Question: ASSN 2 9 Ch 0 9 - Video Lesson - Stocks and Their Valuation The dividend yield for period 1 is and it will each

ASSN Ch Video Lesson Stocks and Their Valuation

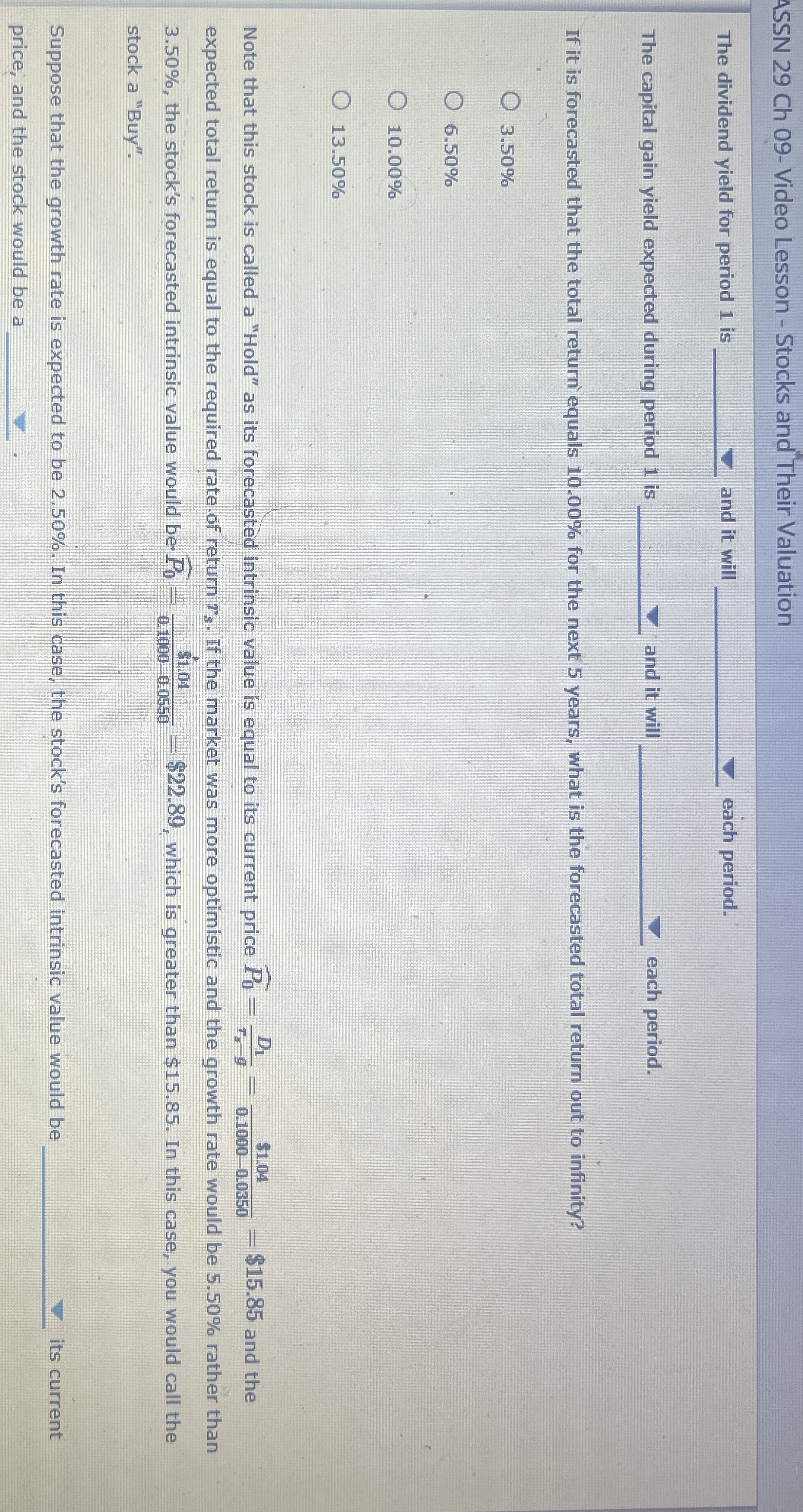

The dividend yield for period is and it will each period.

The capital gain yield expected during period i and it will each period.

If it is forecasted that the total return equals for the next years, what is the forecasted total return out to infinity?

Note that this stock is called a "Hold" as its forecasted intrinsic value is equal to its current price widehat$ and the expected total return is equal to the required rate of return If the market was more optimistic and the growth rate would be rather than the stock's forecasted intrinsic value would be widehat$ which is greater than $ In this case, you would call the stock a "Buy".

Suppose that the growth rate is expected to be In this case, the stock's forecasted intrinsic value would be its current price, and the stock would be a

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock