Question: Assignment What-if analysis is a useful technique to trace through the effects of ch policies on the resources of the company. Consider the following selected

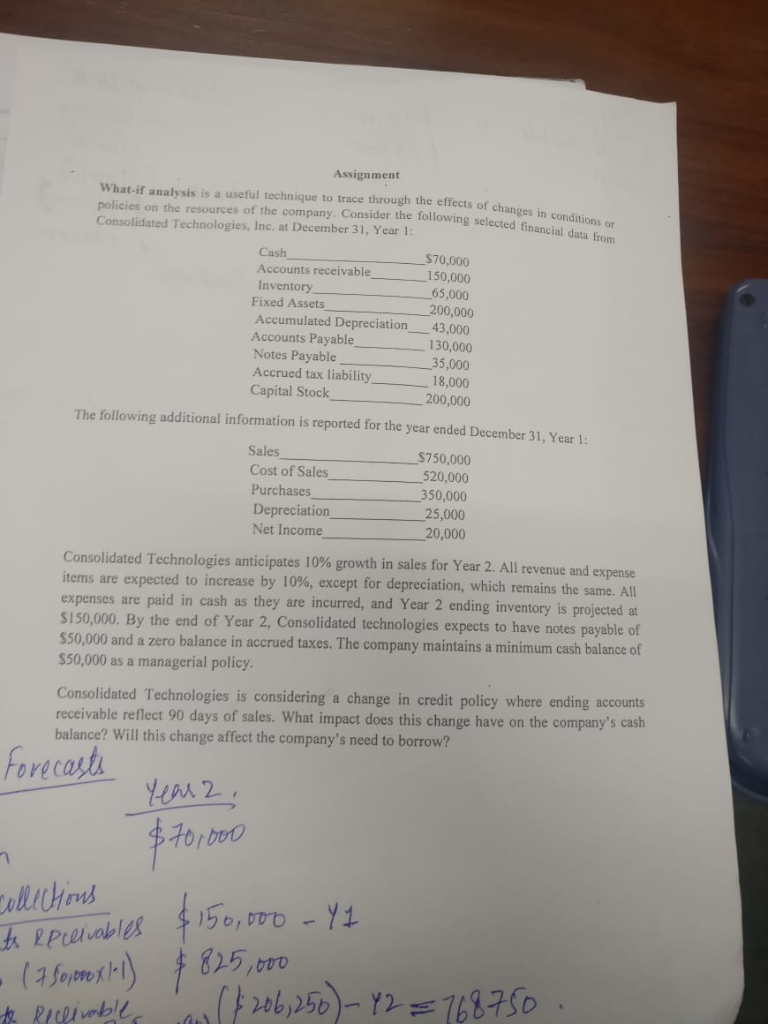

Assignment What-if analysis is a useful technique to trace through the effects of ch policies on the resources of the company. Consider the following selected Consolidated Technologies, Inc. at December 31, Year 1: changes in conditions or financial data from Cash Accounts receivable Inventory $70,000 150,000 65,000 Fixed Assets 200,000 Accumulated Depreciation 43,000 Accounts Payable Notes Payable130,000 35,000 Accrued tax liability Capital Stock 18,000 K200,000 The following additional information is reported for the year ended December 31, Year 1 Sales Cost of Sales Purchases Depreciation Net Income $750,000 520,000 350,000 25,000 20,000 Consolidated Technologies anticipates 10% growth in sales for Year 2, All revenue and expense items are expected to increase by 10%, except for depreciation, which remains the same. All expenses are paid in cash as they are incurred, and Year 2 ending inventory is projected at S150,000. By the end of Year 2, $50,000 and a zero balance in accrued taxes. The company maintains a minimum cash balance of $50,000 as a managerial policy Consolidated technologies expects to have notes payable of Consolidated Technologies is considering a change in credit policy where ending accounts receivable reflect 90 days of sales. What impact does this change have on the company's cash balance? Will this change affect the company's need to borrow? oreca

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts