Question: Assignment Week 1 1) PE 1-1A Cost Concept OBJ. 2 EE 1-1 On February 3, Boulder Repair Service extended an offer of $566,000 for land

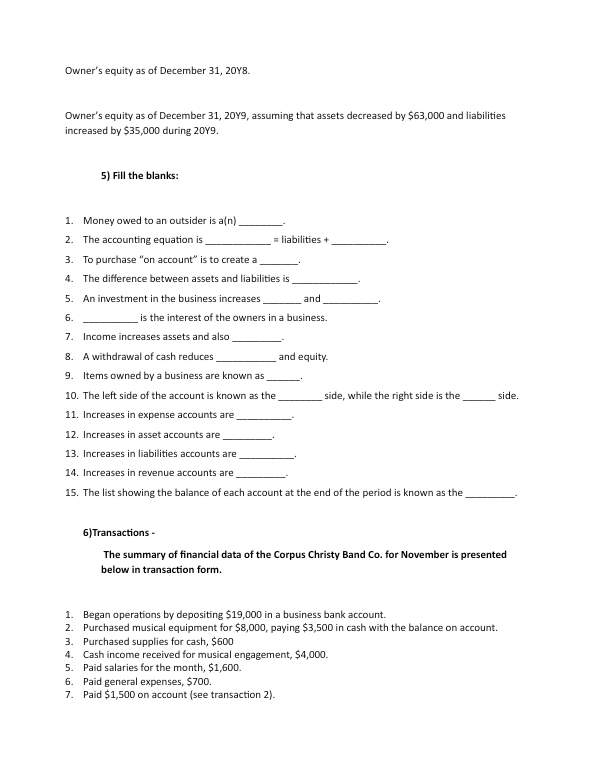

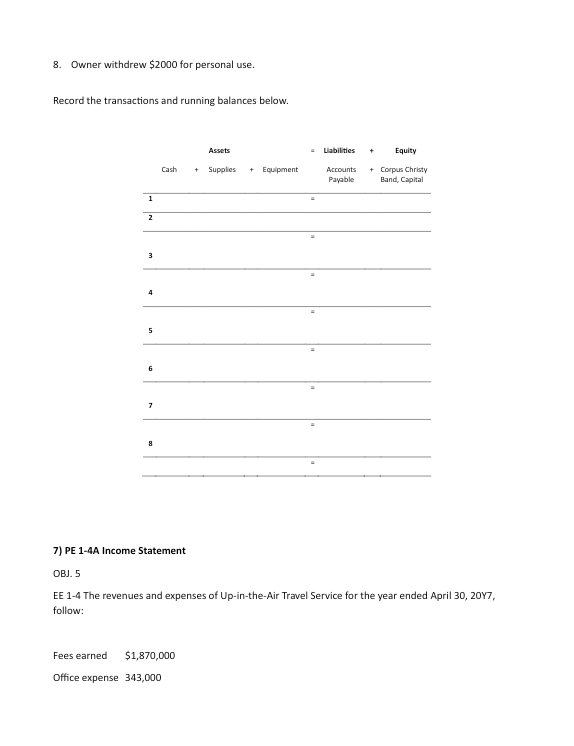

Assignment Week 1 1) PE 1-1A Cost Concept OBJ. 2 EE 1-1 On February 3, Boulder Repair Service extended an offer of $566,000 for land that had been priced for sale at $629,000. On February 28, Boulder Repair Service accepted the seller's counteroffer of $597,000. On October 23, the land was assessed at a value of $613,000 for property tax purposes. On January 15 of the next year, Boulder Repair Service was offered $708,000 for the land by a national retail chain. At what value should the land be recorded in Boulder Repair Service's records? 2) PE 1-18 Cost Concept OBJ. 2 EE 1-1 On March 31, Clementine Repair Service extended an offer of $350,500 for land that had been priced for sale at $388,500. On April 15, Clementine Repair Service accepted the seller's counteroffer of $369,500. On September 9, the land was assessed at a value of $316,700 for property tax purposes. On December 8, Clementine Repair Service was offered $401,200 for the land by a national retail chain. At what value should the land be recorded in Clementine Repair Service's records? 3) PE 1-2A Accounting Equation OBJ. 3 EE 1-2 Patrick Miller is the owner and operator of Chicopee LLC, a motivational consulting business. At the end of its accounting period, December 31, 20Y8, Chicopee has assets of $518,000 and liabilities of $165,000. Using the accounting equation, determine the following amounts: Owner's equity as of December 31, 20Y8. Owner's equity as of December 31, 2019, assuming that assets increased by $86,200 and liabilities increased by $25,000 during 20Y9. 4) PE 1-28 Accounting Equation OBJ. 3 EE 1-2 Pauline Emm is the owner and operator of Power Thoughts, a motivational consulting business. At the end of its accounting period, December 31, 2018, Power Thoughts has assets of $382,000 and liabilities of $94,000. Using the accounting equation, determine the following amounts:Owner's equity as of December 31, 20Y8. Owner's equity as of December 31, 2019, assuming that assets decreased by $63,000 and liabilities increased by $35,000 during 20Y9. 5) Fill the blanks: 1. Money owed to an outsider is a(n) 2. The accounting equation is = liabilities + 3. To purchase "on account" is to create a 4. The difference between assets and liabilities is 5. An investment in the business increases and 6. is the interest of the owners in a business. 7. Income increases assets and also B. A withdrawal of cash reduces and equity. 9. Items owned by a business are known as 10. The left side of the account is known as the side, while the right side is the side. 11. Increases in expense accounts are 12. Increases in asset accounts are 13. Increases in liabilities accounts are 14. Increases in revenue accounts are. 15. The list showing the balance of each account at the end of the period is known as the 6)Transactions - The summary of financial data of the Corpus Christy Band Co. for November is presented below in transaction form. 1. Began operations by depositing $19,000 in a business bank account. Purchased musical equipment for $8,000, paying $3,500 in cash with the balance on account. 3. Purchased supplies for cash, $600 4. Cash income received for musical engagement, $4,000. 5. Paid salaries for the month, $1,600. 6. Paid general expenses, $700. 7. Paid $1,500 on account (see transaction 2).8. Owner withdrew $2000 for personal use. Record the transactions and running balances below. Assets Liabilities Equity Cash + Supplies + Equipment Accounts + Compus Christy Payable Band, Capital 3 3 7) PE 1-4A Income Statement OBJ. 5 EE 1-4 The revenues and expenses of Up-in-the-Air Travel Service for the year ended April 30, 2017, follow: Fees earned $1,870,000 Office expense 343,000Miscellaneous expense 21,000 Wages expense 1,115,000 Prepare an income statement for the year ended April 30, 20Y7. 8) E 1-48 Income Statement OBJ. 5 EE 1-4 The revenues and expenses of Zenith Travel Service for the year ended August 31, 20Y4, follow: Fees earned $899,600 Office expense 353,800 Miscellaneous expense 14,400 Wages expense 539,800 9) PE 1-5A Statement of Owner's Equity OBJ. 5 EE 1-5 Using the income statement for Up-in-the-Air Travel Service shown in Practice Exercise 1-4A, prepare a statement of owner's equity for the year ended April 30, 2017. Jerome Foley, the owner, invested an additional $52,000 in the business during the year and withdrew cash of $34,000 for personal use. Jerome Foley, capital as of May 1, 20Y6, was $876,000. 10) PE 1-58 Statement of Owner's Equity OBJ. 5 EE 1-5 Using the income statement for Zenith Travel Service shown in Practice Exercise 1-48, prepare a statement of owner's equity for the year ended August 31, 20Y4. Megan Cox, the owner, invested an additional $43,200 in the business during the year and withdrew cash of $21,600 for personal use. Megan Cox, capital as of September 1, 2013, was $456,000. 11) PE 1-6A Balance Sheet OBJ. 5 EE 1-6 Using the following data for Up-in-the-Air Travel Service as well as the statement of owner's equity shown in Practice Exercise 1-5A, prepare a report form balance sheet as of April 30, 20Y7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts