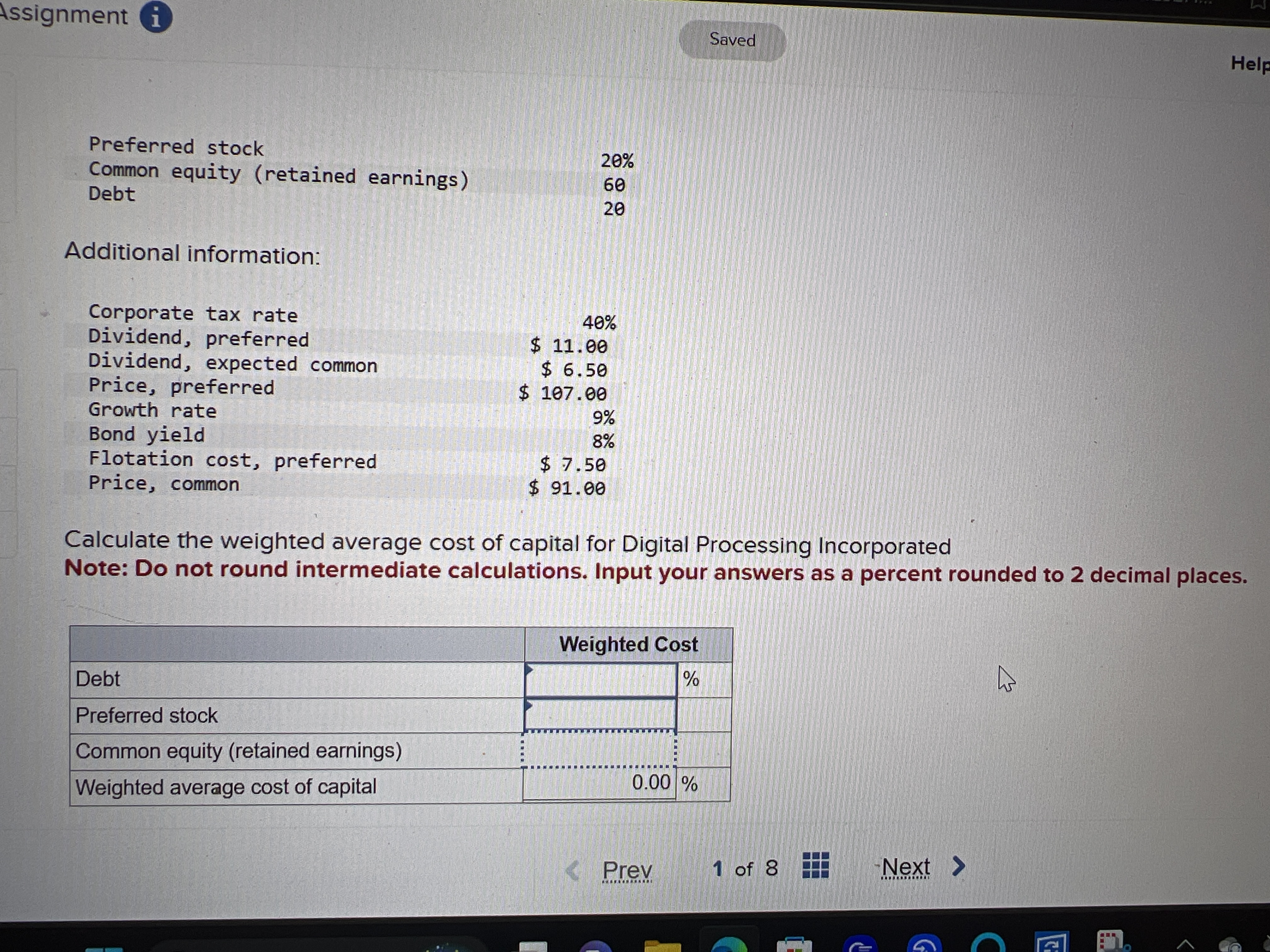

Question: Assignment Saved Help Preferred stock 20% Common equity (retained earnings) 60 Debt 20 Additional information: Corporate tax rate 40% Dividend, preferred $ 11.00 Dividend, expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts