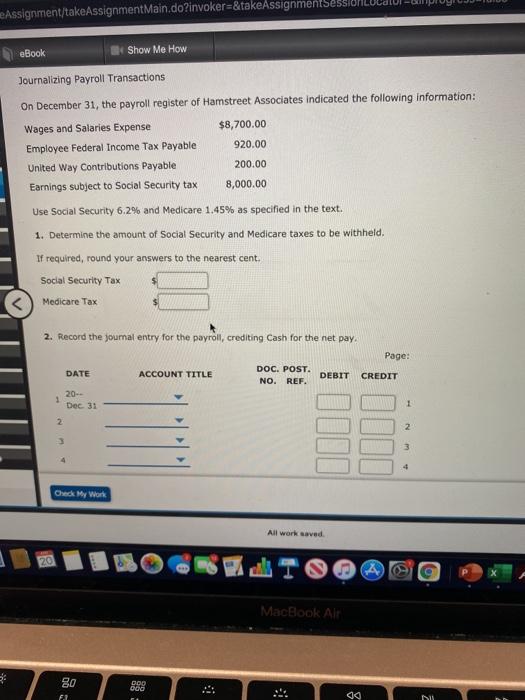

Question: Assignment/takeAssignmentMain.do?invoker=&takeAssignmentes eBook Show Me How Journalizing Payroll Transactions On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense

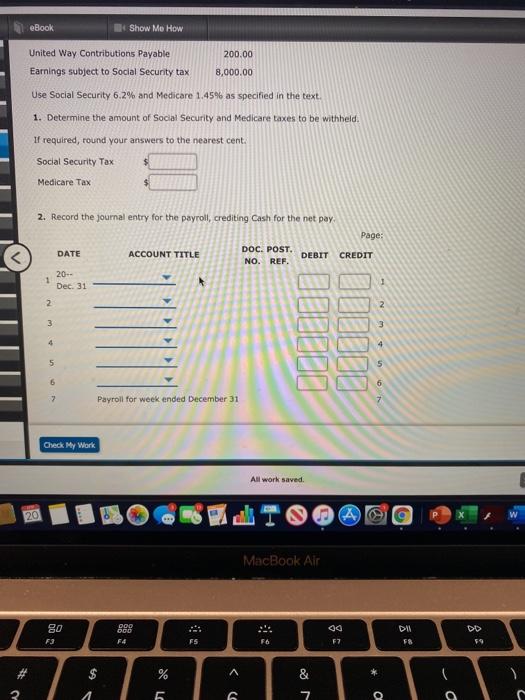

Assignment/takeAssignmentMain.do?invoker=&takeAssignmentes eBook Show Me How Journalizing Payroll Transactions On December 31, the payroll register of Hamstreet Associates indicated the following information: Wages and Salaries Expense $8,700.00 Employee Federal Income Tax Payable 920.00 United Way Contributions Payable 200.00 Earnings subject to Social Security tax 8,000.00 Use Social Security 6.2% and Medicare 1.45% as specified in the text. 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax Medicare Tax 2. Record the journal entry for the payroll, crediting Cash for the net pay. Page: DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 1 20- Dec 31 1 2 2 3 Check My Work All work saved la MacBook Air 80 DOO OGG FI 8 eBook Show Me How United Way Contributions Payable 200.00 Earnings subject to Social Secunty tax 8,000.00 Use Social Security 6.2% and Medicare 1.45% as specified in the text. 1. Determine the amount of Social Security and Medicare taxes to be withheld. If required, round your answers to the nearest cent. Social Security Tax $ Medicare Tax $ 2. Record the journal entry for the payroll, crediting Cash for the net pay Page: DATE ACCOUNT TITLE DOC. POST. NO. REF. DEBIT CREDIT 1 20- Dec. 31 2 2 3 3 4 4 11100 5 5 6 7 Payroll for week ended December 31 Check My Work All work saved 20 fo MacBook Air 80 DU F3 F4 FS F6 F7 F 59 $ A % & * C 3 5 7 o a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts