Question: Assignment S-Erwi. * 100% 11. Axis Corp. is considering an investment in the best of two mutually exclusive projects. Project Kelvin involves an overhaul of

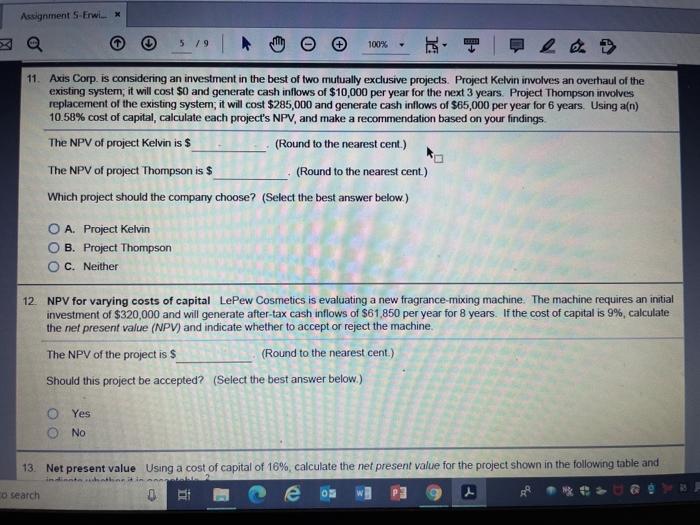

Assignment S-Erwi. * 100% 11. Axis Corp. is considering an investment in the best of two mutually exclusive projects. Project Kelvin involves an overhaul of the existing system, it will cost $0 and generate cash inflows of $10,000 per year for the next 3 years. Project Thompson involves replacement of the existing system, it will cost $285,000 and generate cash inflows of $65,000 per year for 6 years. Using an) 10.58% cost of capital, calculate each project's NPV, and make a recommendation based on your findings The NPV of project Kelvin is $ (Round to the nearest cent.) The NPV of project Thompson is $ (Round to the nearest cent) Which project should the company choose? (Select the best answer below.) O A. Project Kelvin O B. Project Thompson OC. Neither 12 NPV for varying costs of capital LePew Cosmetics is evaluating a new fragrance mixing machine. The machine requires an initial investment of $320,000 and will generate after-tax cash inflows of $61.850 per year for 8 years. If the cost of capital is 9%, calculate the net present value (NPV) and indicate whether to accept or reject the machine. The NPV of the project is $ (Round to the nearest cent.) Should this project be accepted? (Select the best answer below.) Yes No 13. Net present value Using a cost of capital of 16%, calculate the net present value for the project shown in the following table and o search e os W] P3 inten TE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts