Question: Assignment Week 2. For Plastic Door Mats (Hs code 3926.90.20.00) of USA Origin Value for Currency Conversion VFCC -> US$6700 Exchange Rate. (Find Exchange Rate

Assignment Week 2.

- For Plastic Door Mats (Hs code 3926.90.20.00) of USA Origin Value for Currency Conversion VFCC -> US$6700 Exchange Rate. (Find Exchange Rate for Jan 17th 2023)

Find duty rate under Customs Tariff.

- Calculate VFD

- Calculate VFT

- Calculate Total amount of duty and Taxes to be paid to CBSA.

- For Ridding Boots ( HS Code 6401.92.11.00) of Italian Origin, Value for Currency Conversion VFCC -> EURO 4500

- (Find Exchange Rate for Dec 11th 2022)

Find duty rate under Customs Tariff.

- Calculate VFD

- Calculate VFT

- Calculate Total amount of duty and Taxes to be paid to CBSA.

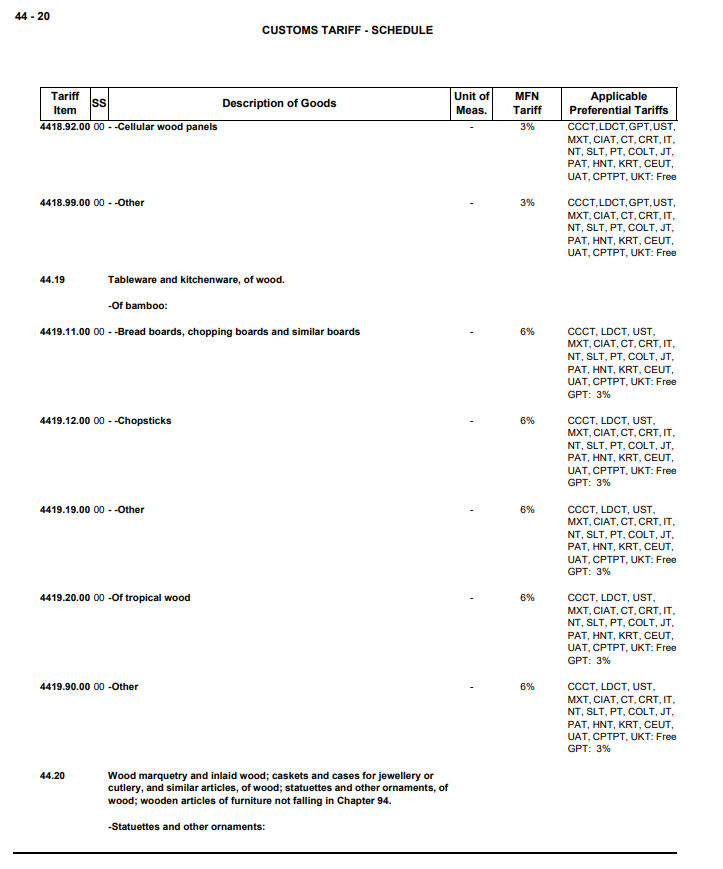

44 - 20 CUSTOMS TARIFF - SCHEDULE Tariff Iss Description of Goods Unit of MFN Applicable Item Meas. Tariff Preferential Tariffs 1418.92.00 00 - -Cellular wood panels 3% CCCT, LDCT, GPT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT, PAT, HNT, KRT, CEUT UAT, CPTPT, UKT: Free 4418.99.00 00 - -Other 3% CCCT, LDCT, GPT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT. PAT, HNT, KRT, CEUT, UAT, CPTPT, UKT: Free 44.19 Tableware and kitchenware, of wood. -Of bamboo: 4419.11.00 00 - -Bread boards, chopping boards and similar boards 6% CCCT, LDCT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT, PAT, HNT, KRT, CEUT, UAT, CPTPT, UKT: Free GPT: 3% 4419.12.00 00 - -Chopsticks 6% CCCT, LDCT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT, PAT, HNT, KRT, CEUT UAT, CPTPT, UKT: Free GPT: 3% 4419.19.00 00 - -Other 6% CCCT, LDCT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT PAT, HNT, KRT, CEUT, UAT, CPTPT, UKT: Free GPT: 3% 4419.20.00 00 -Of tropical wood 6% CCCT, LDCT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT, PAT, HNT, KRT, CEUT, UAT, CPTPT, UKT: Free GPT: 3% 4419.90.00 00 -Other 6% CCCT, LDCT, UST, MXT, CIAT, CT, CRT, IT, NT, SLT, PT, COLT, JT, PAT, HNT, KRT, CEUT, UAT, CPTPT, UKT: Free GPT: 3% 14.20 Wood marquetry and inlaid wood; caskets and cases for jewellery or cutlery, and similar articles, of wood; statuettes and other ornaments, of wood; wooden articles of furniture not falling in Chapter 94. Statuettes and other ornaments