Question: Assignment Setting Assignment 1 focuses on the financial statement analysis of a bank of your choice from the list below. You will be asked to

Assignment Setting

Assignment 1 focuses on the financial statement analysis of a bank of your choice from the list below.

You will be asked to provide a general description of your bank and its competitors (see material in Modules 1 and 2). You will also calculate the performance of your bank and the potential risks surrounding that performance (see material in Module 3).

Work with the accounting data for these banks. You will first need to select onebank from the list below. The list contains banks in two different size categories: large regional banks and small regional banks.

| Large Regional | FDIC Cert # | Small Regional | FDIC Cert # |

| U.S. Bank N.A. | 6548 | Busey Bank | 16450 |

Your team should choose one BHC from one of the size categories on the list (Large Regional or Small Regional). You will eventually be asked to use data from a close competitor BHC ("Peer BHC") to make some comparisons with your selected BHC in later questions.

You must retrieve accounting data for your selected BHC on the FDIC'sBank Find Suite website (https://banks.data.fdic.gov/bankfind-suite/).

At this website:

- Click on "Run Financial Reports by Institution";

- Then click on the "Banks" (tab located in the blue box under "Search for Institutions" header;

- Click on "Bank Name/Cert" menu, select search type of "FDIC Cert #", and enter your selected bank's number (from the table above);

- Finally, select "2019" as the search year and choose "4th Quarter" in the "Reporting Period" field; and

- Click "Search".

There are three things to note about this assignment.

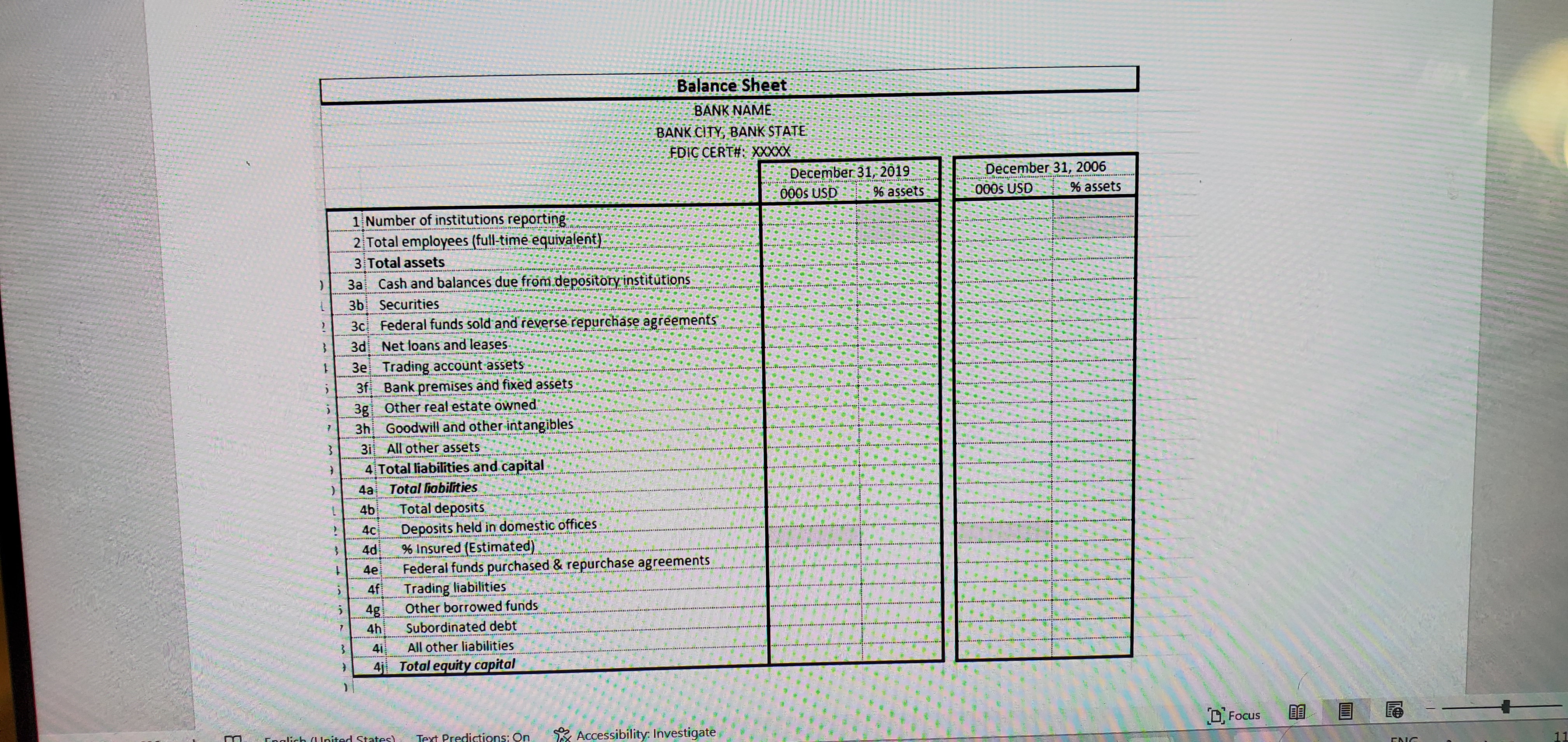

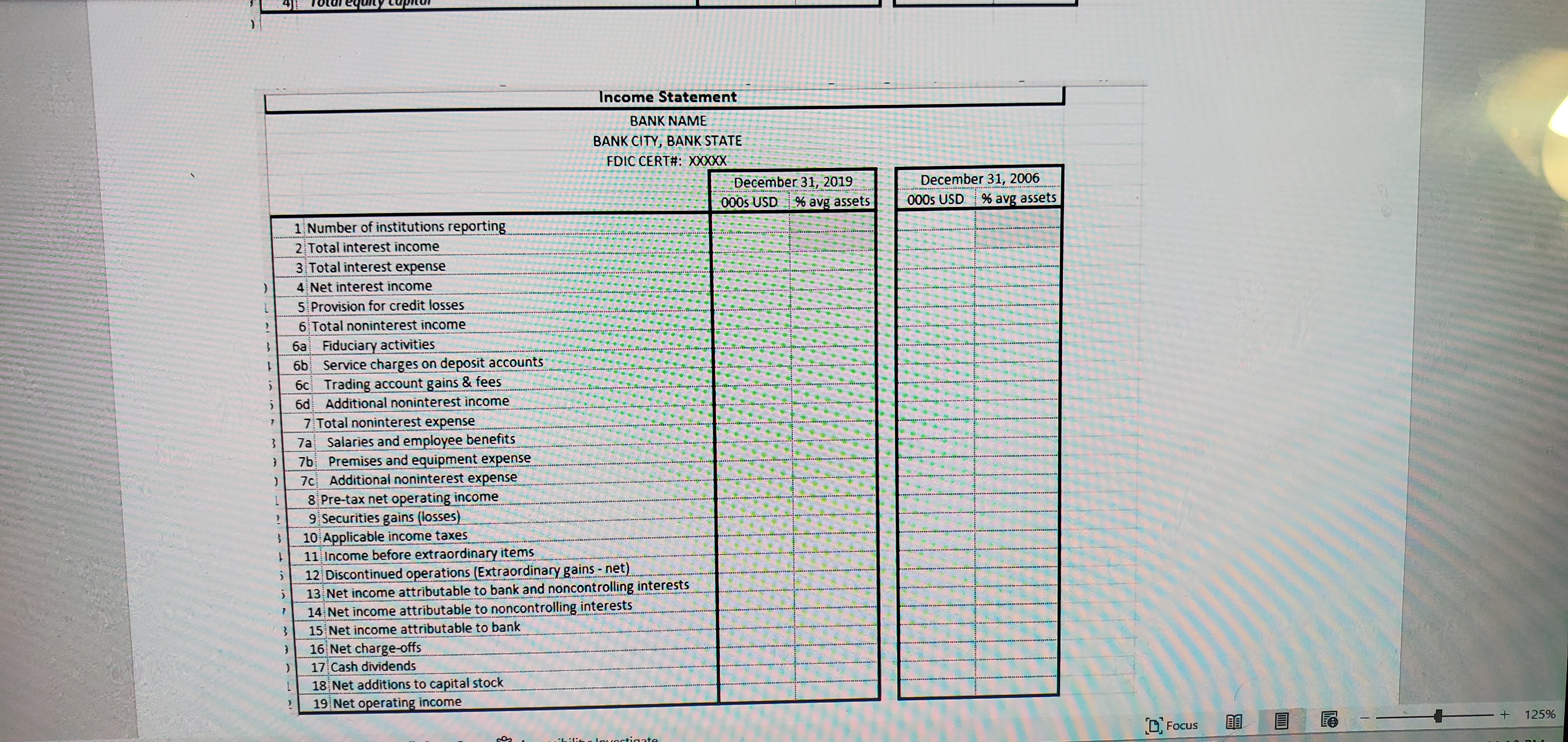

- First, in the FDIC data, the balance sheet is called "Assets, Liabilities, and Capital" and the income statement is called "Income and Expense."

- Second, when questions refer to "2019 data" this means the end-of-year 2019 (i.e., as of December 31, 2019) balance sheet data and the income statement data over 2019 (i.e., income and expense occurring over the four quarters of calendar year 2019).

- Third, when we refer to "your bank", this will be the bank your team has selected from the above table. When we refer to the "peer bank", this will be the competitor bank that your team will discuss in Question 2 (and some of the subsequent questions).

- [4] From the balance sheet, what are your bank's:

Finally, note that the number of points per question is shown in square brackets (i.e., [x]).

Question 5 [18 points]

Based on the 2019 data and expressing your answers in relative terms (as percentage of bank's total assets), unless requested otherwise:

Balance Sheet:

- Most important (largest) source of funds? Please explain.

- Most important (largest) use of funds (investment)? Please explain.

- [2] Is commercial and industrial lending or real estate lending a larger component of the bank's loan portfolio? Please explain.

- [2] Would your answer to part (b) change if you considered only residential (1-4 family) real estate lending? Please explain.

- [2] How much of your bank's domestic deposits are held in transaction accounts? Express your answer as a percentage of bank's assets.

- [2] Does your bank have trading assets? If so, then how much (as percentage of bank's assets)? Would you consider the trading assets to be significant, and why or why not?

- [2] Consider the bank's off-balance sheet items. Does your bank have any exposure to unused credit card line commitments? If so, then how much (as percentage of bank's assets)?

Income Statement:

- [2] From the income statement, what is the ratio of noninterest income to total income (i.e., total income = interest income plus noninterest income)?

- [2] What is your bank's largest source of noninterest income and its magnitude (as percentage of bank's assets)?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts