Question: Assistance needed on this question. The top two are the instructions, the bottom two is the excel sheet in which the answers are inputted. Much

Assistance needed on this question.

The top two are the instructions, the bottom two is the excel sheet in which the answers are inputted.

Much love

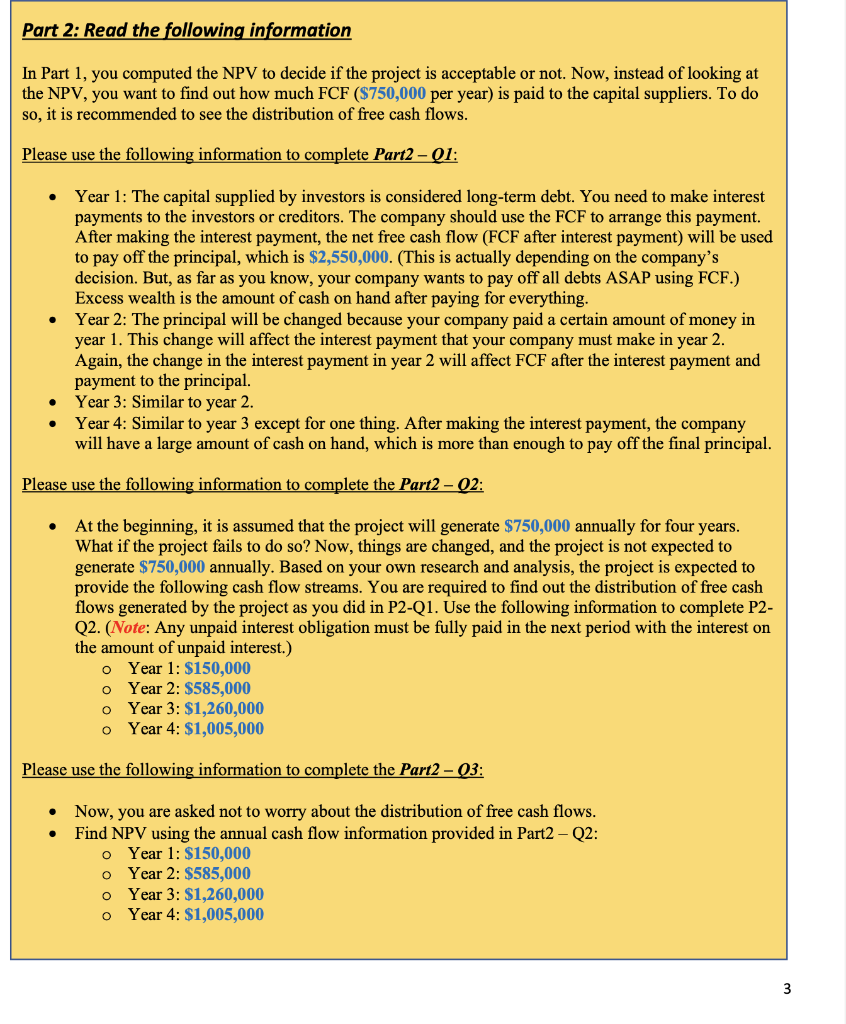

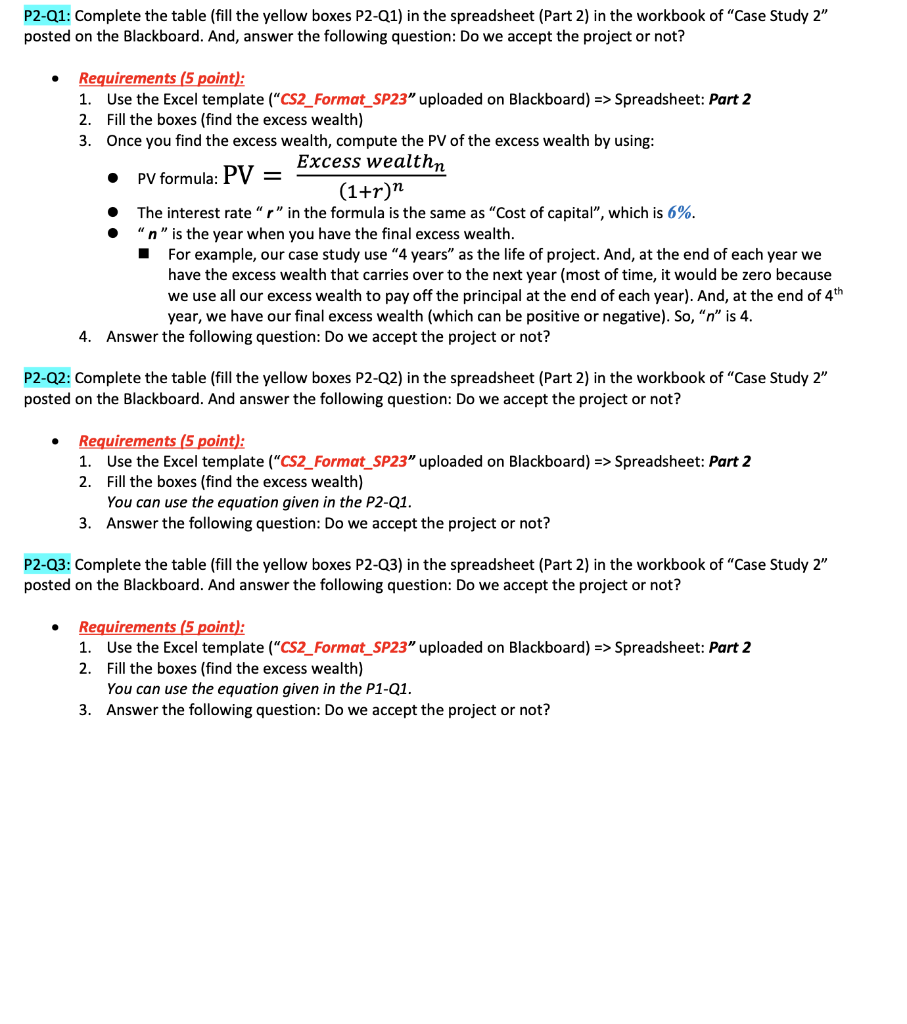

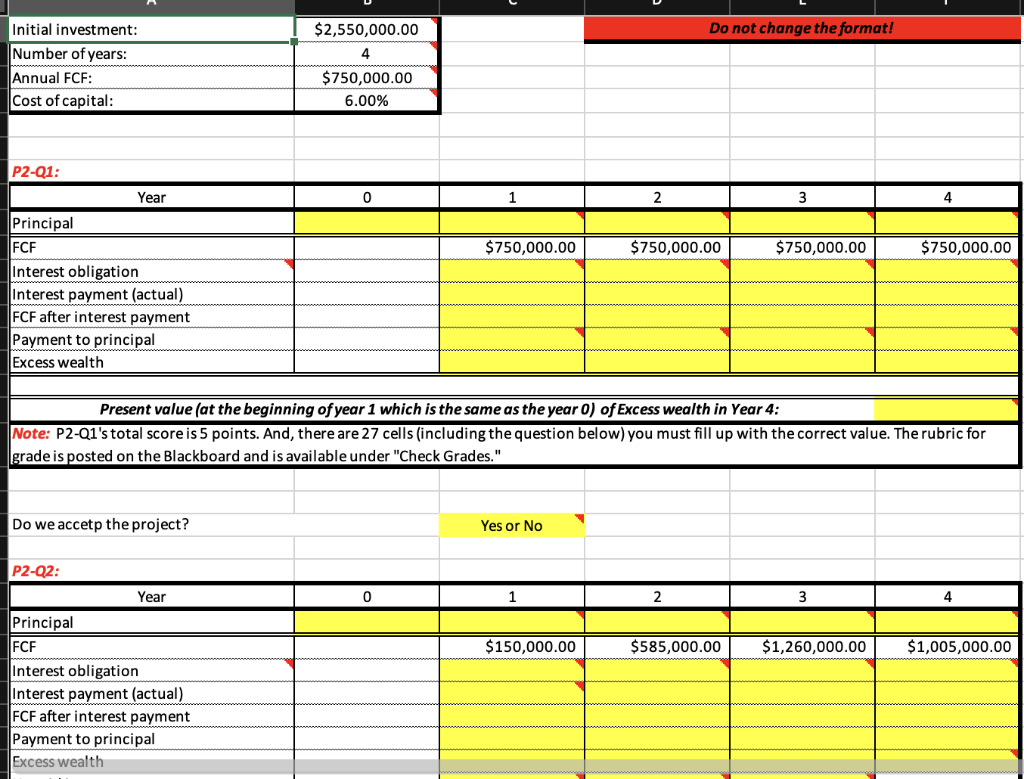

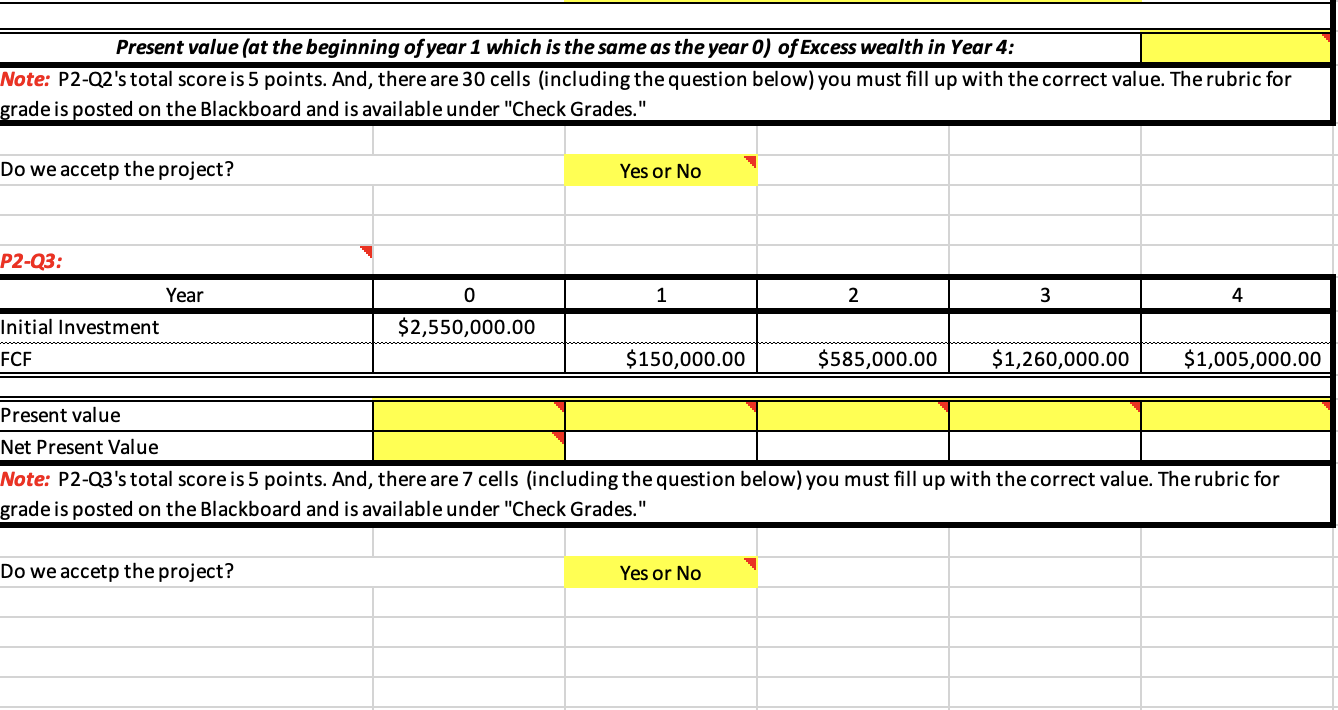

Part 2: Read the following information In Part 1, you computed the NPV to decide if the project is acceptable or not. Now, instead of looking at the NPV, you want to find out how much FCF (\$750,000 per year) is paid to the capital suppliers. To do so, it is recommended to see the distribution of free cash flows. Please use the following information to complete Part2 - Q1: - Year 1: The capital supplied by investors is considered long-term debt. You need to make interest payments to the investors or creditors. The company should use the FCF to arrange this payment. After making the interest payment, the net free cash flow (FCF after interest payment) will be used to pay off the principal, which is $2,550,000. (This is actually depending on the company's decision. But, as far as you know, your company wants to pay off all debts ASAP using FCF.) Excess wealth is the amount of cash on hand after paying for everything. - Year 2: The principal will be changed because your company paid a certain amount of money in year 1 . This change will affect the interest payment that your company must make in year 2 . Again, the change in the interest payment in year 2 will affect FCF after the interest payment and payment to the principal. - Year 3: Similar to year 2. - Year 4: Similar to year 3 except for one thing. After making the interest payment, the company will have a large amount of cash on hand, which is more than enough to pay off the final principal. Please use the following information to complete the Part2 - Q2: - At the beginning, it is assumed that the project will generate $750,000 annually for four years. What if the project fails to do so? Now, things are changed, and the project is not expected to generate $750,000 annually. Based on your own research and analysis, the project is expected to provide the following cash flow streams. You are required to find out the distribution of free cash flows generated by the project as you did in P2-Q1. Use the following information to complete P2Q2. (Note: Any unpaid interest obligation must be fully paid in the next period with the interest on the amount of unpaid interest.) - Year 1: $150,000 - Year 2: $585,000 - Year 3: $1,260,000 - Year 4:$1,005,000 Please use the following information to complete the Part2 - Q3: - Now, you are asked not to worry about the distribution of free cash flows. - Find NPV using the annual cash flow information provided in Part2 - Q2: - Year 1: $150,000 - Year 2: $585,000 - Year 3: $1,260,000 - Year 4:$1,005,000 posted on the Blackboard. And, answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) => Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) 3. Once you find the excess wealth, compute the PV of the excess wealth by using: - PV formula: PV=(1+r)nExcesswealthn - The interest rate " r " in the formula is the same as "Cost of capital", which is 6%. - " n " is the year when you have the final excess wealth. For example, our case study use " 4 years" as the life of project. And, at the end of each year we have the excess wealth that carries over to the next year (most of time, it would be zero because we use all our excess wealth to pay off the principal at the end of each year). And, at the end of 4th year, we have our final excess wealth (which can be positive or negative). So, " n " is 4 . 4. Answer the following question: Do we accept the project or not? P2-Q2: Complete the table (fill the yellow boxes P2-Q2) in the spreadsheet (Part 2) in the workbook of "Case Study 2" posted on the Blackboard. And answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) => Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) You can use the equation given in the P2-Q1. 3. Answer the following question: Do we accept the project or not? P2-Q3: Complete the table (fill the yellow boxes P2-Q3) in the spreadsheet (Part 2) in the workbook of "Case Study 2" posted on the Blackboard. And answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) You can use the equation given in the P1-Q1. 3. Answer the following question: Do we accept the project or not? \begin{tabular}{|l|c|} \hline Initial investment: & $2,550,000.00 \\ \hline Number of years: & 4 \\ \hline Annual FCF: & $750,000.00 \\ \hline Cost of capital: & 6.00% \\ \hline \end{tabular} P2-Q1: Present value (at the beginning of year 1 which is the same as the year 0 ) of Excess wealth in Year 4: Note: P2-Q1's total score is 5 points. And, there are 27 cells (including the question below) you must fill up with the correct value. The rubric for grade is posted on the Blackboard and is available under "Check Grades." Do we accetp the project? Yes or No P2-Q2: Present value (at the beginning of year 1 which is the same as the year 0 ) of Excess wealth in Year 4: Vote: P2-Q2's total score is 5 points. And, there are 30 cells (including the question below) you must fill up with the correct value. The rubric for zrade is posted on the Blackboard and is available under "Check Grades." Part 2: Read the following information In Part 1, you computed the NPV to decide if the project is acceptable or not. Now, instead of looking at the NPV, you want to find out how much FCF (\$750,000 per year) is paid to the capital suppliers. To do so, it is recommended to see the distribution of free cash flows. Please use the following information to complete Part2 - Q1: - Year 1: The capital supplied by investors is considered long-term debt. You need to make interest payments to the investors or creditors. The company should use the FCF to arrange this payment. After making the interest payment, the net free cash flow (FCF after interest payment) will be used to pay off the principal, which is $2,550,000. (This is actually depending on the company's decision. But, as far as you know, your company wants to pay off all debts ASAP using FCF.) Excess wealth is the amount of cash on hand after paying for everything. - Year 2: The principal will be changed because your company paid a certain amount of money in year 1 . This change will affect the interest payment that your company must make in year 2 . Again, the change in the interest payment in year 2 will affect FCF after the interest payment and payment to the principal. - Year 3: Similar to year 2. - Year 4: Similar to year 3 except for one thing. After making the interest payment, the company will have a large amount of cash on hand, which is more than enough to pay off the final principal. Please use the following information to complete the Part2 - Q2: - At the beginning, it is assumed that the project will generate $750,000 annually for four years. What if the project fails to do so? Now, things are changed, and the project is not expected to generate $750,000 annually. Based on your own research and analysis, the project is expected to provide the following cash flow streams. You are required to find out the distribution of free cash flows generated by the project as you did in P2-Q1. Use the following information to complete P2Q2. (Note: Any unpaid interest obligation must be fully paid in the next period with the interest on the amount of unpaid interest.) - Year 1: $150,000 - Year 2: $585,000 - Year 3: $1,260,000 - Year 4:$1,005,000 Please use the following information to complete the Part2 - Q3: - Now, you are asked not to worry about the distribution of free cash flows. - Find NPV using the annual cash flow information provided in Part2 - Q2: - Year 1: $150,000 - Year 2: $585,000 - Year 3: $1,260,000 - Year 4:$1,005,000 posted on the Blackboard. And, answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) => Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) 3. Once you find the excess wealth, compute the PV of the excess wealth by using: - PV formula: PV=(1+r)nExcesswealthn - The interest rate " r " in the formula is the same as "Cost of capital", which is 6%. - " n " is the year when you have the final excess wealth. For example, our case study use " 4 years" as the life of project. And, at the end of each year we have the excess wealth that carries over to the next year (most of time, it would be zero because we use all our excess wealth to pay off the principal at the end of each year). And, at the end of 4th year, we have our final excess wealth (which can be positive or negative). So, " n " is 4 . 4. Answer the following question: Do we accept the project or not? P2-Q2: Complete the table (fill the yellow boxes P2-Q2) in the spreadsheet (Part 2) in the workbook of "Case Study 2" posted on the Blackboard. And answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) => Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) You can use the equation given in the P2-Q1. 3. Answer the following question: Do we accept the project or not? P2-Q3: Complete the table (fill the yellow boxes P2-Q3) in the spreadsheet (Part 2) in the workbook of "Case Study 2" posted on the Blackboard. And answer the following question: Do we accept the project or not? - Requirements (5 point): 1. Use the Excel template ("CS2_Format_SP23" uploaded on Blackboard) Spreadsheet: Part 2 2. Fill the boxes (find the excess wealth) You can use the equation given in the P1-Q1. 3. Answer the following question: Do we accept the project or not? \begin{tabular}{|l|c|} \hline Initial investment: & $2,550,000.00 \\ \hline Number of years: & 4 \\ \hline Annual FCF: & $750,000.00 \\ \hline Cost of capital: & 6.00% \\ \hline \end{tabular} P2-Q1: Present value (at the beginning of year 1 which is the same as the year 0 ) of Excess wealth in Year 4: Note: P2-Q1's total score is 5 points. And, there are 27 cells (including the question below) you must fill up with the correct value. The rubric for grade is posted on the Blackboard and is available under "Check Grades." Do we accetp the project? Yes or No P2-Q2: Present value (at the beginning of year 1 which is the same as the year 0 ) of Excess wealth in Year 4: Vote: P2-Q2's total score is 5 points. And, there are 30 cells (including the question below) you must fill up with the correct value. The rubric for zrade is posted on the Blackboard and is available under "Check Grades

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts