Question: Assignment Score: 67.31% t: Chapter 4 Knowledge Test Save Submit Assignment for Grading Question 17 of 31 Problem 4.13 (TIE and ROIC Ratios) Check My

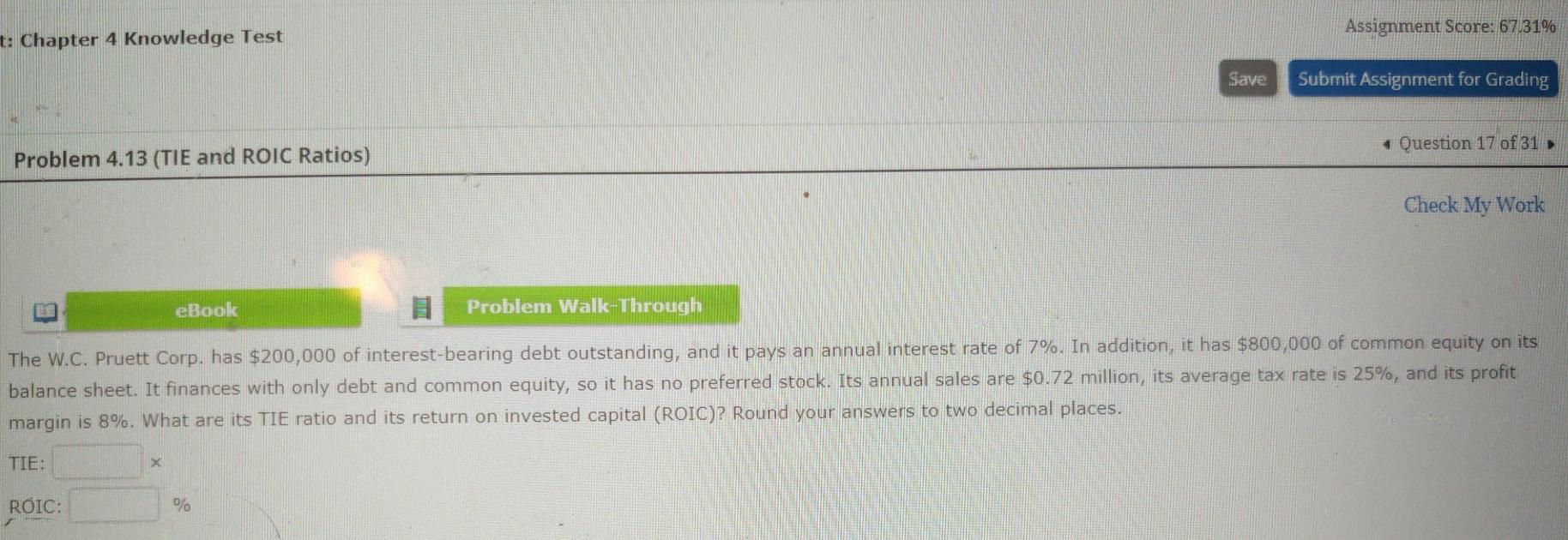

Assignment Score: 67.31% t: Chapter 4 Knowledge Test Save Submit Assignment for Grading Question 17 of 31 Problem 4.13 (TIE and ROIC Ratios) Check My Work eBook Problem Walk-Through The W.C. Pruett Corp. has $200,000 of interest-bearing debt outstanding, and it pays an annual interest rate of 7%. In addition, it has $800,000 of common equity on its balance sheet. It finances with only debt and common equity, so it has no preferred stock. Its annual sales are $0.72 million, its average tax rate is 25%, and its profit margin is 8%. What are its TIE ratio and its return on invested capital (ROIC)? Round your answers to two decimal places. TIE: ROIC: %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts