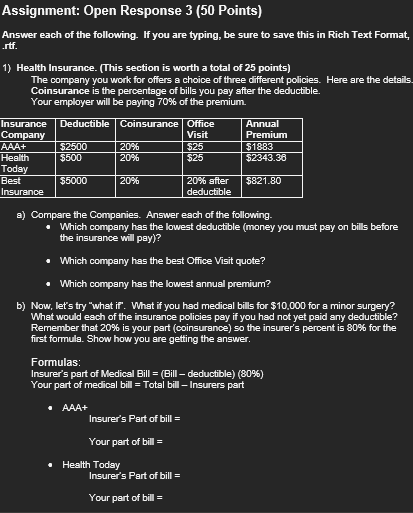

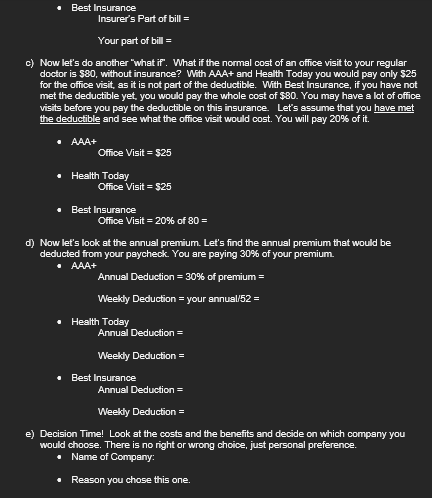

Question: Assignment: Open Response 3 (50 Points) Answer each of the following. If you are typing, be sure to save this in Rich Text Format, .rif.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts