Question: Assignment: RE model vs. AEG model An analyst presents you the following pro forma that gives her forecast of earnings and dividends for the period

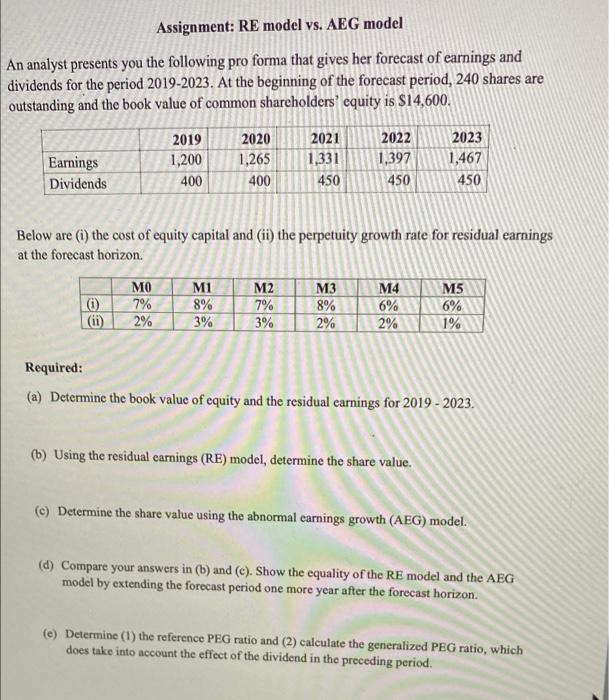

Assignment: RE model vs. AEG model An analyst presents you the following pro forma that gives her forecast of earnings and dividends for the period 2019-2023. At the beginning of the forecast period, 240 shares are outstanding and the book value of common shareholders' equity is $14,600. Earnings Dividends 2019 1,200 400 2020 1,265 400 2021 1,331 450 2022 1,397 450 2023 1,467 450 Below are (i) the cost of equity capital and (ii) the perpetuity growth rate for residual earnings at the forecast horizon. ee MO 7% 2% M1 8% 3% M2 7% 3% M3 8% 2% M4 6% 2% M5 6% 1% Required: (a) Determine the book value of equity and the residual earnings for 2019-2023. (b) Using the residual carnings (RE) model, determine the share value. (C) Determine the share value using the abnormal earnings growth (AEG) model. (d) Compare your answers in (b) and (c). Show the equality of the RE model and the AEG model by extending the forecast period one more year after the forecast horizon. (e) Determine (1) the reference PEG ratio and (2) calculate the generalized PEG ratio, which does take into account the effect of the dividend in the preceding period. Assignment: RE model vs. AEG model An analyst presents you the following pro forma that gives her forecast of earnings and dividends for the period 2019-2023. At the beginning of the forecast period, 240 shares are outstanding and the book value of common shareholders' equity is $14,600. Earnings Dividends 2019 1,200 400 2020 1,265 400 2021 1,331 450 2022 1,397 450 2023 1,467 450 Below are (i) the cost of equity capital and (ii) the perpetuity growth rate for residual earnings at the forecast horizon. ee MO 7% 2% M1 8% 3% M2 7% 3% M3 8% 2% M4 6% 2% M5 6% 1% Required: (a) Determine the book value of equity and the residual earnings for 2019-2023. (b) Using the residual carnings (RE) model, determine the share value. (C) Determine the share value using the abnormal earnings growth (AEG) model. (d) Compare your answers in (b) and (c). Show the equality of the RE model and the AEG model by extending the forecast period one more year after the forecast horizon. (e) Determine (1) the reference PEG ratio and (2) calculate the generalized PEG ratio, which does take into account the effect of the dividend in the preceding period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts