Question: Assignment W3 - TVM Solve following problems: 1. You just inherited a trust that will pay you $100,000 per year in perpetuity. However, the first

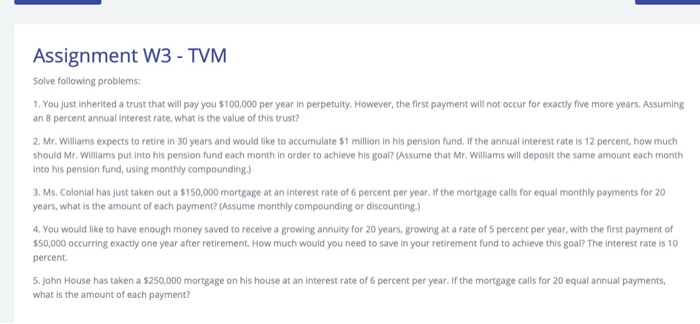

Assignment W3 - TVM Solve following problems: 1. You just inherited a trust that will pay you $100,000 per year in perpetuity. However, the first payment will not occur for exactly five more years. Assuming an 8 percent annual interest rate, what is the value of this trust? 2. Mr. Williams expects to retire in 30 years and would like to accumulate $1 million in his pension fund. If the annual interest rate is 12 percent, how much should Mr. Williams put into his pension fund each month in order to achieve his goal? (Assume that Mr. Williams will deposit the same amount each month into his pension fund, using monthly compounding) 3. Ms. Colonial has just taken out a $150,000 mortgage at an interest rate of 6 percent per year. If the mortgage calls for equal monthly payments for 20 years, what is the amount of each payment? (Assume monthly compounding or discounting.) 4. You would like to have enough money saved to receive a growing annuity for 20 years, growing at a rate of 5 percent per year, with the first payment of $50,000 occurring exactly one year after retirement. How much would you need to save in your retirement fund to achieve this goal? The interest rate is 10 percent. 5. John House has taken a $250,000 mortgage on his house at an interest rate of 6 percent per year. If the mortgage calls for 20 equal annual payments, what is the amount of each payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts