Question: Assignment Problems You have been asked to compare the dividend policies of three firms in the same business and have collected the following information on

Assignment Problems

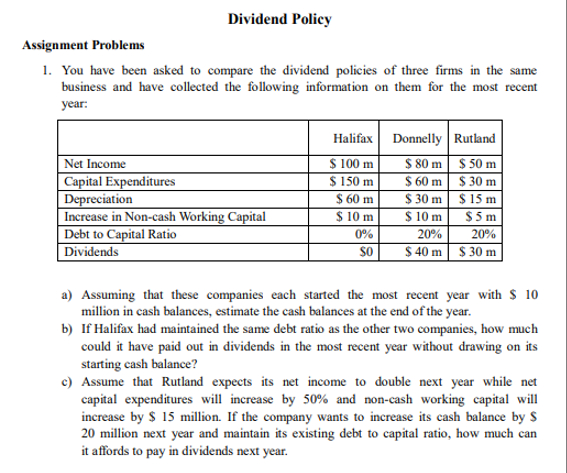

You have been asked to compare the dividend policies of three firms in the same

business and have collected the following information on them for the most recent

year:

a Assuming that these companies each started the most recent year with $

million in cash balances, estimate the cash balances at the end of the year.

b If Halifax had maintained the same debt ratio as the other two companies, how much

could it have paid out in dividends in the most recent year without drawing on its

starting cash balance?

c Assume that Rutland expects its net income to double next year while net

capital expenditures will increase by and noncash working capital will

increase by $ million. If the company wants to increase its cash balance by $

million next year and maintain its existing debt to capital ratio, how much can

it affords to pay in dividends next year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock