Question: Assignment Question 2 In most countries in the world, the companies account for less than 20% of the total tax-payers. However, records show that the

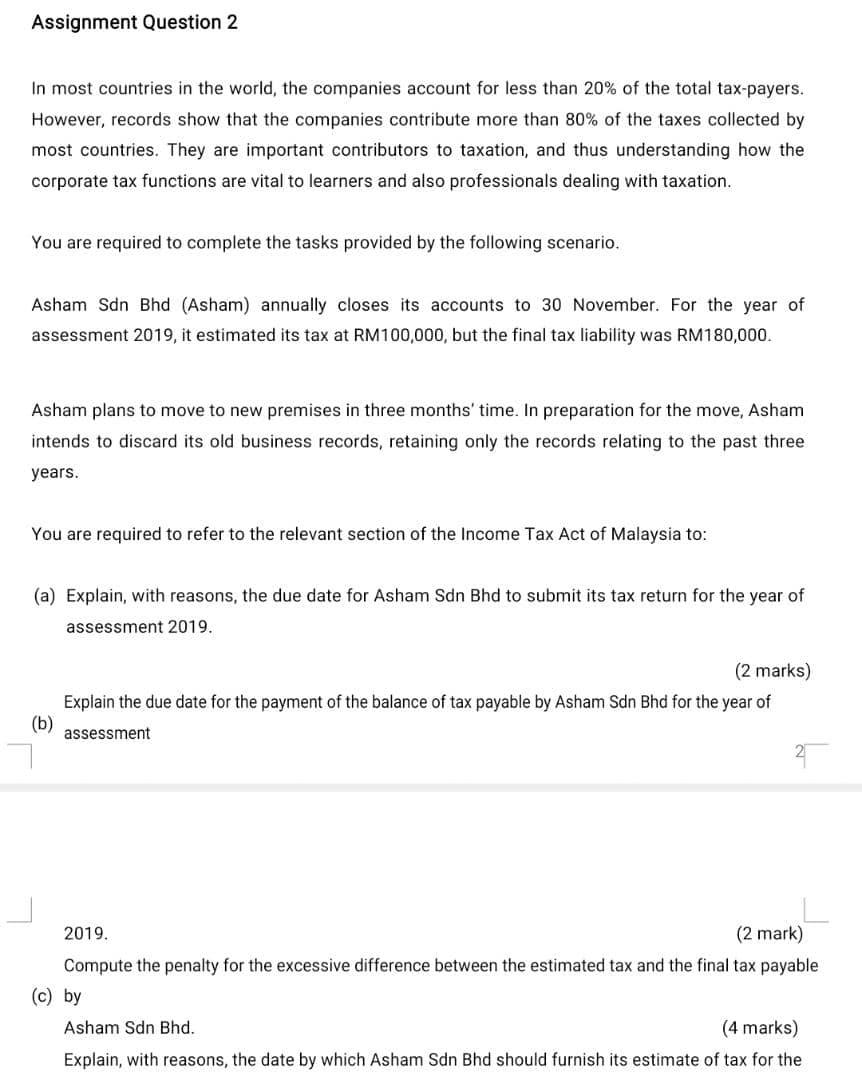

Assignment Question 2 In most countries in the world, the companies account for less than 20% of the total tax-payers. However, records show that the companies contribute more than 80% of the taxes collected by most countries. They are important contributors to taxation, and thus understanding how the corporate tax functions are vital to learners and also professionals dealing with taxation. You are required to complete the tasks provided by the following scenario. Asham Sdn Bhd (Asham) annually closes its accounts to 30 November. For the year of assessment 2019, it estimated its tax at RM100,000, but the final tax liability was RM180,000. Asham plans to move to new premises in three months' time. In preparation for the move, Asham intends to discard its old business records, retaining only the records relating to the past three years. You are required to refer to the relevant section of the Income Tax Act of Malaysia to: (a) Explain, with reasons, the due date for Asham Sdn Bhd to submit its tax return for the year of assessment 2019. (b) (2 marks) Explain the due date for the payment of the balance of tax payable by Asham Sdn Bhd for the year of assessment 2 2019. (2 mark) Compute the penalty for the excessive difference between the estimated tax and the final tax payable (c) by Asham Sdn Bhd. (4 marks) Explain, with reasons, the date by which Asham Sdn Bhd should furnish its estimate of tax for the Assignment Question 2 In most countries in the world, the companies account for less than 20% of the total tax-payers. However, records show that the companies contribute more than 80% of the taxes collected by most countries. They are important contributors to taxation, and thus understanding how the corporate tax functions are vital to learners and also professionals dealing with taxation. You are required to complete the tasks provided by the following scenario. Asham Sdn Bhd (Asham) annually closes its accounts to 30 November. For the year of assessment 2019, it estimated its tax at RM100,000, but the final tax liability was RM180,000. Asham plans to move to new premises in three months' time. In preparation for the move, Asham intends to discard its old business records, retaining only the records relating to the past three years. You are required to refer to the relevant section of the Income Tax Act of Malaysia to: (a) Explain, with reasons, the due date for Asham Sdn Bhd to submit its tax return for the year of assessment 2019. (b) (2 marks) Explain the due date for the payment of the balance of tax payable by Asham Sdn Bhd for the year of assessment 2 2019. (2 mark) Compute the penalty for the excessive difference between the estimated tax and the final tax payable (c) by Asham Sdn Bhd. (4 marks) Explain, with reasons, the date by which Asham Sdn Bhd should furnish its estimate of tax for the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts