Question: Assignment question : Compare the bad debt allowance practice of Poseidon and Open Range. --------------------- POSEIDON CONCEPTS CORPORATION: BOOM TO BUST On February 25, 2013

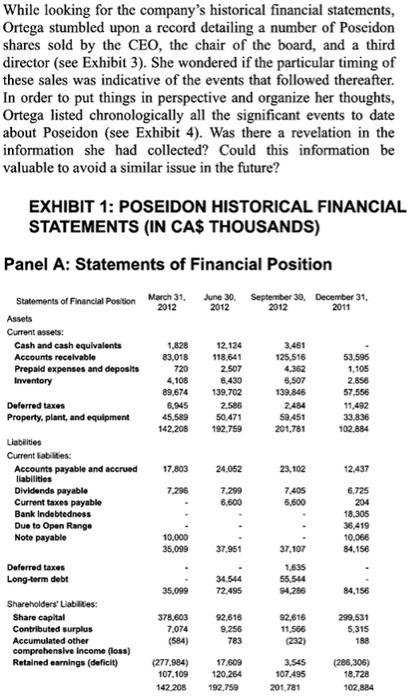

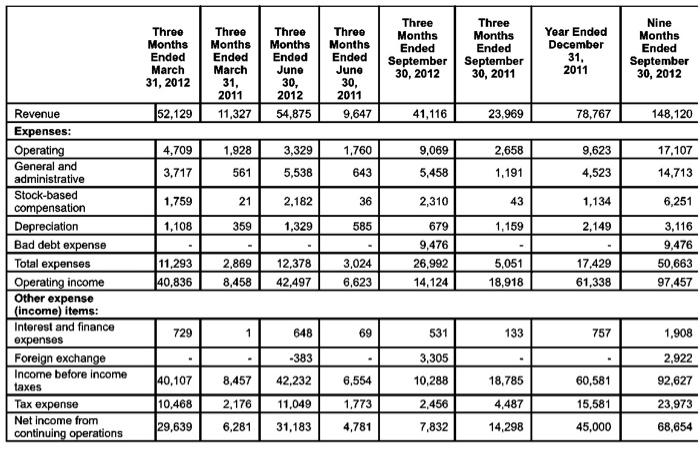

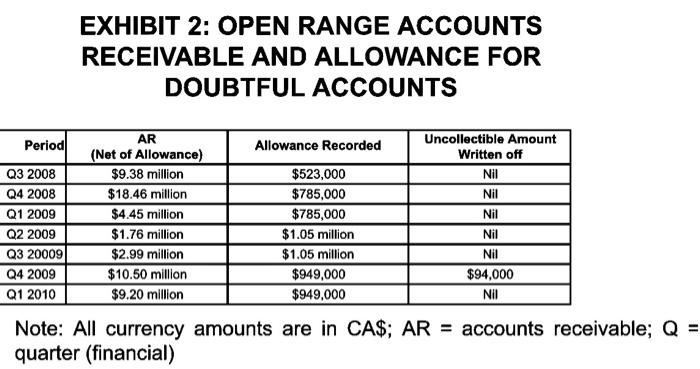

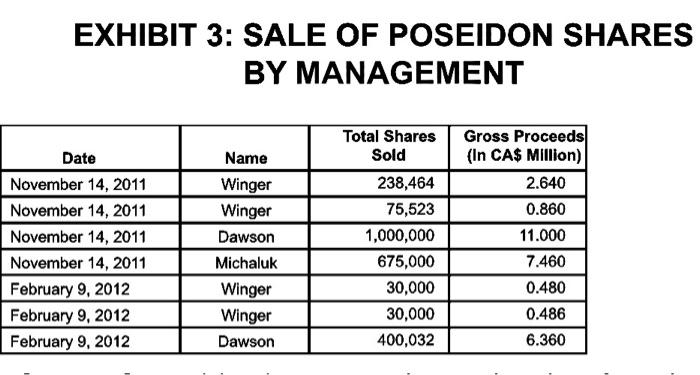

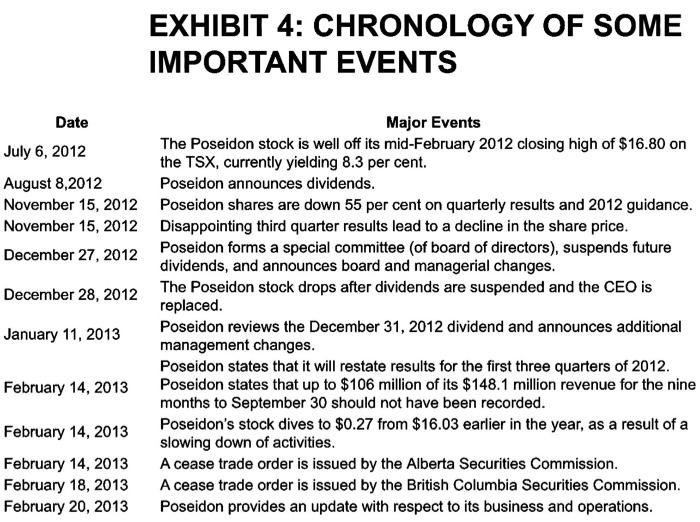

POSEIDON CONCEPTS CORPORATION: BOOM TO BUST On February 25, 2013 Paulina Ortega, the chief investment officer (CIO) of University of Regina Investing (URI), was reviewing a draft copy of the annual report for fiscal year 2012 that was to be submitted to its client, the University of Regina. One investment that stood out was Poseidon Concepts Corporation (Poseidon), which had lost all its stock value. The investment was made in April 2012 at CAS14.02 - per share and had gained 14 per cent by September, when the stock price hit a high of $16.02. Ortega decided to review the Poseidon transaction to understand the reasons for the loss on this investment, which included the potential that Poseidon's management team had manipulated its financial statements. More importantly, Ortega wondered whether there had been early signs or red flags, for such manipulation. If there were, and they had been read and acted on in time, those signs would have saved URI the loss incurred on the transaction. The ability to identify such red flags could help avoid similar situations in the future. The URI program was a student-run investment fund, where students managed approximately $1.5 million in funds provided by the University of Regina. The majority of these funds were contributed by the University's endowment. The program was an important aspect of the finance curriculum because it complemented the vision of the faculty to become a school of choice for experiential leaming. The URI program received strong support from the Regina business community. Students in the program regularly received guest lectures and presentations from investment professionals, as well as free trading and research services from CIBC Wood Gundy. The URI fund was structured like a professional investment fund. It was headed by an executive team that included a CIO and a chief compliance officer. The student analysts were divided into sector teams, each headed by a manager. POSEIDON CONCEPTS CORPORATION History Poseidon was formed in November 2011, when the parent company, Open Range Energy Corporation (Open Range) reorganized and split into two independent entities. Open Range time of the reorganization, received one share of the new Open Range company and 0.8839 shares of Poseidon for each share of the old company. Poseidon inherited a management team with strong experience in the industry. Independent board members also had rich experience, both in the oil and gas sector and in capital markets. Lyle Michaluk, the vice- president (VP) of finance and chief financial officer of Open Range, became the chief executive officer (CEO) of Poseidon. Cliff Wiebe, who was responsible for designing the Poseidon tank system while acting as completion manager at Open Range, became the chief operating officer. Brad Wanchulak, the VP of business development at Poseidon, was previously the VP of business development at Talisman Energy. The CEO of Open Range, Scott Dawson, was appointed chair of the Poseidon board of directors. Michaluk and disehe joined the board as management representatives. B001 Tank Rental Business The core business of Poseidon was its proprietary tank rental to oil and gas companies. These tanks were designed by an employee of Open Range (prior to the companies splitting) to enhance operational efficiency. Once the tanks were successfully tested on Open Range's sites, the company began renting them to other companies' sites. The proprietary design of the tanks afforded them several competitive advantages in terms of costs, efficiencies, and environmental concerns. The tanks were relatively large. The larger model could handle up to 41,000 oil barrels, compared to the average conventional tank size of around 500 barrels. Despite their large size, however, Poseidon's tanks could be installed, uninstalled, and reinstalled quickly, generally within one day. They could be transported easily and more economically than the smaller conventional prefabricated tanks. The above-ground installation of Poseidon's tanks also provided huge environmental benefits, relative to the alternative of storing the fluid in lined pits. The pits experienced frequent leaks, which could not be detected until the pits were reclaimed. Due to this significant disadvantage of lined pits, Poseidon's tank rentals increased from 25 units at the end of 2010 to 170 tanks in September 2011.? Poseidon supplied its tanks to both U.S. and Canadian customers. Of the company's total revenue for the nine months ending September 30,2012,85 per cent was generated from U.S. rentals.' In the United States, Poseidon operated through a firm's prospects. Some analysts considered management's earnings guidance to be too conservative, setting a higher target price for the company. On November 14, 2012, Poseidon issued financial statements for the third quarter of 2012 , as well as for the nine months ending September 2012. In these statements, Poseidon reported an increase in accounts receivable to $125.5 million, out of which $36 million was outstanding for more than 120 days. It also took a charge of $9.5 million for bad debt." Market backlash was strong following Poseidon's disclosures. The next day, on November 15, 2012, the company's stock price plunged to $5.00 - a drop of 62 per cent from the previous day's closing price of $13.22. On December 27, 2012. Poscidon establiched a special committee of the board to investigate the controversy surrounding the company's acoounts receivable. The committee retained legal counsel, who in turn consulted with Emst and Young Inc. The findings of the investigation were disclosed on February 14, 2013. Poseidon admitted that it had materially inflated revenues. In particular, \$106 million out of $148 million total revenue for the period lanuary to September 2012 was based on non-existing or uncollectible take-or-pay contracts," and should not have been recorded as revenues.' Long-term sales and service contracts were common in the mining industry and in the oil and gas industry. One type of long-term contract - the take-or-pay arrangement-obliged Poseidon's customers to rent a minimum number of tanks at an agreed rate. Poseidon offered many take-or-pay contracts to its U.S. customers. After the investigation, Poseidon announced that it would restate its financial statements according to the findings. However, stock trading ceased ahogether upon this disclosure on February 14.2013. THE ANALYSIS Ortega looked up the historical quarterly financial statements of Poseidon (see Exhibit 1). Her goal was to identify any red flags that her team could have missed, so that they could be better prepared to avoid such scenarios in the future. The November 15 announcement that triggered the downward spiral in the stock price was related to accounts receivable and a considerable bad debt expense recognition. Therefore, Ortega collected data relating to accounts receivable and bad debt allowance for Poseidon's parent company, and compared the two companies' accounting practices (see Exhibit 2). While looking for the company's historical financial statements, Ortega stumbled upon a record detailing a number of Poseidon shares sold by the CEO, the chair of the board, and a third director (see Exhibit 3). She wondered if the particular timing of these sales was indicative of the events that followed thereafter. In order to put things in perspective and organize her thoughts, Ortega listed chronologically all the significant events to date about Poseidon (see Exhibit 4). Was there a revelation in the information she had collected? Could this information be valuable to avoid a similar issue in the future? EXHIBIT 1: POSEIDON HISTORICAL FINANCIAL STATEMENTS (IN CA\$ THOUSANDS) Panel A: Statements of Financial Position EXHIBIT 2: OPEN RANGE ACCOUNTS RECEIVABLE AND ALLOWANCE FOR DOUBTFUL ACCOUNTS Note: All currency amounts are in CA$;AR= accounts receivable; Q= quarter (financial) EXHIBIT 3: SALE OF POSEIDON SHARES BY MANAGEMENT EXHIBIT 4: CHRONOLOGY OF SOME IMPORTANT EVENTS Major Events The Poseidon stock is well off its mid-February 2012 closing high of $16.80 on the TSX, currently yielding 8.3 per cent. Poseidon announces dividends. Poseidon shares are down 55 per cent on quarterly results and 2012 guidance. Disappointing third quarter results lead to a decline in the share price. Poseidon forms a special committee (of board of directors), suspends future dividends, and announces board and managerial changes. The Poseidon stock drops after dividends are suspended and the CEO is replaced. Poseidon reviews the December 31, 2012 dividend and announces additional management changes. Poseidon states that it will restate results for the first three quarters of 2012. Poseidon states that up to $106 million of its $148.1 million revenue for the nine months to September 30 should not have been recorded. Poseidon's stock dives to $0.27 from $16.03 earlier in the year, as a result of a slowing down of activities. A cease trade order is issued by the Alberta Securities Commission. A cease trade order is issued by the British Columbia Securities Commission. Poseidon provides an update with respect to its business and operations. POSEIDON CONCEPTS CORPORATION: BOOM TO BUST On February 25, 2013 Paulina Ortega, the chief investment officer (CIO) of University of Regina Investing (URI), was reviewing a draft copy of the annual report for fiscal year 2012 that was to be submitted to its client, the University of Regina. One investment that stood out was Poseidon Concepts Corporation (Poseidon), which had lost all its stock value. The investment was made in April 2012 at CAS14.02 - per share and had gained 14 per cent by September, when the stock price hit a high of $16.02. Ortega decided to review the Poseidon transaction to understand the reasons for the loss on this investment, which included the potential that Poseidon's management team had manipulated its financial statements. More importantly, Ortega wondered whether there had been early signs or red flags, for such manipulation. If there were, and they had been read and acted on in time, those signs would have saved URI the loss incurred on the transaction. The ability to identify such red flags could help avoid similar situations in the future. The URI program was a student-run investment fund, where students managed approximately $1.5 million in funds provided by the University of Regina. The majority of these funds were contributed by the University's endowment. The program was an important aspect of the finance curriculum because it complemented the vision of the faculty to become a school of choice for experiential leaming. The URI program received strong support from the Regina business community. Students in the program regularly received guest lectures and presentations from investment professionals, as well as free trading and research services from CIBC Wood Gundy. The URI fund was structured like a professional investment fund. It was headed by an executive team that included a CIO and a chief compliance officer. The student analysts were divided into sector teams, each headed by a manager. POSEIDON CONCEPTS CORPORATION History Poseidon was formed in November 2011, when the parent company, Open Range Energy Corporation (Open Range) reorganized and split into two independent entities. Open Range time of the reorganization, received one share of the new Open Range company and 0.8839 shares of Poseidon for each share of the old company. Poseidon inherited a management team with strong experience in the industry. Independent board members also had rich experience, both in the oil and gas sector and in capital markets. Lyle Michaluk, the vice- president (VP) of finance and chief financial officer of Open Range, became the chief executive officer (CEO) of Poseidon. Cliff Wiebe, who was responsible for designing the Poseidon tank system while acting as completion manager at Open Range, became the chief operating officer. Brad Wanchulak, the VP of business development at Poseidon, was previously the VP of business development at Talisman Energy. The CEO of Open Range, Scott Dawson, was appointed chair of the Poseidon board of directors. Michaluk and disehe joined the board as management representatives. B001 Tank Rental Business The core business of Poseidon was its proprietary tank rental to oil and gas companies. These tanks were designed by an employee of Open Range (prior to the companies splitting) to enhance operational efficiency. Once the tanks were successfully tested on Open Range's sites, the company began renting them to other companies' sites. The proprietary design of the tanks afforded them several competitive advantages in terms of costs, efficiencies, and environmental concerns. The tanks were relatively large. The larger model could handle up to 41,000 oil barrels, compared to the average conventional tank size of around 500 barrels. Despite their large size, however, Poseidon's tanks could be installed, uninstalled, and reinstalled quickly, generally within one day. They could be transported easily and more economically than the smaller conventional prefabricated tanks. The above-ground installation of Poseidon's tanks also provided huge environmental benefits, relative to the alternative of storing the fluid in lined pits. The pits experienced frequent leaks, which could not be detected until the pits were reclaimed. Due to this significant disadvantage of lined pits, Poseidon's tank rentals increased from 25 units at the end of 2010 to 170 tanks in September 2011.? Poseidon supplied its tanks to both U.S. and Canadian customers. Of the company's total revenue for the nine months ending September 30,2012,85 per cent was generated from U.S. rentals.' In the United States, Poseidon operated through a firm's prospects. Some analysts considered management's earnings guidance to be too conservative, setting a higher target price for the company. On November 14, 2012, Poseidon issued financial statements for the third quarter of 2012 , as well as for the nine months ending September 2012. In these statements, Poseidon reported an increase in accounts receivable to $125.5 million, out of which $36 million was outstanding for more than 120 days. It also took a charge of $9.5 million for bad debt." Market backlash was strong following Poseidon's disclosures. The next day, on November 15, 2012, the company's stock price plunged to $5.00 - a drop of 62 per cent from the previous day's closing price of $13.22. On December 27, 2012. Poscidon establiched a special committee of the board to investigate the controversy surrounding the company's acoounts receivable. The committee retained legal counsel, who in turn consulted with Emst and Young Inc. The findings of the investigation were disclosed on February 14, 2013. Poseidon admitted that it had materially inflated revenues. In particular, \$106 million out of $148 million total revenue for the period lanuary to September 2012 was based on non-existing or uncollectible take-or-pay contracts," and should not have been recorded as revenues.' Long-term sales and service contracts were common in the mining industry and in the oil and gas industry. One type of long-term contract - the take-or-pay arrangement-obliged Poseidon's customers to rent a minimum number of tanks at an agreed rate. Poseidon offered many take-or-pay contracts to its U.S. customers. After the investigation, Poseidon announced that it would restate its financial statements according to the findings. However, stock trading ceased ahogether upon this disclosure on February 14.2013. THE ANALYSIS Ortega looked up the historical quarterly financial statements of Poseidon (see Exhibit 1). Her goal was to identify any red flags that her team could have missed, so that they could be better prepared to avoid such scenarios in the future. The November 15 announcement that triggered the downward spiral in the stock price was related to accounts receivable and a considerable bad debt expense recognition. Therefore, Ortega collected data relating to accounts receivable and bad debt allowance for Poseidon's parent company, and compared the two companies' accounting practices (see Exhibit 2). While looking for the company's historical financial statements, Ortega stumbled upon a record detailing a number of Poseidon shares sold by the CEO, the chair of the board, and a third director (see Exhibit 3). She wondered if the particular timing of these sales was indicative of the events that followed thereafter. In order to put things in perspective and organize her thoughts, Ortega listed chronologically all the significant events to date about Poseidon (see Exhibit 4). Was there a revelation in the information she had collected? Could this information be valuable to avoid a similar issue in the future? EXHIBIT 1: POSEIDON HISTORICAL FINANCIAL STATEMENTS (IN CA\$ THOUSANDS) Panel A: Statements of Financial Position EXHIBIT 2: OPEN RANGE ACCOUNTS RECEIVABLE AND ALLOWANCE FOR DOUBTFUL ACCOUNTS Note: All currency amounts are in CA$;AR= accounts receivable; Q= quarter (financial) EXHIBIT 3: SALE OF POSEIDON SHARES BY MANAGEMENT EXHIBIT 4: CHRONOLOGY OF SOME IMPORTANT EVENTS Major Events The Poseidon stock is well off its mid-February 2012 closing high of $16.80 on the TSX, currently yielding 8.3 per cent. Poseidon announces dividends. Poseidon shares are down 55 per cent on quarterly results and 2012 guidance. Disappointing third quarter results lead to a decline in the share price. Poseidon forms a special committee (of board of directors), suspends future dividends, and announces board and managerial changes. The Poseidon stock drops after dividends are suspended and the CEO is replaced. Poseidon reviews the December 31, 2012 dividend and announces additional management changes. Poseidon states that it will restate results for the first three quarters of 2012. Poseidon states that up to $106 million of its $148.1 million revenue for the nine months to September 30 should not have been recorded. Poseidon's stock dives to $0.27 from $16.03 earlier in the year, as a result of a slowing down of activities. A cease trade order is issued by the Alberta Securities Commission. A cease trade order is issued by the British Columbia Securities Commission. Poseidon provides an update with respect to its business and operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts