Question: Assignment Problem Two - 4 (Instalments, Interest, And Penalties For Corporations) For both tax and accounting purposes, Lanterna Inc. has a July 31 year end.

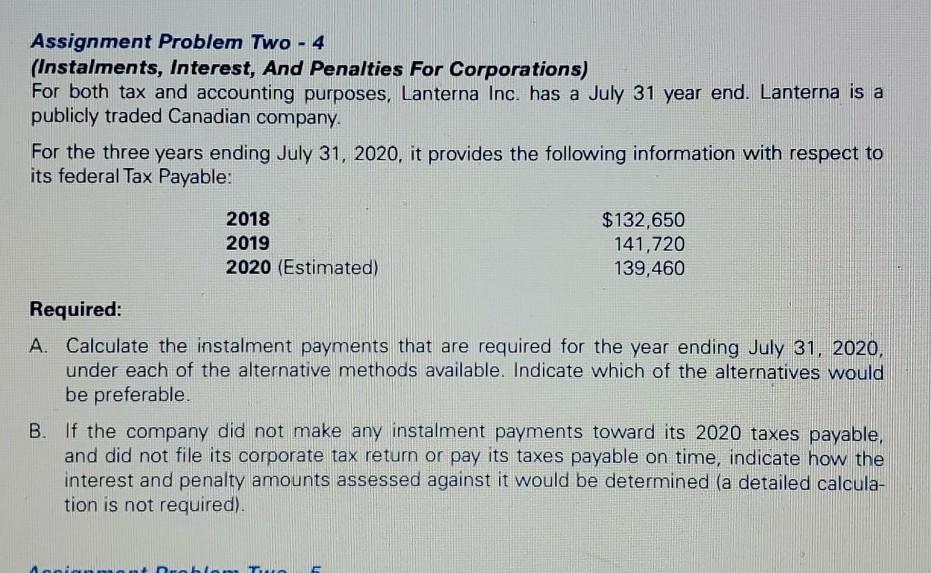

Assignment Problem Two - 4 (Instalments, Interest, And Penalties For Corporations) For both tax and accounting purposes, Lanterna Inc. has a July 31 year end. Lanterna is a publicly traded Canadian company. For the three years ending July 31, 2020, it provides the following information with respect to its federal Tax Payable: 2018 2019 2020 (Estimated) $132,650 141,720 139,460 Required: A. Calculate the instalment payments that are required for the year ending July 31, 2020, under each of the alternative methods available. Indicate which of the alternatives would be preferable. B. If the company did not make any instalment payments toward its 2020 taxes payable, and did not file its corporate tax return or pay its taxes payable on time, indicate how the interest and penalty amounts assessed against it would be determined (a detailed calcula- tion is not required)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts