Question: Assignments: (Set up reasonable and effective spreadsheet-solutions!) 1. Find the relevant Cash-Flows for both alternatives. 2. Find the Net Present Value, the (dynamic) Payback-Period, the

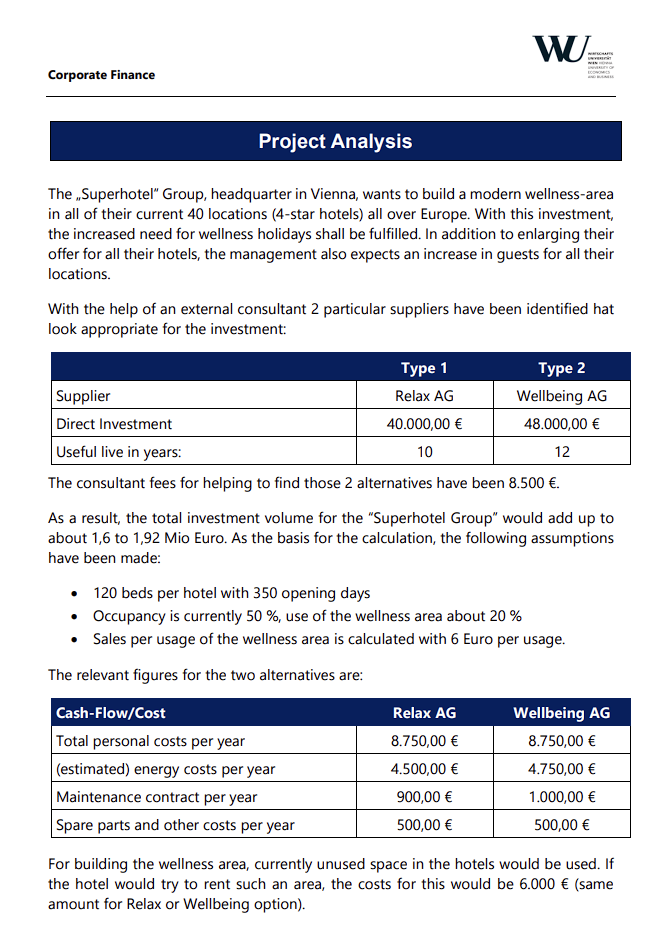

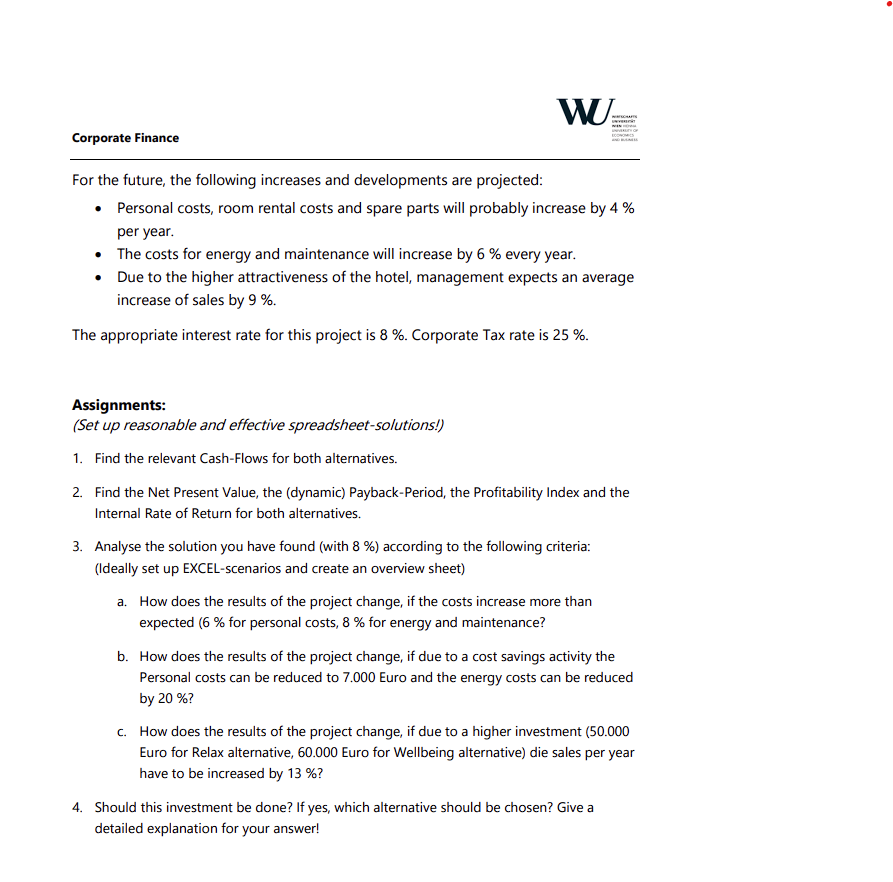

Assignments: (Set up reasonable and effective spreadsheet-solutions!) 1. Find the relevant Cash-Flows for both alternatives. 2. Find the Net Present Value, the (dynamic) Payback-Period, the Profitability Index and the Internal Rate of Return for both alternatives. 3. Analyse the solution you have found (with 8% ) according to the following criteria: (Ideally set up EXCEL-scenarios and create an overview sheet) a. How does the results of the project change, if the costs increase more than expected (6% for personal costs, 8% for energy and maintenance? b. How does the results of the project change, if due to a cost savings activity the Personal costs can be reduced to 7.000 Euro and the energy costs can be reduced by 20% ? c. How does the results of the project change, if due to a higher investment (50.000 Euro for Relax alternative, 60.000 Euro for Wellbeing alternative) die sales per year have to be increased by 13% ? 4. Should this investment be done? If yes, which alternative should be chosen? Give a detailed explanation for your answer! Corporate Finance Project Analysis The "Superhotel" Group, headquarter in Vienna, wants to build a modern wellness-area in all of their current 40 locations (4-star hotels) all over Europe. With this investment, the increased need for wellness holidays shall be fulfilled. In addition to enlarging their offer for all their hotels, the management also expects an increase in guests for all their locations. With the help of an external consultant 2 particular suppliers have been identified hat look appropriate for the investment: The consultant fees for helping to find those 2 alternatives have been 8.500. As a result, the total investment volume for the "Superhotel Group" would add up to about 1,6 to 1,92 Mio Euro. As the basis for the calculation, the following assumptions have been made: - 120 beds per hotel with 350 opening days - Occupancy is currently 50%, use of the wellness area about 20% - Sales per usage of the wellness area is calculated with 6 Euro per usage. The relevant figures for the two alternatives are: For building the wellness area, currently unused space in the hotels would be used. If the hotel would try to rent such an area, the costs for this would be 6.000 (same amount for Relax or Wellbeing option). Corporate Finance For the future, the following increases and developments are projected: - Personal costs, room rental costs and spare parts will probably increase by 4% per year. - The costs for energy and maintenance will increase by 6% every year. - Due to the higher attractiveness of the hotel, management expects an average increase of sales by 9%. The appropriate interest rate for this project is 8%. Corporate Tax rate is 25%. Assignments: (Set up reasonable and effective spreadsheet-solutions!) 1. Find the relevant Cash-Flows for both alternatives. 2. Find the Net Present Value, the (dynamic) Payback-Period, the Profitability Index and the Internal Rate of Return for both alternatives. 3. Analyse the solution you have found (with 8% ) according to the following criteria: (Ideally set up EXCEL-scenarios and create an overview sheet) a. How does the results of the project change, if the costs increase more than expected (6% for personal costs, 8% for energy and maintenance? b. How does the results of the project change, if due to a cost savings activity the Personal costs can be reduced to 7.000 Euro and the energy costs can be reduced by 20% ? c. How does the results of the project change, if due to a higher investment (50.000 Euro for Relax alternative, 60.000 Euro for Wellbeing alternative) die sales per year have to be increased by 13% ? 4. Should this investment be done? If yes, which alternative should be chosen? Give a detailed explanation for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts