Question: Assignment Question 4 Analyse the scenario given below and complete the given task MBI Sdn Bhd is in the business of operating a houseboat in

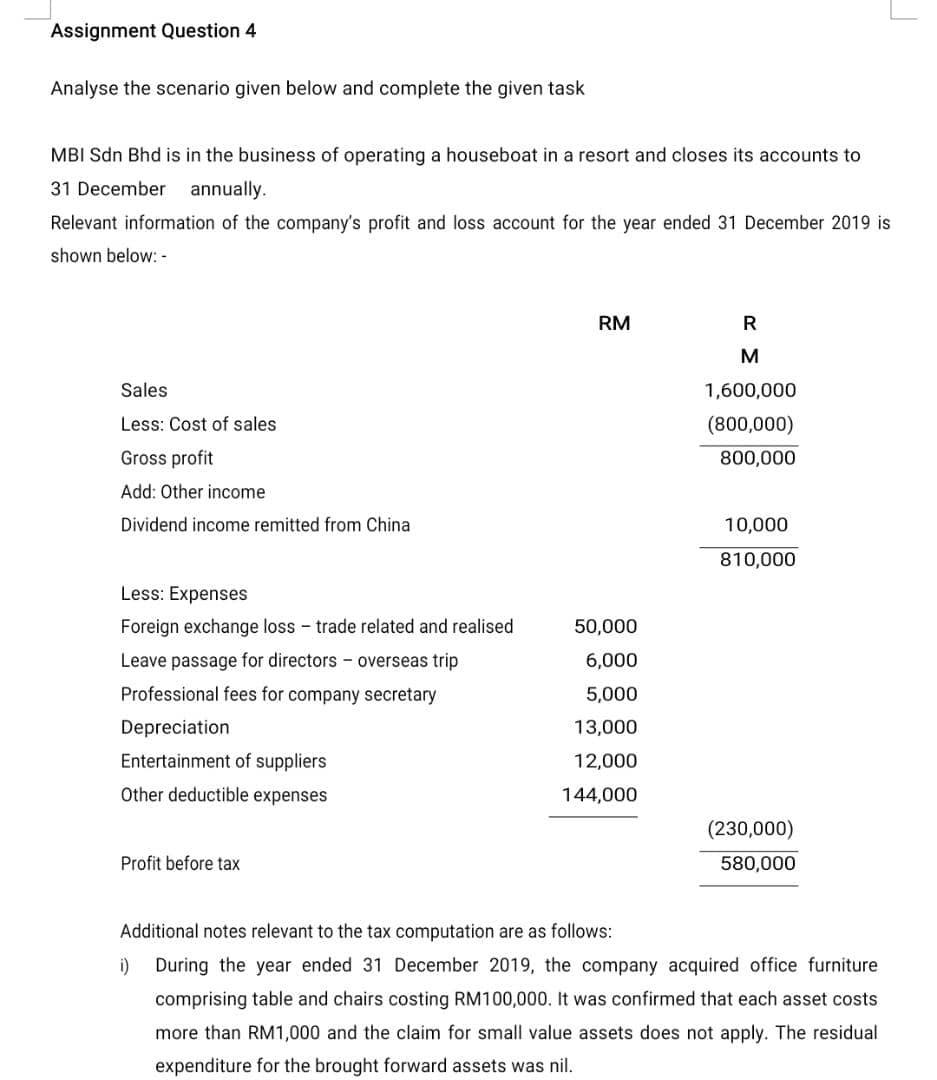

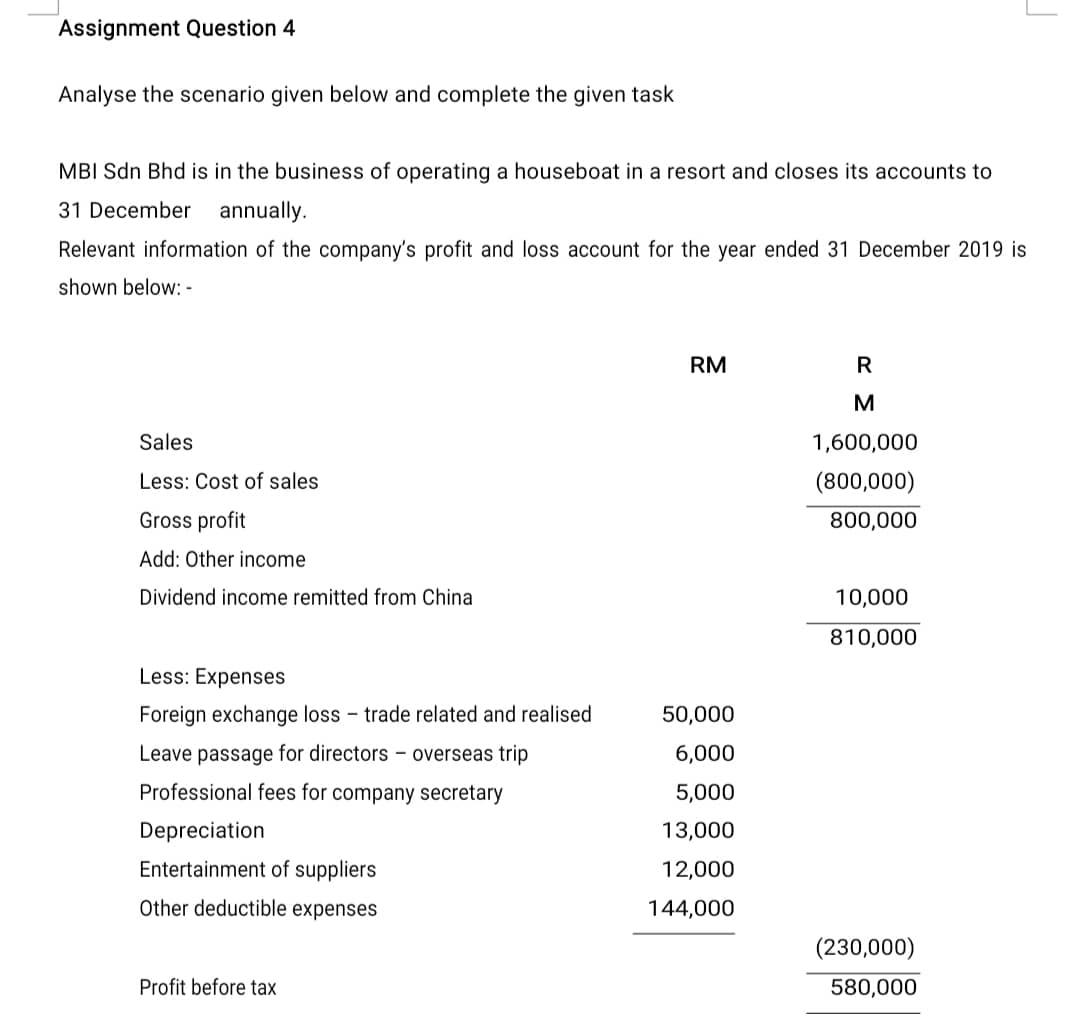

Assignment Question 4 Analyse the scenario given below and complete the given task MBI Sdn Bhd is in the business of operating a houseboat in a resort and closes its accounts to 31 December annually. Relevant information of the company's profit and loss account for the year ended 31 December 2019 is shown below:- RM R M Sales 1,600,000 (800,000) 800,000 Less: Cost of sales Gross profit Add: Other income Dividend income remitted from China 10,000 810,000 Less: Expenses Foreign exchange loss - trade related and realised Leave passage for directors - overseas trip Professional fees for company secretary Depreciation Entertainment of suppliers Other deductible expenses 50,000 6,000 5,000 13,000 12,000 144,000 (230,000) 580,000 Profit before tax Additional notes relevant to the tax computation are as follows: i) During the year ended 31 December 2019, the company acquired office furniture comprising table and chairs costing RM100,000. It was confirmed that each asset costs more than RM1,000 and the claim for small value assets does not apply. The residual expenditure for the brought forward assets was nil. L Assignment Question 4 Analyse the scenario given below and complete the given task MBI Sdn Bhd is in the business of operating a houseboat in a resort and closes its accounts to 31 December annually. Relevant information of the company's profit and loss account for the year ended 31 December 2019 is shown below:- RM R M Sales Less: Cost of sales 1,600,000 (800,000) 800,000 Gross profit Add: Other income Dividend income remitted from China 10,000 810,000 Less: Expenses Foreign exchange loss - trade related and realised Leave passage for directors - overseas trip Professional fees for company secretary Depreciation Entertainment of suppliers Other deductible expenses 50,000 6,000 5,000 13,000 12,000 144,000 (230,000) 580,000 Profit before tax Assignment Question 4 Analyse the scenario given below and complete the given task MBI Sdn Bhd is in the business of operating a houseboat in a resort and closes its accounts to 31 December annually. Relevant information of the company's profit and loss account for the year ended 31 December 2019 is shown below:- RM R M Sales 1,600,000 (800,000) 800,000 Less: Cost of sales Gross profit Add: Other income Dividend income remitted from China 10,000 810,000 Less: Expenses Foreign exchange loss - trade related and realised Leave passage for directors - overseas trip Professional fees for company secretary Depreciation Entertainment of suppliers Other deductible expenses 50,000 6,000 5,000 13,000 12,000 144,000 (230,000) 580,000 Profit before tax Additional notes relevant to the tax computation are as follows: i) During the year ended 31 December 2019, the company acquired office furniture comprising table and chairs costing RM100,000. It was confirmed that each asset costs more than RM1,000 and the claim for small value assets does not apply. The residual expenditure for the brought forward assets was nil. L Assignment Question 4 Analyse the scenario given below and complete the given task MBI Sdn Bhd is in the business of operating a houseboat in a resort and closes its accounts to 31 December annually. Relevant information of the company's profit and loss account for the year ended 31 December 2019 is shown below:- RM R M Sales Less: Cost of sales 1,600,000 (800,000) 800,000 Gross profit Add: Other income Dividend income remitted from China 10,000 810,000 Less: Expenses Foreign exchange loss - trade related and realised Leave passage for directors - overseas trip Professional fees for company secretary Depreciation Entertainment of suppliers Other deductible expenses 50,000 6,000 5,000 13,000 12,000 144,000 (230,000) 580,000 Profit before tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts