Question: Assignment Webmaster.com has decleped a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year to buy

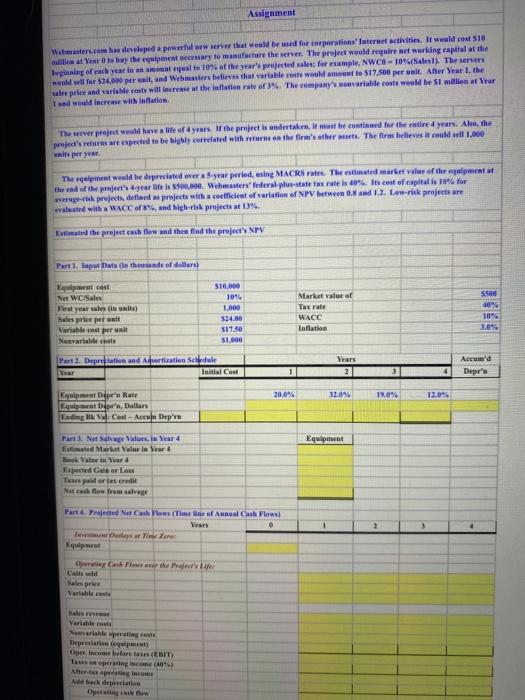

Assignment Webmaster.com has decleped a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year to buy the equipment necessary to manufacture the server. The project would require nel merking capital at the beginning of each year in an amount equal to 10% of the year's projected sales for example, NWC - 10*6(Salest). The servers mould sell for $14.000 per unit, and Webmasters believes that variable costs would amount to $17.500 per unit. After Year 1, the les price and variable easts will increase the inflation rate of 34. The company's variable costs would be st million at Year Id would increase with inflation The winner project we have a life of 4 years of the project is undertaken, it must be continued for the entire 4 years. Also, the project's return are expected to be highly correlated with return on the firm's others. The firm believes it could sell 1,000 knits per year The equipment would be depreciated over a year period, sing MACRS rates. The estimated market value of the equipment at the end of the project gear life le 800,000. Webmasters' federal-plus-state tax rate is 40%. It cost of capital is 10% for werpersprejets, defined as projects with a coefficient of variation of NPV between 0 and 1.2. Lewrak projets are evaluated with a WACC of 8%, and high-risk projects at 13%. Estimated the project cash flow and then find the project NPV Part I. laput Data (in theads of dollars) Equipment cost Net WC/Sales First year sales in units) Sales prior per wait Variable cost per unit Navariable costs $10.000 10% 1.000 524.00 $17.50 51.000 Market value of Tax rate WACC Inflation 5500 4036 109 3.04 Part 2 Depreciation and Agertation Schedule Initial Cast Years 2 Accu'd Depre 4 20,0% 32.0% 19.0% Equipment prie Rate Equipment pro, Dollars Kading RLV Cost - Apr Equipment Part No Salvage Value In Year 4 fifimated Market Value in Year 4 Hook Valim Year 4 Expected Gale or Low Terespalder tes credit Netflow from salg! Part Projected Net Cushwa (Timeline of Annual Ch Flows) Years Pulsar Equipment 1 > as wald Sales prie Variable costs Variable Nasrihle sperating Depreciation meat Oper income before IT Las operating income (10) As income A back depreciati Assignment Webmaster.com has decleped a powerful new server that would be used for corporations Internet activities. It would cost $10 million at Year to buy the equipment necessary to manufacture the server. The project would require nel merking capital at the beginning of each year in an amount equal to 10% of the year's projected sales for example, NWC - 10*6(Salest). The servers mould sell for $14.000 per unit, and Webmasters believes that variable costs would amount to $17.500 per unit. After Year 1, the les price and variable easts will increase the inflation rate of 34. The company's variable costs would be st million at Year Id would increase with inflation The winner project we have a life of 4 years of the project is undertaken, it must be continued for the entire 4 years. Also, the project's return are expected to be highly correlated with return on the firm's others. The firm believes it could sell 1,000 knits per year The equipment would be depreciated over a year period, sing MACRS rates. The estimated market value of the equipment at the end of the project gear life le 800,000. Webmasters' federal-plus-state tax rate is 40%. It cost of capital is 10% for werpersprejets, defined as projects with a coefficient of variation of NPV between 0 and 1.2. Lewrak projets are evaluated with a WACC of 8%, and high-risk projects at 13%. Estimated the project cash flow and then find the project NPV Part I. laput Data (in theads of dollars) Equipment cost Net WC/Sales First year sales in units) Sales prior per wait Variable cost per unit Navariable costs $10.000 10% 1.000 524.00 $17.50 51.000 Market value of Tax rate WACC Inflation 5500 4036 109 3.04 Part 2 Depreciation and Agertation Schedule Initial Cast Years 2 Accu'd Depre 4 20,0% 32.0% 19.0% Equipment prie Rate Equipment pro, Dollars Kading RLV Cost - Apr Equipment Part No Salvage Value In Year 4 fifimated Market Value in Year 4 Hook Valim Year 4 Expected Gale or Low Terespalder tes credit Netflow from salg! Part Projected Net Cushwa (Timeline of Annual Ch Flows) Years Pulsar Equipment 1 > as wald Sales prie Variable costs Variable Nasrihle sperating Depreciation meat Oper income before IT Las operating income (10) As income A back depreciati

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts