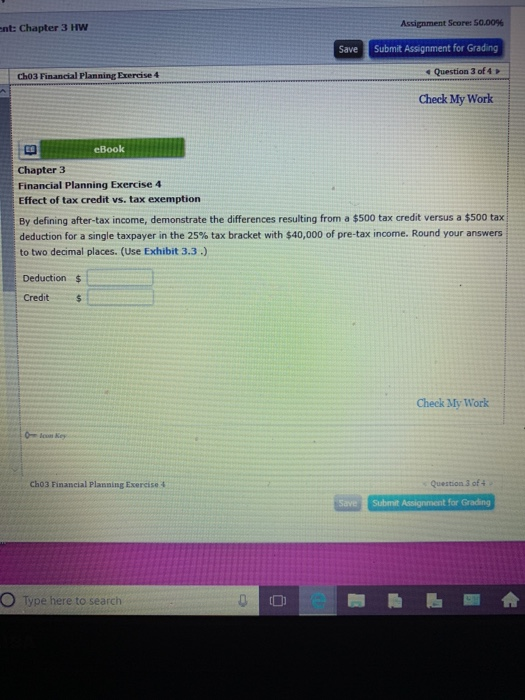

Question: Assignment Score: S00% nt: Chapter 3 HW Save Submit Assignment for Grading e Question 3 of 4 ch03 Financial Planning Exercise 4 Check My Work

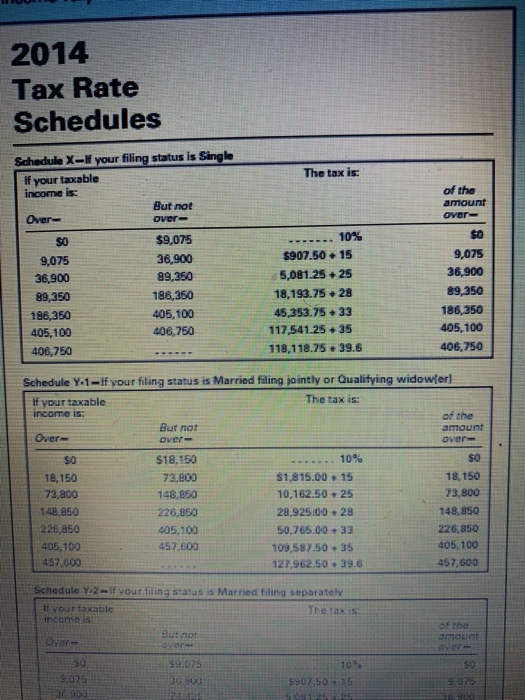

Assignment Score: S00% nt: Chapter 3 HW Save Submit Assignment for Grading e Question 3 of 4 ch03 Financial Planning Exercise 4 Check My Work eBook Chapter 3 Financial Planning Exercise 4 Effect of tax credit vs. tax exemption By defining after-tax income, demonstrate the differences resulting from a $500 tax credit versus a $500 tax deduction for a single taxpayer in the 25% tax bracket with $40,000 of pre-tax income. Round your answers to two decimal places. (Use Exhibit 3.3. Deduction $ Credit Check My Work Cho3 Financial Planning Exercise 3 Question 3 of Type here to search 0 2014 Tax Rate Schedules Schedule X-f your filing status is Single The tax is If your taxable income is: of the amount over- But not $0 9,075 36,900 89,350 186,350 405,100 406.750 .. 10% S0 9,075 38,900 89,350 196,350 405,100 406,750 $9,075 36,900 89,350 186,350 405,100 406,760 $907.50 15 5,081.25 25 18,193.75 28 45,353.75 33 117,541.25 35 118,118.75 39.6 Schedule Y-1-If your filing status is Married filing jointly or Qualitying widowferl The tax is: If your taxable income 15: of the amoun But not over- $18,150 73.800 148,850 226,850 405.100 457,600 10% so 50 18,150 73,800 148,850 226,850 405.100 457.600 $1,815.00 15 10,162.50+25 28.925.00 28 50,765.00 33 109,587.50 35 127,962.50 39.6 18,150 73,800 148,850 226,850 405,100 457,600 Schedule Y.z-lf your filing status is Married filing separately If vour taxable ream3 Thetaxis or the Dut not 9.075

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts