Question: Assignment Subject Property This is a Class B duplex in Gainesville that you plan to renovate before leasing out to students in order to command

Assignment

Subject Property

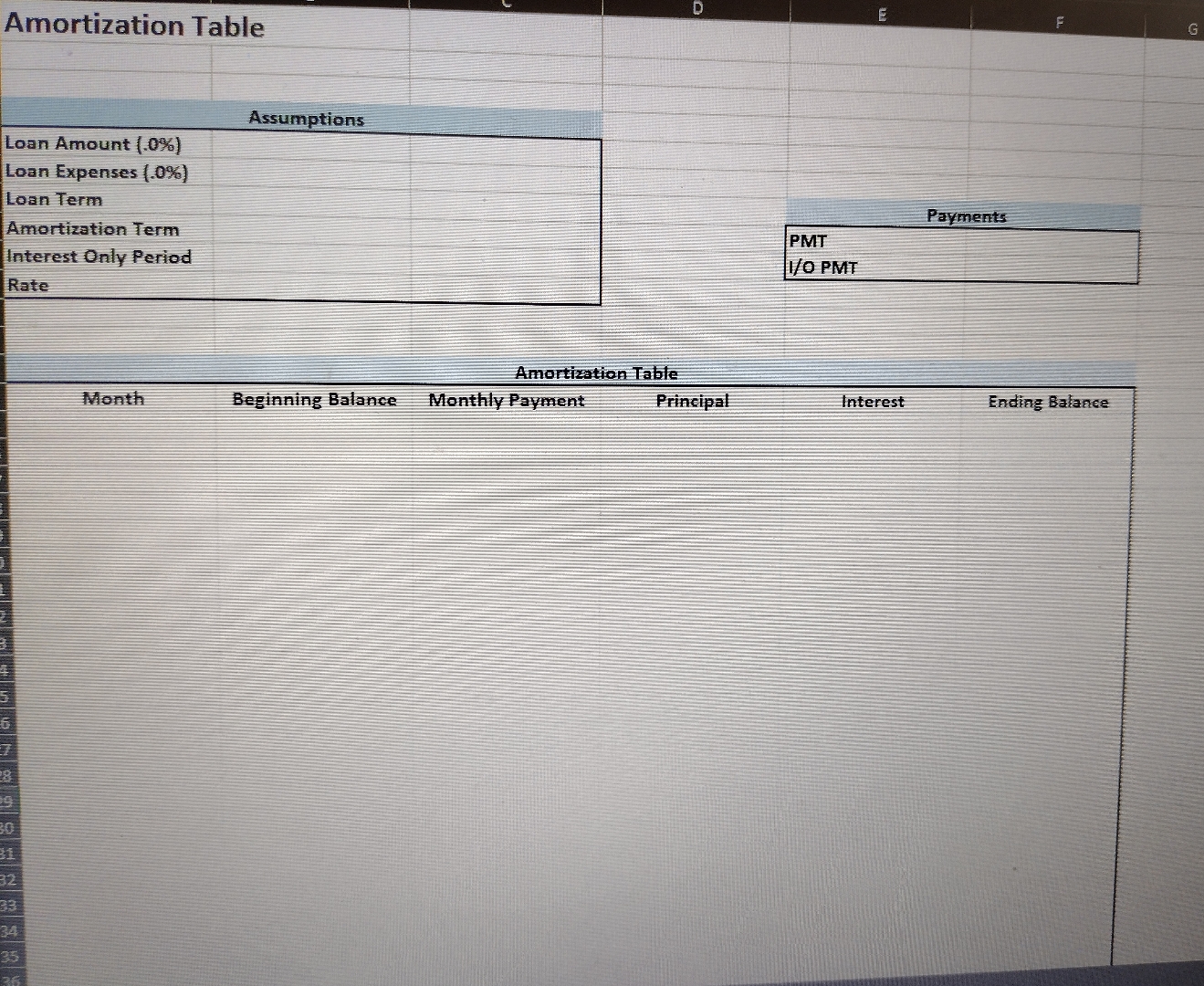

This is a Class B duplex in Gainesville that you plan to renovate before leasing out to students in order to command higher rents. You did your research and project the renovations to cost you $ per unit in year You can purchase the property for $ today and you believe that the total combined rent will be $ a month for the entire property with a month lease. You also believe that your rent will grow at a constant yearly rate of and project that you will have vacancy and collection losses of annually since you secured creditable tenants. Both tenants will be charged $ a month for their parking spot, maintenance and utilities will cost you $ annually, and the operating expenses will grow at yearly. Based on your assumptions you can sell your property in years for $ You expect there to be selling expenses of You will not invest in this property unless you can realize an unlevered before tax return of a levered before tax return of and a levered after tax return of You would like to acquire the property with financed by ABC Bank with a year fixed interest rate loan at per year. You also negotiate to only pay interest for the six months. You will have to pay in loan expenses and you plan on using an amortization term of years making this a fixed rate partially amortized loan with an interest only period. Your yearly taxes will be $ and you will have taxes due on sale of on the property. Once you complete the model please provide EXCel formulas so I know how to approach this problem.

Amortization Table goes from row to row

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock