Question: Assignment Questions 1. Give a decriptive introduction about the different types of brockarage accounts and how trading take place in cach accounts. 2. Assume you

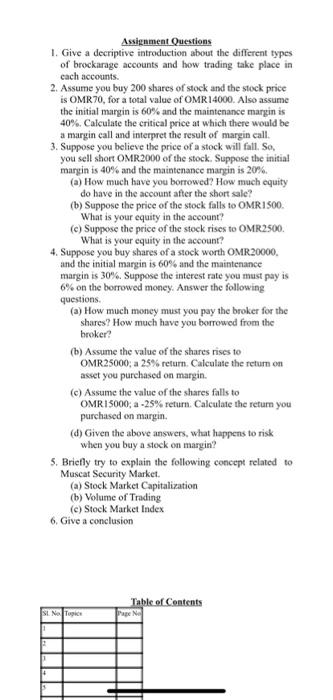

Assignment Questions 1. Give a decriptive introduction about the different types of brockarage accounts and how trading take place in cach accounts. 2. Assume you buy 200 shares of stock and the stock price is OMR70, for a total value of OMR 14000. Also assume the initial margin is 60% and the maintenance margin is 40%. Calculate the critical price at which there would be a margin eall and interpret the result of margin call. 3. Suppose you believe the price of a stock will fall. S o, you sell short OMR2000 of the stock. Suppose the initial margin is 40% and the maintenance margin is 20%. (a) How much have you borrowed? How much equity do have in the account after the short sale? (b) Suppose the price of the stock falls to OMR 1500 . What is your cquity in the account? (c) Suppose the price of the stock rises to OMR2500. What is your equity in the account? 4. Suppose you buy shares of a stock worth OMR20000. and the initial margin is 60% and the maintenance margin is 30%. Suppose the interest rate you must pay is 6% on the borrowed money. Answer the following questions. (a) How much moncy must you pay the broker for the shares? How much have you borrowed from the broker? (b) Assume the value of the shares rises to OMR25000; a 25\% return. Calculate the return on asset you purchased on margin. (c) Assume the value of the shares falls to OMR 15000; a -25\% return. Calculate the return you purchased on margin. (d) Given the above answers, what happens to risk When you buy a stock on margin? 5. Briefly try to explain the following concept related to Muscat Security Market. (a) Stock Market Capitalization (b) Volume of Trading (c) Stock Market Index 6. Give a conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts