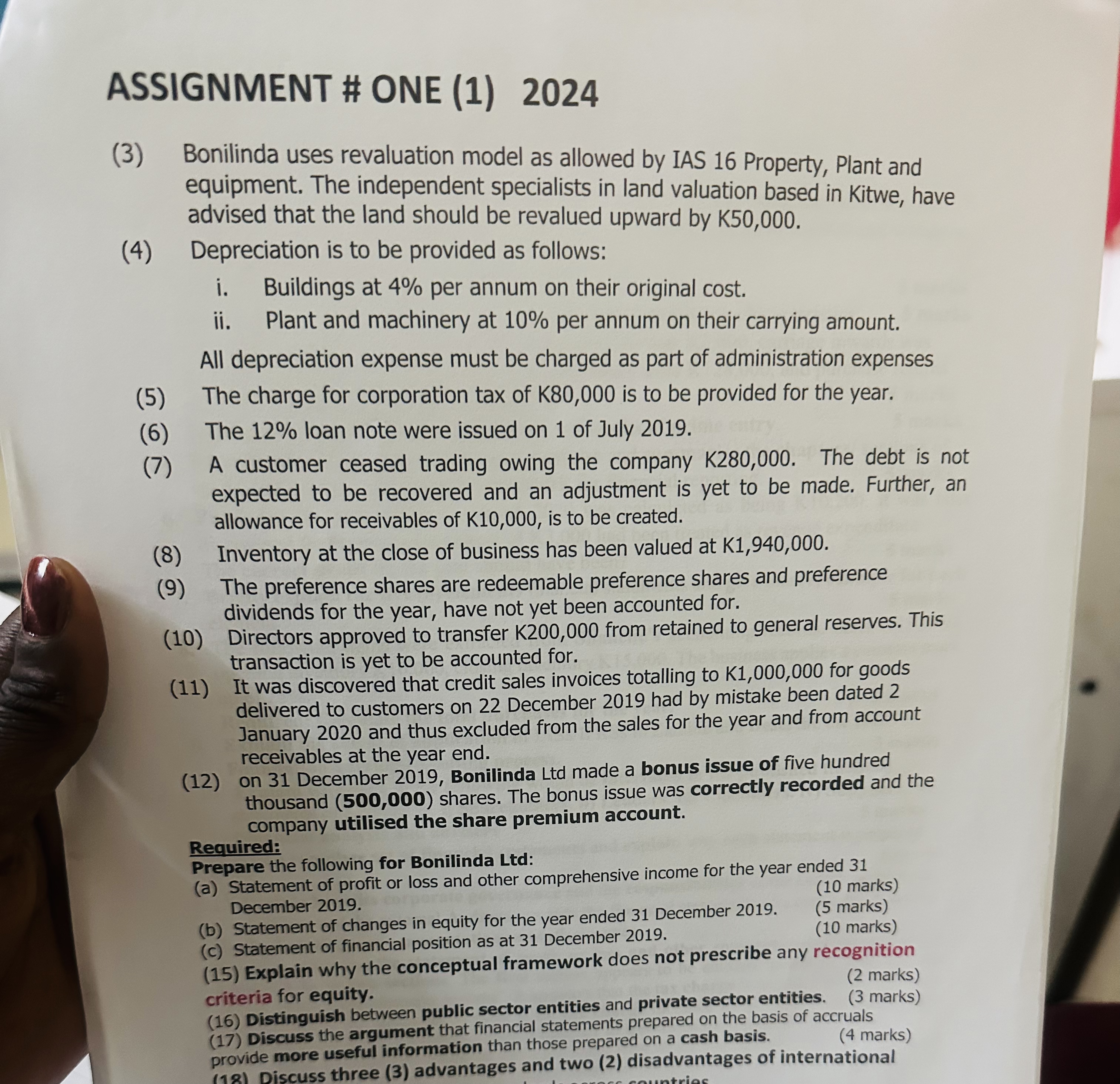

Bonilinda uses revaluation model as allowed by IAS Property, Plant and equipment. The independent specialists in land valuation based in Kitwe, have advised that the land should be revalued upward by K

Depreciation is to be provided as follows:

i Buildings at per annum on their original cost.

ii Plant and machinery at per annum on their carrying amount.

All depreciation expense must be charged as part of administration expenses

The charge for corporation tax of is to be provided for the year.

The loan note were issued on of July

A customer ceased trading owing the company K The debt is not expected to be recovered and an adjustment is yet to be made. Further, an allowance for receivables of is to be created.

Inventory at the close of business has been valued at

The preference shares are redeemable preference shares and preference dividends for the year, have not yet been accounted for.

Directors approved to transfer from retained to general reserves. This transaction is yet to be accounted for.

It was discovered that credit sales invoices totalling to for goods delivered to customers on December had by mistake been dated January and thus excluded from the sales for the year and from account receivables at the year end.

on December Bonilinda Ltd made a bonus issue of five hundred thousand shares. The bonus issue was correctly recorded and the company utilised the share premium account.

Required:

Prepare the following for Bonilinda Ltd:

a Statement of profit or loss and other comprehensive income for the year ended December

marks

b Statement of changes in equity for the year ended December marks

c Statement of financial position as at December marks

Explain why the conceptual framework does not prescribe any recognition criteria for equity.

marks

Distinguish between public sector entities and private sector entities. marks

Discuss the argument that financial statements prepared on the basis of accruals

provide more useful information than those prepared on a cash basis. marks

Discuss three advantages and two disadvantages of international

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock