Question: Assume 90% CPP and OAS at 65 for both. Use MTR of 45%; 3% interest rate; 2% mortgage rate for calculations. Use and state reasonable

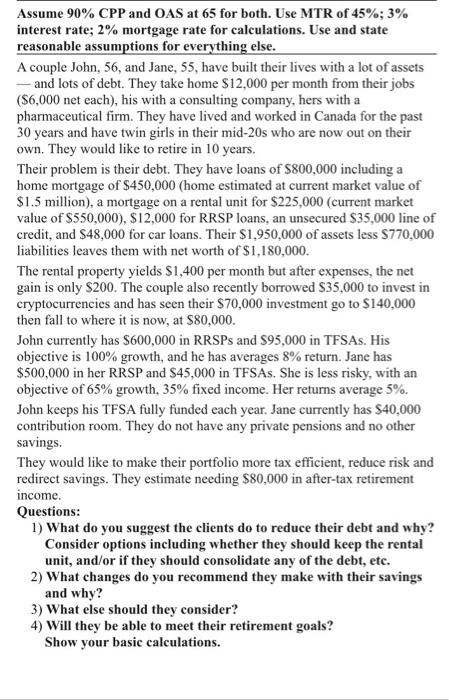

Assume 90% CPP and OAS at 65 for both. Use MTR of 45%; 3% interest rate; 2% mortgage rate for calculations. Use and state reasonable assumptions for everything else. A couple John, 56, and Jane, 55, have built their lives with a lot of assets - and lots of debt. They take home $12,000 per month from their jobs ($6,000 net each), his with a consulting company, hers with a pharmaceutical firm. They have lived and worked in Canada for the past 30 years and have twin girls in their mid-20s who are now out on their own. They would like to retire in 10 years. Their problem is their debt. They have loans of $800,000 including a home mortgage of $450,000 (home estimated at current market value of $1.5 million), a mortgage on a rental unit for $225,000 (current market value of $550,000), $12,000 for RRSP loans, an unsecured $35,000 line of credit, and $48,000 for car loans. Their $1,950,000 of assets less S770,000 liabilities leaves them with net worth of $1,180,000. The rental property yields $1,400 per month but after expenses, the net gain is only $200. The couple also recently borrowed $35,000 to invest in cryptocurrencies and has seen their $70,000 investment go to $140,000 then fall to where it is now, at $80,000. John currently has $600,000 in RRSPs and 595,000 in TFSAs. His objective is 100% growth, and he has averages 8% return. Jane has $500,000 in her RRSP and S45,000 in TFSAs. She is less risky, with an objective of 65% growth, 35% fixed income. Her returns average 5%. John keeps his TFSA fully funded each year. Jane currently has $40,000 contribution room. They do not have any private pensions and no other savings. They would like to make their portfolio more tax efficient, reduce risk and redirect savings. They estimate needing $80,000 in after-tax retirement income. Questions: 1) What do you suggest the clients do to reduce their debt and why? Consider options including whether they should keep the rental unit, and/or if they should consolidate any of the debt, etc. 2) What changes do you recommend they make with their savings and why? 3) What else should they consider? 4) Will they be able to meet their retirement goals? Show your basic calculations. Assume 90% CPP and OAS at 65 for both. Use MTR of 45%; 3% interest rate; 2% mortgage rate for calculations. Use and state reasonable assumptions for everything else. A couple John, 56, and Jane, 55, have built their lives with a lot of assets - and lots of debt. They take home $12,000 per month from their jobs ($6,000 net each), his with a consulting company, hers with a pharmaceutical firm. They have lived and worked in Canada for the past 30 years and have twin girls in their mid-20s who are now out on their own. They would like to retire in 10 years. Their problem is their debt. They have loans of $800,000 including a home mortgage of $450,000 (home estimated at current market value of $1.5 million), a mortgage on a rental unit for $225,000 (current market value of $550,000), $12,000 for RRSP loans, an unsecured $35,000 line of credit, and $48,000 for car loans. Their $1,950,000 of assets less S770,000 liabilities leaves them with net worth of $1,180,000. The rental property yields $1,400 per month but after expenses, the net gain is only $200. The couple also recently borrowed $35,000 to invest in cryptocurrencies and has seen their $70,000 investment go to $140,000 then fall to where it is now, at $80,000. John currently has $600,000 in RRSPs and 595,000 in TFSAs. His objective is 100% growth, and he has averages 8% return. Jane has $500,000 in her RRSP and S45,000 in TFSAs. She is less risky, with an objective of 65% growth, 35% fixed income. Her returns average 5%. John keeps his TFSA fully funded each year. Jane currently has $40,000 contribution room. They do not have any private pensions and no other savings. They would like to make their portfolio more tax efficient, reduce risk and redirect savings. They estimate needing $80,000 in after-tax retirement income. Questions: 1) What do you suggest the clients do to reduce their debt and why? Consider options including whether they should keep the rental unit, and/or if they should consolidate any of the debt, etc. 2) What changes do you recommend they make with their savings and why? 3) What else should they consider? 4) Will they be able to meet their retirement goals? Show your basic calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts